- Sākotnējā aizdevuma summa €170000.00

- Atlikusī summa €0.00

-

Interest rate with special conditions

up to 12% Guaranteed interest rate:*

8.00% -

- Pieejams investīcijām €0.00

-

- Finansēts €70066.12

-

*Two component compensation model: monthly interest rate plus bonus at the end of the agreement if sales revenue exceeds the set threshold. Investor’s total interest income depends on the capitalization rate. Capitalization rate indicates the expected rate of return an investor is likely to achieve on an investment property. The rate is calculated by dividing net annual operating income by the value of the property and multiplied by 100 to get the percentage. Capitalization rate will be calculated at the end of the agreement and paid to the investors according to the threshold provided in the table below. Fixed interest of 8% is paid to the investor on a monthly basis. Namely if the total capitalization rate will reach 5.25%, effective interest income will reach 10%, the difference will be paid out at the end of the agreement.

Calculation example:

Rent yield Sales price Interest income 5,75% 38 093 071 € 8% 5,25% 41 720 983 € 10% 4,75% 46 112 665 € 12%

Aizdevuma detaļas

Aizņēmēja detaļas

| Aizņēmēja tips: | Legal Entity |

| Uzņēmuma nosaukums: | BCN investment Ltd. |

| Valsts, pilsēta: | Riga, Latvia |

| Industrija : | Nekustamā īpašuma attīstīšana |

| Datums | Pamatsumma (€) | Procentu ienākumi (€) | Kopā (€) | Statuss |

|---|---|---|---|---|

| 05.04.2020 | 0.00 | 707.95 | 707.95 | Izmaksāts |

| 05.05.2020 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.06.2020 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.07.2020 | 0.00 | 1061.92 | 1061.92 | Izmaksāts |

| 05.08.2020 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.09.2020 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.10.2020 | 0.00 | 1061.92 | 1061.92 | Izmaksāts |

| 05.11.2020 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.12.2020 | 0.00 | 1061.92 | 1061.92 | Izmaksāts |

| 05.01.2021 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.02.2021 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.03.2021 | 0.00 | 991.12 | 991.12 | Izmaksāts |

| 05.04.2021 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.05.2021 | 0.00 | 1061.92 | 1061.92 | Izmaksāts |

| 05.06.2021 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.07.2021 | 0.00 | 1061.92 | 1061.92 | Izmaksāts |

| 05.08.2021 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.09.2021 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.10.2021 | 0.00 | 1061.92 | 1061.92 | Izmaksāts |

| 05.11.2021 | 0.00 | 1097.32 | 1097.32 | Izmaksāts |

| 05.12.2021 | 170000.00 | 1061.92 | 171061.92 | Izmaksāts |

Projekta detaļas

-

Borrower and real estate developer description

This business loan is issued to the BCN investment Ltd. (reg. No.: 40203004558, address: Audēju iela 14 - 11, Rīga, LV-1050) which is aiming to participate in the development of the new concept Student Hall Project in Barcelona, Spain. The participation (investing) will be ensured through special purpose venture (SPV) Dismer Solutions SL (reg. No.: B67443408; address: Cl Balmes Num.191 P.6 Pta.1 08006 - Barcelona) cooperating with real estate developer JSC R.Evolution City (operating under the brand name R.evolution). R.Evolution has 20 years of experience in real estate project development, the company’s main office is located in Riga, Latvia, but it has established its operational offices in Berlin, Barcelona and New York, and currently employs more than 60 professionals.

Until now R.evolution has developed such projects as Hoft, House of the flying trees, Lofts&Rosegold, Villa Milia, Philosophers Residence, etc. R.Evolution tends to be a part of the city’s evolution, which creates something more significant and important than just the development of commercially and cost effective projects. As R.evolution is both real estate investment partner and real estate developer, its mission includes creating an environment that is in line with the company’s internal philosophy and customer requirements, as well as strengthening investors’ satisfaction by maximizing land-use performance, ensuring clear and timely coordination with government and municipal institutions, planning of investment inflows, optimizing construction and sales schedules, implementing up-to-date construction and engineering solutions, and performing general management function.

