Investment platform VIAINVEST closely cooperating with the Financial and Capital Market Commission (FKTK) to obtain an IBF licence

Considering the official stance of the Financial and Capital Market Commission (FKTK) regarding commercial activities related to selling claim rights to consumer loans on online platforms, and also to ensure the continuity of such business operations, VIAINVEST intends to become a participant of a regulated financial and capital market by obtaining an investment brokerage firm (IBF) licence. Currently, VIAINVEST is going through a licensing process in close cooperation with FKTK, which will become the supervisory authority for the company after obtaining the licence.

“Transparency has always been one of the core priorities for VIAINVEST, and it has certainly served as a significant trust factor for the investors, therefore we believe that the FKTK’s initative to make the industry more regulated is a step in the right direction. The licensing process is quite complex, however the prospective surpervisory authority has been actively involved, ensuring that the interests of all stakeholders are taken into account. Moreover, securing equal terms for all the participants of the market will significantly decrease potential risks of dishonest business practices, and will also diminish industry reputation risks, thus restoring investor confidence. Given Latvia’s importance in the overall context of the European investment industry, building and maintaining industry’s reputation should become a common goal for all market participants,” explains Eduards Lapkovskis, Member of the Board of VIAINVEST.

As a result of the licensing VIAINVEST will become a participant of a regulated financial and capital market, and will provide services of initial placement of financial instruments and execution of investors’ orders for actions with financial instruments. Currently, the platform provides consumer loan claim rights trading, primarly based on the assignment agreement. Once licensed, these claim rights will be securitized i.e. they will be available for investment as asset-backed securities. However, for the convenience of current customers, VIAINVEST intends to maintain the previous user interface as much as possible. Subject to the requirements of the Investor Protection Law, in the event when the company has not registered financial instruments or the financial instruments have been permanently lost, the statutory class of investors shall be entitled to compensation of 90% of the invested amount up to EUR 20 000, ensured by FKTK.

“To prepare for the upcoming changes in the company’s operations, we have recently increased the company’s share capital to EUR 350 000, and we are actively planning to implement other changes necessary for the operations of the company. We anticipate that during the transition period there will be technical, legal and administrative improvements made to the financial instrument trading, including the provision of detailed information in investment risks, credit quality assessment as well as management of conflict of interest. VIAINVEST aims to make the transition from investing in an investment platform to cooperation with an investment brokerage firm as smooth as possible, therefore we intend to maintain both – the existing design of the platform and the user interface. VIAINVEST is constantly working on innovations - to be ready to meet the requirements of a licensed investement brokerage firm, we have introduced improvements in customer identification and asset valuation procedures, so we hope that the transition to the new system will be efficient and fast,” adds Mr. Lapkovskis.

VIAINVEST is an investment platform currently offering private investors an opportunity to invest in pre-funded loans issued by non-banking lenders. VIAINVEST was launched in December, 2016, and since then the platform has attracted nearly 16 000 customers from all over Europe, funding loans with the total value of more than EUR 195 million. VIAINVEST is a subsidiary of an alternative financial services provider – VIA SMS Group.

VIAINVEST parent company VIA SMS Group enters into a joint venture with TWINO to explore the potential of the Asia-Pacific region

Two major players of Latvian FinTech, namely VIAINVEST parent company VIA SMS Group and TWINO, have decided to join forces to enter Asia-Pacific consumer lending market by launching their first joint consumer lending brand VAMO in Vietnam. The potential of the emerging Asia-Pacific market is indicated by strong demand for consumer lending services. Both partners are committed and determined to unlock the opportunities presented by this particular market.

VIA SMS Group and TWINO are well-known consumer lenders operating across Europe, Russia and Kazakhstan, and each of them has acquired a significant market share in Latvia. Besides, both companies also operate peer to peer lending platforms VIAINVEST and TWINO. Since consumer lending has been the core business for both partners for over 10 years, companies were able to find a common ground on sharing the know-how and resources to target less-explored Asia-Pacific market, while aiming to diversify consumer lending portfolio and expanding their global reach. JSC VIA SMS group and TWINO Ltd. have entered into this joint venture on equal terms sharing 50% of business each.

Anastasija Oļeiņika, CEO of TWINO Group: “In FinTech, to be successful, your business should be constantly looking for ways of growth and development by means of innovation and change. At TWINO, our mission is to break the existing borders as we continue to expand our business in emerging markets with the aim to make FinTech products accessible to a range of borrowers and investors with a focus on speed and convenience. Our midterm strategy is to open at least 2 new markets in Asia-Pacific by the end of 2020 and our strategic partnership will allow us to significantly decrease the time to market.”

VAMO.vn, operating in Vietnam under the brand name VAMO, was launched in December, 2019 and closed the year of 2019 with the first loan issued shortly after the public launch. “Vietnam and Asia-Pacific region in general is a large and challenging market, but it also offers opportunities that cannot be found anywhere in Europe. VAMO essentially is a venture launched to test the waters and our capacity, as market differences between Asia and Europe are significant. By now we are happy with the first weeks of operations and we are really looking forward to expansion,” adds Deniss Šerstjukovs, Member of the Board at VIA SMS Group.

VIAINVEST sets one interest rate for all loan originators

VIAINVEST has announced changes affecting its interest rate policy by introducing one interest rate to all loan originators set to 11% annually. This newly established interest rate will be applied to all loans published on the platform, starting from 13.06.2019. These changes will allow VIAINVEST to offer 2 times bigger loan portfolio with beneficial 11% annual interest rate, and will also raise average interest rate on the platform while making investment portfolio diversification easier.

All available loans that were listed on the platform before 13.06.2019 will remain available with the old interest rates until complete settlement. All earnings from investments in loans published before 13.06.2019 will be calculated according to the previous interest rates.

NB! Interest rate changes do not in any way impact VIAINVEST taxation policy.

VIAINVEST varies its range of deposit options

Are you ready to kick-start this summer with some really great news? VIAINVEST team is happy to announce that starting from June 21 you will be able to make deposits into your investor account by using electronic money or payment institutions.

To make deposits from your personal electronic money or payment institution account, make sure that:

- the service you are using is registered and licensed in the EU

- funds are being transferred as SEPA payment

- the payment is made from your personal IBAN and it is identifiable from payment details

- we will be able to identify your personal details (name, surname) from the incoming payment details

Just so you know, the new deposit options bring minor changes in the Regulations of the Investment Platform, the same goes for theAssignment and Loan agreement, so please take a moment to review the new versions of the respective agreements available in the footer of our website.

The new agreements will come into force on June 21, 2019; until then you have a chance to inform us if any concerns arise.

VIA SMS Group publishes audited consolidated and separate financial statements for the year of 2018

VIA SMS Group has closed the reporting period with a net turnover of EUR 25 387 460 that shows 21% increase in comparison to the same period in 2017. The most notable turnover increase of 51% was reached in Sweden, followed by Spain, where the subsidiary has demonstrated growth of 15%, and Czech Republic, where net turnover increased by 12% in comparison to the previous reporting period. Lithuanian subsidiary VIA Payments UAB has successfully started its operations in 2018, reaching a turnover of EUR 2 million and resulting in net profit of EUR 185 000. The Group's consolidated EBITDA for 2018 has reached EUR 4 893 084 and consolidated net profit amounted to EUR 2 768 915.

Consolidated net loan portfolio of the Group as of December 31, 2018 was EUR 22 983 054, increasing by 27% in comparison to December 31, 2017. Operations in Sweden ensured the most notable increase of portfolio reaching 73% gap, Latvia demonstrated growth of 39% and net loan portfolio in Spain increased by 29%.

During 2018 the Group made substantial financial investments in the newly established subsidiary in Romania, digital payments platform VIA Payments UAB (Lithuania) operating under the brand name VIALET, and also invested in the further development of peer-to-peer lending platform VIAINVEST.

Audited consolidated and separate financial statements for the year of 2018 can be found in the Group's website section Investor Relations or on Nasdaq Baltic website.

VIAINVEST hits the milestone of 10 000 registered investors

VIAINVEST team is beyond excited to announce that the platform has hit the milestone of 10 000 registered investors in less than 3 years of operations.