-

Project description – Student Hall Project concept

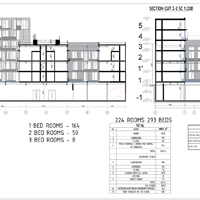

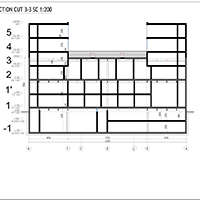

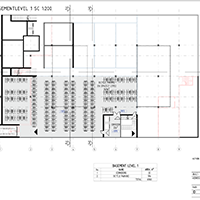

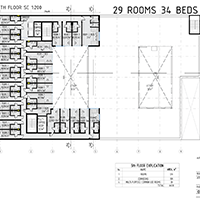

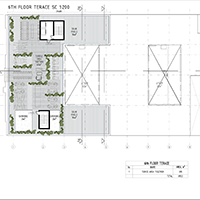

An architectural project of the Student Hall building will be developed, and the building permit will be obtained within 24 months after the purchase of land plot and premises. The current layout of the ci. 6 000m2 building and its bearing construction elements allow redevelopment into a student hall that is in line with contemporary standards. A complex of student residence includes guest rooms, co-working areas, student labs, recreation areas, cafe, gym, rooftop swimming pool, etc. At the moment there are 2 major architectural concepts developed in association with potential operational partners. Both concepts include several classrooms of various sizes for 100 to 400 seats, as well as a number of bedrooms with different amount of bed spaces:

- Concept 1 (224 rooms 293 beds)

- Concept 2 (154 rooms 363 beds)

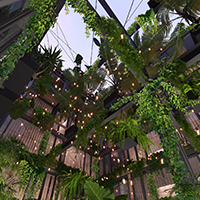

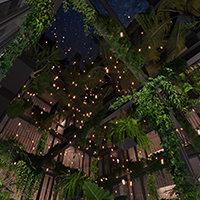

Each concept on average has 200 m2 of common use areas (kitchens, classes, etc.) per floor. The windows of living rooms overlook spectacular atriums with vertical tropical forests with rain irrigation systems. On the rooftop, it is planned to build a terrace with furniture and canopies made of solar panels. Facade of the building will be decorated with threaded plants supported by the automatic irrigation system.

-

Community and environment issues

R.Evolution has a responsible approach towards the environment and society the company works in. Within this project, the developer offers Student Hall Community members to tackle overconsumption and pollution issues in the scope of a particular student hall.. The Student Hall will become an eco-system in the middle of an urban jungle. Its inhabitants will have not only to live inside that system but also will have the possibility to study it and analyze the level of energy consumption. Community members will then explore the processes that stimulate modest energy and food consumption principles. For that purpose, there will be an informative multimedia panel installed and available for all the spectators. It will illustrate live statistics for the consumption of major energy resources as electricity, water, heating, etc.

The Student Hall community will offer a unique membership transport sharing service in association with Tesla, which is considered an environmental transport flagship. Each member who will have a valid driving license will be able to book one of the vehicles from R.Evolution Community Tesla set, whether it is a single shopping drive or a ride with friends to a party. Different types of vehicles Model 3, Model S and Model X will be available. For those, who like to feel the wind in their hair an electric scooter sharing service will become a great addition to daily activities. The aim of community building is to encourage its members to choose the most appropriate vehicle for a particular occasion, taking in consideration principles of green-living and avoiding overconsumption.

R.Evolution Community together with Flax&Kale will also offer its members to choose between half-board or full-board healthy menus for affordable prices on the spot.

Members of the R.Evolution community will be able to develop their social, artistic and entrepreneurial skills and competences inside student hall and participate in its maintenance and management. Community members will have an opportunity to have part-time employment in the student hall as a receptionist, cleaner or barista in the lobby bar.

After a busy day of self-development, students will have an opportunity to use rooftop recreation area. Yoga areas will be located both on the rooftop recreation zone and inside the building.

R.Evolution Community has a responsible approach towards the environment and society they live in. Community offers its members to challenge the overconsumption and pollution issues in the scope of a particular Student hall and on their own example transform these values to the whole urban society.

By proposing the project on VIAINVEST R.Evolution Community invites a wider public to join them as their partners and earn together with them.