VIAINVEST was launched in December, 2016 and since then has been offering profitable and transparent alternative investment opportunities to both private individuals and legal entities. The core business of VIAINVEST is pre-funded consumer loan financing using private capital within the European Union. Since the launch VIAINVEST has experienced significant development and growth of trust among investor community. Currently the platform serves investors from 32 countries offering to invest in diverse investment portfolio consisting of 5 loan origin countries with 100% Buyback Guarantee for all listed loans. Up to this day VIAINVEST has reached the amount of almost 130 million EUR funded through the platform.

VIA SMS Group publishes unaudited financial statement for the year of 2018

The Group has closed the reporting period with a net turnover of EUR 24 854 095 that shows 24% increase in comparison to the same period in 2017. The most notable turnover increase of 52% was reached in Sweden, followed by Spain, demonstrating growth of 16%, and Czechia, where net turnover increased by 12% in comparison to the previous reporting period. Lithuanian subsidiary VIA Payments had fast and successful growth of operations in 2018, approaching a turnover of EUR 2 million and resulting in net profit of EUR 270 000. The Group's consolidated EBITDA for 2018 has reached EUR 5 215 724 and consolidated net profit amounted to EUR 3 031 526.

During 2018 the Group has made investments in newly established subsidiary in Romania, digital payment services provider VIA Payments and has also invested in the further development of the peer-to-peer lending platform VIAINVEST.

Consolidated net loan portfolio of the Group as at December 31, 2018 was EUR 22 439 857, which has increased by 23% in comparison to December 31, 2017. Operations in Sweden ensured the most notable increase of portfolio of 68%, Latvia demonstrated growth of 36% and net loan portfolio in Spain increased by 22%.

In 2018 the main goal of VIA SMS group was strengthening its positions in existing markets and intensively developing existing product portfolio, in particular focusing on Romanian subsidiary established in 2017 and currently operating under the brand name VIACONTO.ro, as well as expanding various lending opportunities in all markets. Taking into account customer needs, the Group has restructured its lending products in Sweden and Latvia by introducing credit line that allows customers to apply for a higher amount and enjoy favorable repayment terms. After evaluating the overall market situation in Poland, the Group has decided to discontinue operations of its consumer lending brand Cashalot. VIASMS.pl still remains active and significant market player in Poland.

Full financial statement can be found on Nasdaq Baltic website or in Group's website section Investor Relations.

VIAINVEST lists new loan originator from Sweden!

New year comes with new opportunities! VIAINVEST team is beyond excited to announce another investment diversification opportunity available on the platform - starting from today VIAINVEST lists new loan originator from Sweden! Credit line loans issued by Swedish VIACONTO.se will be available on the platform with 9% annual interest rate and secured with the Buyback Guarantee. No taxes will be applied to income earned when invested in Swedish loans on the platform.*

VIACONTO.se is a part of alternative financial services provider VIA SMS Group.

VIACONTO.se has been operating in the Swedish consumer lending market since 2011 and has proved to be a highly valued lender with a trust score of 9,3 on Trustpilot. More information: www.viaconto.se

If you are willing to automatically invest in the freshly listed Swedish loans, go to your auto invest portfolio and change the settings by adding VIACONTO.se in the Loan originator section.

*Management of personal tax issues is a responsibility of each investor.

VIAINVEST hits EUR 60 000 000 loans funded!

We are celebrating another great milestone - VIAINVEST has reached EUR 60 000 000 in funded loans!

Shout out to our investor community - it is a pleasure to grow together!

VIA SMS Group publishes 12 month report for 2017

The Group has closed the reporting period with a net turnover of EUR 20 141 087 that shows 21,5% increase in comparison with the same period in 2016. The largest net turnover was reached in Spain where the net turnover has increased by 63%; the second largest turnover was reached in Sweden - by 55%, the third - in Poland where net turnover increased by 17% in comparison with data reported to December 31, 2016. Company's EBITDA in 2017 has reached EUR 2 779 456 and has ensured the net profit of EUR 835 542.

The decrease in net turnover in 2017 is associated with VIA SMS Group investments in the establishment of new companies and subsidiaries, as well as expanding the product portfolio. In 2017 the Group has established a subsidiary in Romania, digital payment services provider VIA Payments, as well as developed new consumer lending brand in Poland - Cashalot. VIA SMS Group has also invested in the further development of the peer-to-peer lending platform VIAINVEST.

The net loan portfolio as per December 31, 2017, was EUR 18 022 102 which shows 23% growth in comparison with December 31, 2016. The largest portfolio increase was reached in the Czech Republic where the difference between reporting period and the same period last year amounts to 41%. The Czech Republic is followed by Poland with 32% growth, Latvia - with 25% growth and Spain - with 24% growth.

Business overview for 2017Since the 2009 VIA SMS Group core activity has been providing consumer lending services for private individuals. The company has been operating under several brands - VIA SMS, SAVA.card, VIAKREDIT, VIA CONTO - and is offering consumer loans with a maturity term up to 12 months in Latvia, Czech Republic, Poland, Sweden and Spain. VIA SMS Group has more than 1mio registered clients and the total amount of issued loans has reached 95.8 million EUR within the year 2017.

In 2017 VIA SMS Group was mainly focused on strengthening its positions in existing markets, acquiring new ones, as well as intensive product development. Following the strong performance in existing markets and growing demand for consumer lending services across Europe, VIA SMS Group has obtained a license allowing to operate in the Romanian consumer lending market. The newly established consumer lending company operating under the brand name VIACONTO.ro is providing online lending services in Romania. To expand existing operations in Poland, in July of 2017, VIA SMS Group has launched a new consumer lending brand Cashalot that is offering short-term online lending services for Polish residents.

VIA SMS Group has also established new daughter company VIA Payments that has obtained the electronic money institution license and is planning to develop and launch digital payment services brand within the Q2 of 2018.

During the 2017 VIA SMS Group has been working on improving the quality of creditworthiness evaluation and customer service effectiveness in all markets. The company was also focused on further development of the peer-to-peer lending platform VIAINVEST. 2017 marked a milestone of loans with a total value of 43 million EUR funded through the platform.

On September 7, 2017, VIA SMS Group has successfully finished the reorganization of the company and changed its legal form from Ltd. (Limited Liability Company) to JSC (Joint Stock Company).

The full interim financial report can be found in VIA SMS Group website Investor Relations section as well as on the Nasdaq Baltic website.

VIAINVEST parent company VIA SMS Group enters Romania with consumer lending brand VIACONTO.ro

VIA SMS Group is pleased to announce that following rapid and steady growth in existing markets, the company has expanded its operations to Romania. Considering existing branches in Latvia, Sweden, Czech Republic, Poland and Spain, VIA SMS Group is currently present in 6 European countries and has built an extensive product portfolio and consumer base.

As the core business of VIA SMS Group remains consumer lending, this is also a focus area in Romania. The product offered in Romania is a consumer loan up to RON 1000 with a loan term up to 30 days. Online lending services in Romania will be available under the brand name VIACONTO that is widely recognized among existing company customers in Sweden and Spain. Company's values remain immutable - VIACONTO.ro will strive to provide convenient and accessible lending products as well as high-quality customer service.

VIA SMS Group is an alternative financial services provider founded in 2009. Company's headquarters are located in Riga, Latvia, but company subsidiaries under various brand names are operating in 5 other European countries. VIA SMS Group has developed an extensive product portfolio which includes consumer lending products on various terms, savings products, payment card SAVA.card and peer to peer lending platform VIAINVEST.

VIAINVEST parent company VIA SMS Group publishes six-month financial report

VIA SMS Group, alternative financial services provider and the parent company of VIAINVEST, has published an interim six-month report for the first half of 2017. During the period from January 1, 2017, to June 30, 2017, company's operations were highly successful. V IA SMS Group has closed the reporting period with a net turnover of EUR 9 567 475 and corresponding 22% increase in comparison with the same period in 2016. The largest net turnover growth was reached in company's subsidiaries in Spain and Sweden, where the net turnover has doubled. During the first six months of 2017, the company has reached EBITDA of EUR 1 188 562, ensuring the net profit of EUR 363 159. The net loan portfolio as per June 30, 2017, is EUR 17 996 380 increasing by 22,7% in comparison with the net loan portfolio as per December 31, 2016. The largest net portfolio increase was reached in Spain, where the indicator has increased by 44%, in Poland - 37% and in Latvia - by 25%. The full report is available on the company's website or the Nasdaq Baltic stock exchange market website.