-

Market description (why the project has potential within the existing market)

It is planned to develop Student Hall Project in 22@ district of Barcelona which is a world-class innovation and technology hub. 22@ district is currently populated by universities, research and education centers, headquarters of the most advanced start-ups and international hi-tech companies. Since 2004, more than 5 000 companies and 100 000 employees have shifted to 22@ district as it is conveniently located near to the historical center, within the walking distance from the beach and a lot of other amenities.

A vast majority of student residences of Barcelona are created and operated under a similar architectural and business model based on the following principles - a mixture of a large amount of hostel-type guest rooms and relatively few common use areas and recreation zones. R.Evolution offers a conceptually new type of student residence – it aims to create a student community with an emphasis on anti-consumerism and promotion of social and environmental friendliness.

Barcelona student accommodation market characteristics

- Total number of students in Barcelona: 171 849

- Number of international students in Barcelona: 25 780

- Number of Erasmus+ students in Spain: 45 831

- Number of beds in student halls in Barcelona: 9 221

- Average price per bed in student hall: 460 – 1 980 EUR/month

- Annual price growth for student accommodation: 7%-8%

- Current proportion of students and beds in Barcelona: 17:1

Predictions of the segment growth are based on mounting domestic demand and increasing student mobility within Bologna Process. Spain and the UK are the only participating countries where international Erasmus students outnumber domestic students travelling abroad.

-

Project timeline

- Project launch: July 2019

- Project completion: September 2023

- Project development: 24 months

- Construction and commissioning: 18 months

- Withdrawal from the project: 6 months after commissioning

-

Capital structure

-

- Equity

- Bank

Property acquisition

-

- Equity

- Bank

Building construction

-

- Equity

- Bank

Total project financing

-

-

Finances and flows

The project sales price is calculated based on capitalization rate on net annual income that the property is expected to guarantee for a final investor. The total development cost of the project is estimated at 24 334 920 EUR. The two major sources of financing will be equity of investors and bank loan (projected LTC 52%).

The equity is will be provided via the direct purchase of the project development company's shares and loans of project investors' bearing fixed annual interest rate. Investors’ loans will be provided on the monthly basis depending on cash demands for actions planned in the next month.

The total project development period is 54 months (24 months - pre-development; 18 months - building construction; 6 - 12 months - project exit). In the normal scenario return on equity for the project investors for this period will be 71.24%, whereas the internal rate of return will reach 20.10%. In the best-case scenario, the operational costs of student residence will decrease, annual income will grow, therefore the sales price will rise. This scenario sets the expected IRR at the level of 24.89%, ROE – 93.68%.

Exit strategies and opportunities:

- Scenario 1 - Exit before construction. According to current projections it will be possible to sell the property after completing technical project and obtaining construction permit. It is estimated to reach this point in 24 months time from the start of the project.

- Scenario 2 - Forward purchase. The developer is actively working with the investment funds active in the student housing sector. Taking into account very low supply of good quality properties on the market, the funds are ready to enter into forward purchase agreements before the start of the construction works. The deal will be structured with an advance payment and full clearing once the building is put into operation by the Developer. Full exit is expected in 42 - 48 months from start of the project in this scenario.

- Scenario 3 - Selling the Property to a broader spectrum of investment funds (pension funds, real estate investment trusts, prominent family offices) once the cash-flow is established. Professional local student housing operator will be contracted to ensure maximum operating income of the property. It is expected that the full cash-flow potential will be reached in 48 months time from the start of the project and exit in this scenario is possible in 48-54 months time from the start of the project.

The estimated purchase price will start from 38 093 000 EUR in pessimistic scenario and go up to 46 112 665 in the best case scenario. It derives from the division of annual rental income of the student hotel (2 190 352 EUR) by pessimistic capitalization rate of 5.75% or optimistic 4.75%. The calculation of rental income is based on the opinions of market participants (operators), demand and accommodation prices in residences of Barcelona.

Equity investors' return will be paid by the return of the loans, accumulated loan interest and dividends.