Also, VIA SMS Group has completed the reorganization of the company; and it has resulted in the change of the legal form. Starting from 07.09.2017, the legal form of VIA SMS Group is JSC (Joint Stock Company).

VIA SMS Group is an alternative financial services provider operating across Europe. Since its founding, the company has expanded operations to 5 countries and developed an extensive product portfolio with more than 10 different brands. As consumer lending remains the core business of VIA SMS Group it has also developed such products as payment card SAVA.card, peer to peer lending platform VIAINVEST, savings product ViaSpar and has also issued company's bonds. VIA SMS Group headquarters are located in Riga, Latvia, but its subsidiaries are operating in Sweden, Poland, Czech Republic and Spain under related brands.

Participate in VIAINVEST Investor Survey!

Your feedback matters! Share your thoughts on peer-to-peer lending platform #VIAINVEST and get a chance to win 1 out of 5 VIAINVEST promo coupons with a value of EUR 20!

Participate in the survey now: https://buff.ly/2vVkJwK

VIAINVEST reaches milestone of 10 million EUR loans funded through its platform

Merely seven months after the launch, peer-to-peer lending platform VIAINVEST has reached a milestone of 10 million EUR loans funded through its platform. Listed consumer loans issued by the alternative financial services provider VIA SMS Group in Czech Republic, Poland, Latvia and Spain were funded by investors from more than 30 countries.

Peer-to-peer lending platform VIAINVEST was launched in December 2016 and has grown significantly since then. "We are excited to be a part of a continuously growing peer-to-peer and fintech community," says Eduards Lapkovskis, CEO of VIAINVEST. "Success of VIAINVEST shows that we have set the right goal - to deliver outstanding investor support service and bring added value instead of focusing on quantity. Currently, VIAINVEST offers unique investment portfolio and provides a solution to help investors manage tax issues arising from investing in the platform."

While Germany remains the capital of peer-to-peer investors amounting to 44% of the total number of investors registered on VIAINVEST, Latvia and Estonia has also proved their interest in fintech and ranks, respectively, second with 11% and third - with 9% of the total number of investors. The average deposit on the platform is EUR 4136, and to date, VIAINVEST has paid out almost EUR 85 000 in interest.

In the nearest future, VIAINVEST is planning to expand its investment portfolio with new loan originators as well as developing several features to make investing more convenient, even when using mobile devices.

VIAINVEST is a part of the alternative financial services provider VIA SMS Group operating across Europe. VIAINVEST offers both private individuals and legal entities to invest in consumer loans originated by VIA SMS Group subsidiaries in Latvia, Czech Republic, Poland and Spain.

A new model for funding Polish claim rights!

VIAINVEST is growing rapidly and we are happy to announce that in following days our investment portfolio will be expanded with loans originated in Poland by VIASMS.pl!

To ensure full transparency and most favorable investment environment, we would like to inform you that there will be changes applied to the traditional order of investing in claim rights originated in Poland. To avoid negative tax consequences, in particular possible imposition of the Tax on Civil Law Transactions to the investor resulting in change of ownership title, VIAINVEST has developed a new model of the funding of claim rights. Investor and Polish loan originator relations will be defined by the Loan Agreement (instead of the Assignment Agreement), where the investor will act as the lender, but loan originator - as the debtor. To show differences between the traditional Assignment Agreement and the Loan Agreement that will currently be applied exclusively to loans originated in Poland, we have prepared a comparison of both types of the agreement:

| Assignment Agreement (for investments in claim rights originated in countries currently listed) |