-

Downloadable files

Project presentation

This particular business loan allows early exit from the investment taking into account specific annual interest rate calculation terms. Early exit options and respective annual interest rates are listed below. Early exit from the investment can be requested by pressing EARLY EXIT button available in this particular business loan profile. Invested principal and earned interest returns to investor account after selected notice period.

| Reason for withdrawal from the agreement | Prior notice period | Guaranteed annual interest rate (paid on monthly basis) | Extra annual interest, paid once at the end of the agreement | Total annual interest rate |

|---|---|---|---|---|

| The loan maturity day | n/a | 12% | 2% | 14% |

| Early exit request before the maturity day | 1 month | 12% | n/a | 12% |

| Early exit request before the maturity day | 3 month | 12% | 1% | 13% |

| Early exit request before the maturity day | 6 month | 12% | 2% | 14% |

By selecting one of the early exit options listed below, you will automatically inform VIAINVEST about your willingness to exit the investment after the selected period of time starting from the date when the request is made. Invested principal and respective earned interest will be transferred to your investor account after chosen time period.

This particular business loan allows early exit from the investment taking into account specific annual interest rate calculation terms. Early exit options and respective annual interest rates are listed below. Early exit from the investment can be requested by pressing EARLY EXIT button available in this particular business loan profile. Invested principal and earned interest returns to investor account after selected notice period.

| Reason for withdrawal from the agreement | Prior notice period | Guaranteed annual interest rate (paid on monthly basis) | Extra annual interest, paid once at the end of the agreement | Total annual interest rate |

|---|---|---|---|---|

| The loan maturity day | n/a | 11% | 2% | 13% |

| Early exit request before the maturity day | 1 month | 11% | n/a | 11% |

| Early exit request before the maturity day | 3 month | 11% | 1% | 12% |

| Early exit request before the maturity day | 6 month | 11% | 2% | 13% |

By selecting one of the early exit options listed below, you will automatically inform VIAINVEST about your willingness to exit the investment after the selected period of time starting from the date when the request is made. Invested principal and respective earned interest will be transferred to your investor account after chosen time period.

This particular business loan allows early exit from the investment taking into account specific annual interest rate calculation terms. Early exit options and respective annual interest rates are listed below. Early exit from the investment can be requested by pressing EARLY EXIT button available in this particular business loan profile. Invested principal and earned interest returns to investor account after selected notice period.

| Reason for withdrawal from the agreement | Prior notice period | Guaranteed annual interest rate (paid on monthly basis) | Extra annual interest, paid once at the end of the agreement | Total annual interest rate |

|---|---|---|---|---|

| The loan maturity day | n/a | 9% | 2% | 11% |

| Early exit request before the maturity day | 1 month | 9% | n/a | 9% |

| Early exit request before the maturity day | 3 month | 9% | 1% | 10% |

| Early exit request before the maturity day | 6 month | 9% | 2% | 11% |

By selecting one of the early exit options listed below, you will automatically inform VIAINVEST about your willingness to exit the investment after the selected period of time starting from the date when the request is made. Invested principal and respective earned interest will be transferred to your investor account after chosen time period.

Two component compensation model: monthly interest rate plus bonus at the end of the agreement if sales revenue exceeds the set threshold. Investor’s total interest income depends on the rent yield. Rent yield is the return a property investor is likely to achieve on a property through rent, which is calculated by dividing net annual property rental income by the value of the property and multiplied by 100 to get the percentage. Rent yield will be calculated at the end of the agreement and paid to the investors according to the threshold provided in the table below. Fixed interest of 8% is paid to the investor on a monthly basis. Namely if the total rent yield will reach 5.25%, effective interest income will reach 10%, the difference will be paid out at the end of the agreement.

Calculation example:

| Rent yield | Sales price | Interest income |

|---|---|---|

| 5,75% | 38 093 071 € | 8% |

| 5,25% | 41 720 983 € | 10% |

| 4,75% | 46 112 665 € | 12% |

Do you want to leave the section "Appropriateness Assessment data"? Changes you made won’t be saved.

Vai esat drošs, ka vēlaties pamest sadaļu "Investora dati"? Veiktās izmaiņas netiks saglabātas.

Do you want to leave the section "Site Settings data" ? Changes you made won’t be saved.

Paldies, ka ieguldāt kopā ar mums! Lai jūs arī turpmāk saņemtu jaunākās ziņas, vērtīgu informāciju un personalizētus piedāvājumus, mēs lūdzam atjaunināt savu mārketinga piekrišanu.

Jums ir nesaglabāti dati. Vai tiešām vēlaties pamest lapu?