Loan Agreement (for investments in claim rights originated in Poland) |

|

| The subject of the Agreement | By transferring the funds into the Platform's bank account and choosing the fraction of the particular claim right exhibited in the Platform, Investor (Assignee) becomes the owner of claim right originated by the Loan Originator. | Investor (Lender) via Platform bank account lends money secured by the collateral of prefunded loans. Borrowed funds will be further distributed across general loan originator business operations. The appropriate part of the particular claim right equal to the amount of the Loan serves as a loan's collateral. |

| The Investor's reward | The Investor will receive the fee for the use of Investor's funds invested when buying the Claim rights during the validity of the Assignment Agreement. | The investor will receive the interest for the use of Investor's funds invested by entering into the Loan Agreement via investment platform. |

| The ownership title of claim rights | The Investor becomes the owner of the fraction of the Claim rights, though Loan Originator is the one who continues to manage distributed loans with the borrowers based on the authorization provided by the Investor. | The owner of the claim rights remains the Loan Originator. In the case of Loan originator's default, the collateral is executed, and the Lender becomes the owner of the claim rights equal to the Loan amount. |

| The case of the Borrower default | If the Borrower delays its payment for more than 30 days, the Loan Originator undertakes to buy back the right to the claim. | If the Borrower delays its payment for more than 30 days, the Loan Originator repays the loan principal and calculated interest to the Lender. |

| The case of the loan repayment date prolongation by the Borrower | The Assignment Agreement validity date will be prolonged respectively. | The Loan Agreement due date will be prolonged accordingly. |

| The case of the Loan originator default | The guarantee agreement between parent company VIA SMS Group and the Loan Originator is concluded, therefore VIA SMS group will settle outstanding liabilities. | The guarantee agreement between parent company VIA SMS Group and the Loan Originator is concluded, therefore VIA SMS group will settle outstanding liabilities. |

| The reward payment order | The fee and the appropriate part of the assignment amount (if received from the Borrower) are paid out to the Investor in the following cases:

|

The interest and the appropriate part of the loan principal (if received from the Borrower) is paid out to the Investor in the following cases:

|

| Taxation | WHT will be applied at the moment when the fee is paid out to the Investor. | WHT will be applied at the moment when the interest is paid out to the Investor. |

| Investor's expenses when entering into the agreement | None | None |

Please note that the existing VIAINVEST User Agreement will be also updated according to the new model of funding claim rights. Both current and updated version of the Loan Agreement will shortly be available on VIAINVEST webpage. New version will come into force within 30 days.

We will be happy to answer any questions that may arise!

Explore wide investment opportunities with VIAINVEST!

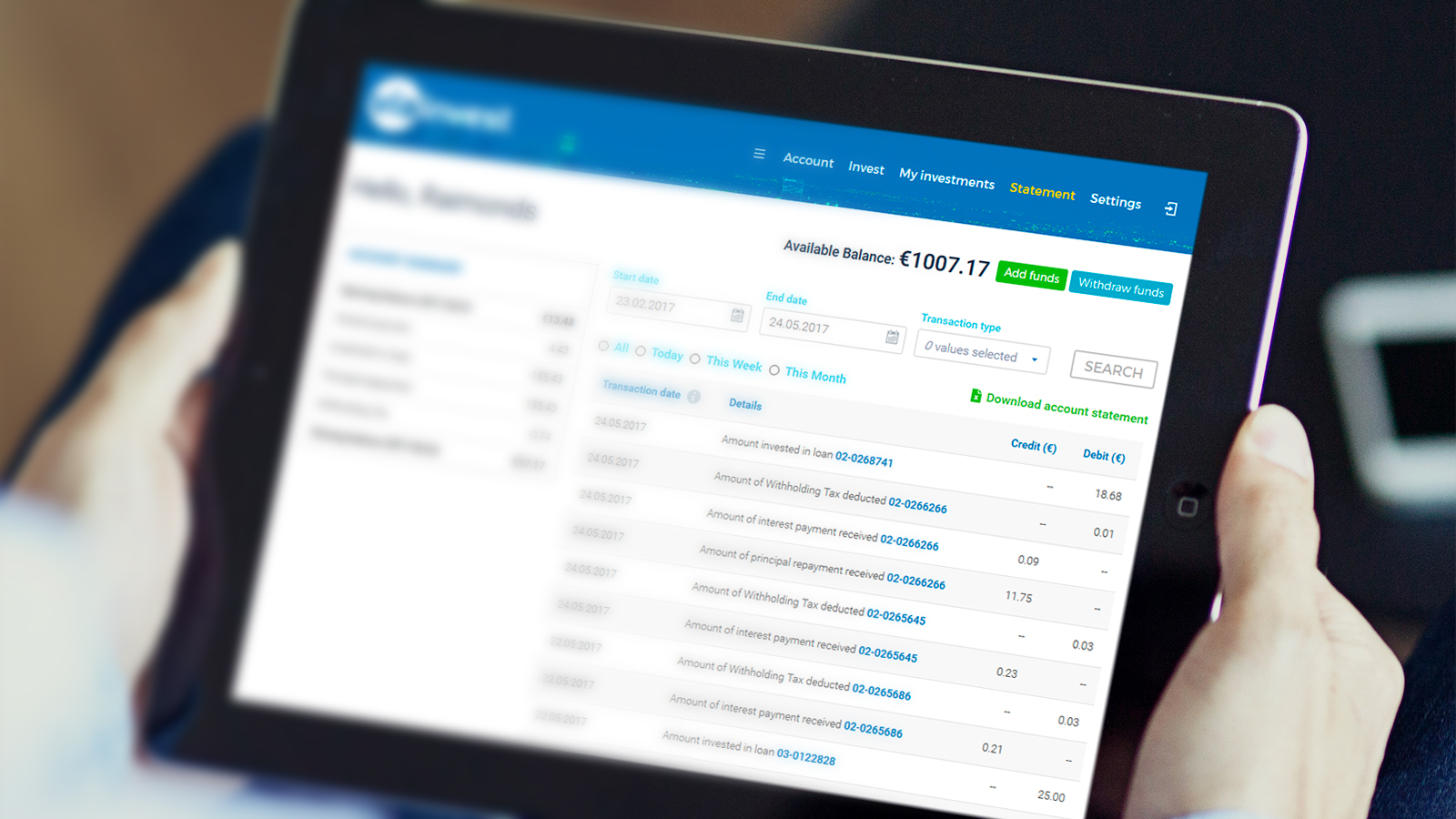

Download your VIAINVEST account statement!

This seemed to be the most wanted feature on VIAINVEST, so we are excited to announce that VIAINVEST investment environment has become even more convenient - investors are able to download their account statement at any time! This feature is available for all investors and reflects information on transactions to date - both transaction and value dates, transaction type, loan origin country, loan ID, as well as the amount of the transaction. You can easily download your investor account statement by browsing the Statement section in your investor account or by taking a shortcut!

Also, to avoid any misunderstandings with transaction dates, all transactions in your regular account summary sent out by e-mail will be listed with the transaction date, not the value date.

1 000 000 EUR invested into loans with VIAINVEST within first three months of operation

The first three months of operation have been highly productive for VIAINVEST - 1 000 000 EUR invested into consumer loans through the platform. The great activity of investors once again proves the growing demand for alternative investment opportunities as well as the role of Latvia in the European fintech community.

VIAINVEST is a peer to peer lending platform providing alternative online investment opportunities - both private individuals and legal entities are welcome to invest in consumer loans originated by the VIA SMS Group and its daughter companies operating across Europe. Since launch, VIAINVEST has significantly increased its investment portfolio and currently boasts an offer of up to 12,2% annual return to its investors.

Eduards Lapkovskis, CEO of VIAINVEST: "We are pleased with what we have achieved in these first months after launch - if we take into account that the number of peer to peer lending market participants has raised noticeably, funding one million euros of loans within such a short period of time is a significant success. Our main priority is to ensure outstanding investor support as well as a seamless investing experience to build a trustful relationship with all our clients. The first milestone proves that we are on the right track!"

Since the launch of the company in December of 2016, the development of VIAINVEST has never stopped. "The truth is that you can find gaps or opportunities for development only when the platform is live - when real investors come in, try the features and share their experience. The majority of our investors come from German-speaking countries and traditionally pay significant attention to the details especially when it comes to their finance management. In response to the high demand we now offer the possibility to browse VIAINVEST in German." says Eduards, adding that VIAINVEST will soon also be available in Latvian. "We welcome any feedback from investors because we believe that a platform bringing the highest added value is the one that is built according to investor requirements."

VIAINVEST is a part of the alternative financial services provider VIA SMS Group, operating its daughter companies and brands in Latvia, Sweden, Poland, Czech Republic and Spain. VIA SMS Group has built a diversified product portfolio that includes consumer lending and savings products, payment card SAVA.card as well as peer to peer lending platform VIAINVEST.

Updates in your Investor Account dashboard

To help investors closely monitor transactions, current balance and future prospects in their Investor Account, we have recently modified existing indicators as well as added new one.

If previously you were able to see the amount of paid interest under the Earnings to Date indicator, then now we have structured earned interest into two separate indicators. Now updated Investor Account dashboard will provide you the information about the Paid Interest - earned and paid out interest to date - and Accumulated Interest - cumulative interest due and not yet paid. Accumulated Interest helps to calculate how much funds investor will have earned when the interest is paid out. These indicators are displayed both in % and EUR.

To make your account transactions more transparent, we have also updated Net Annual Return (NAR) indicator. Until now in calculation of the NAR indicator only paid amount of interest was used, but updated version of NAR will provide an opportunity to see both the amount of interest paid and the total amount of earned interest (%).

Find out more in your Investor Account.

VIAINVEST expands its portfolio to Spain

We are excited to announce new update - to offer diversified investment opportunities, VIAINVEST has recently expanded its portfolio with loans originated in Spain. From now on You will be able to invest in short-term consumer loans in Spain originated by VIACONTO.es. All recently added loans are secured with a Buyback Guarantee and offer investors 11,2% Net Annual Return. Go to your Investor Profile and explore wide investment opportunities!

VIAINVEST launch event

It seems like a good idea to talk fintech on Thursday! Take a look at how we took VIAINVEST public on early Thursday evening covering topics, such as how the platform functions and what benefits are offered to our investors. Special thanks to amazing Mike Baliman from London Fintech Podcast who spiced the event up with some insight on how fintech and P2P lending is taking over the finance world. Enjoy!

VIAINVEST - new platform to join the peer-to-peer lending community

The launch of new peer-to-peer lending platform VIAINVEST once again proves the continuous growth and significance of the alternative finance and peer-to-peer lending industry. VIAINVEST is a peer-to-peer marketplace for both private and legal entities offering to invest into consumer loans originating from non-banking lenders. Unlike other P2P platforms, all loan agreements available for investment within the VIAINVEST are secured with a buyback guarantee.

Eduards Lapkovskis, Member of the Board:"By launching VIAINVEST we aim to ensure easy-to-use peer-to-peer lending marketplace that offers secure and transparent investment opporunities. Our priority is to focus on the needs of each investor despite their level of experience. One of our main concerns is investment security, so all loans currently available for investment are secured with buyback guarantee. This also allows less confident investors to invest their funds safely. Peer-to-peer lending is another tool that helps to educate society on well-considered and responsible behavior, so our VIAINVEST investor support team is ready to adress all related issues at any time."

Loans available for investment on VIAINVEST are originated by VIA SMS group and it's daughter companies across Europe, so investors are able to create diversified and secured investment portfolios. Currently loans offered for investment on VIAINVEST are issued in Czech Republic with EUR 290 of the average amount of the loan. Total amount of these loans in first 6 months of VIAINVEST operations will reach 3 millions EUR. Maturity of listed loans are up to 30 days helping guarantee short term return on investment with 12% annual interest rate. VIAINVEST offers private investors access to the non-banking lending sector.

"We are planning to develop continuously by regularly expanding the list loan originators and become one of the leading peer-to-peer lending platforms in the Baltic states. Shortly we are planning to offer our clients to invest in loans originated in Spain with total amount that will reach 2,4 million EUR in first six months of VIAINVEST operations. It will also be followed by other countries," says Eduards.

VIAINVEST is a part of the VIA SMS Group operating it's brands in Latvia, Sweden, Poland, Czech Republic and Spain.