If you dream of growing your wealth beyond your take-home pay and pension, experts say investing is the way to do it. But if you’re ever going to be able to take that first step toward generating returns from asset classes such as peer-to-peer investing (P2P investing), you might want to learn how to budget first.

Budgeting might seem like an onerous task, but the rewards are greater than any amount of inconvenience it might cause. Besides, a lack of a budget can not only steal your savings but also rob you of your dreams and goals as well. For instance, without a budget you may never notice that the average household throws away GBP 470 each year on food waste.

If you don’t know the first thing about how to budget, you’re not alone. Fortunately, there are more tools available than ever including budgeting mobile apps that are accessible at the touch of a finger to help you on your journey to gaining control of your finances. And there’s no one size fits all budget. So whether you’re single or managing your money as a couple, chances are there’s a budget that’s right for you.

Why budget?

Budgeting is simply documenting all of the money that’s coming in vs. the amount that’s going out each month. It’s designed to help you prioritize spending, erase debt and reach financial goals. You can create an annual budget for the entire household or design something more specific, say a short-term vacation budget. The possibilities are limited only by your imagination and your goals.

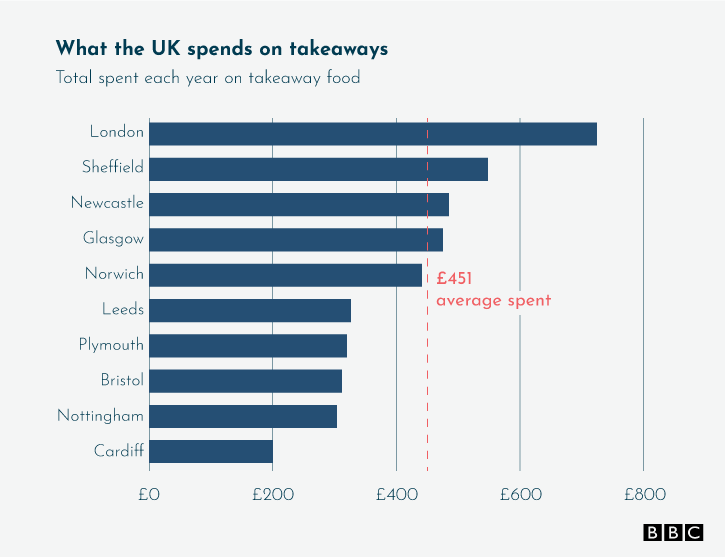

In addition to bringing organization to the chaos, it’s also a way to shine a spotlight on your spending habits that you might not even realize you’ve developed. For instance, with the emergence of food delivery apps such as Deliveroo, Uber Eats and Just Eat, UK residents under the age of 30 are spending an average of GBP 7.80 per week. That’s not an eye-popping amount, but it can add up. One couple reportedly doles out about GBP 1,600 per month on food “takeaways.”

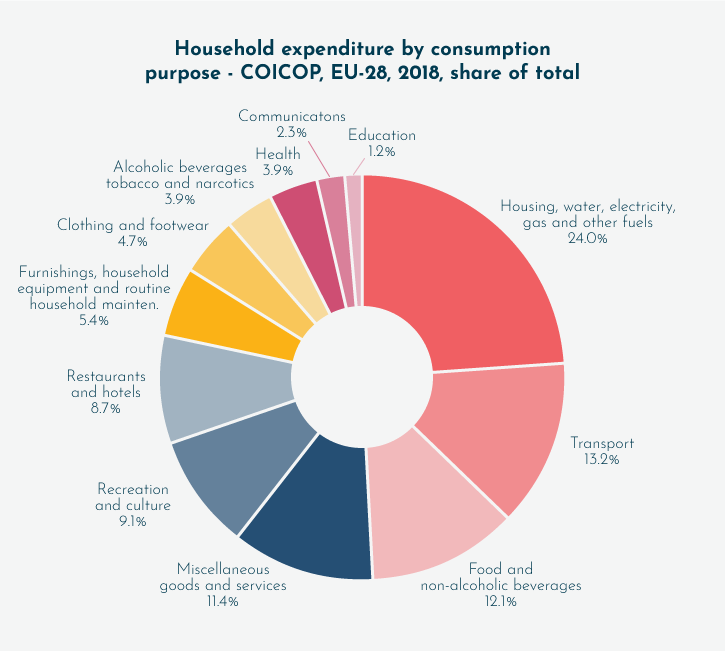

And while you can’t control some costs such as housing, power, and transportation, there may be areas where you can clearly save.

Budgeting Tips

Sticking to the discipline of a budget can seem challenging at first, but with some practice it will become easier over time. Here are some tips to get you started:

- Leave your credit cards behind. If you have to do some shopping, leave your credit cards at home so that you don’t fall for impulse buys.

- Be real. Nobody’s perfect, and if you stray from your budget this month don’t lie to yourself about it. Regroup and start again next month.

- Plan your meals each week. By planning your meals ahead of time, you will be less likely to spend on costly takeout or other spontaneous food items when hunger hits.

- Use auto-draft. By setting your key bills to auto-draft, you won’t have to worry about forgetting to pay something and incurring late fees. Some providers such as insurance companies will offer customers a discount for doing so, which is money you can direct toward savings.

Zero-Based Budgeting

When you’re deciding how to budget, there are a couple of popular strategies. Zero-based budgeting was popular in the 1970s but is making a comeback. It’s clear to see why. You’ll notice that zero-based budgeting not only tracks your income and spending but gives you a plan to direct funds toward growing your income such as P2P investing. While it will require some discipline on your part, the end result could be the difference between reaching financial goals and watching them pass by.

It’s hard to talk about how to budget without turning to the pros, such as personal finance expert Dave Ramsey. As the author of books such as The Total Money Makeover, Complete Guide to Money, and Smart Money Smart Kids, Ramsey is famous for helping families get out of debt. Ramsey is a fan of the zero-based budget, which is also known as the every-dollar budget.

To start, follow these steps:

- Jot down your total income

- List your expenses

- Subtract expenses from income, the result of which should equal zero.

- Track your spending.

Create lines for every single expense, and assign every EUR/GBP/USD etc. that you earn to one of these slots. To be more specific, split your expenses between discretionary and non-discretionary items.

Non-discretionary items are non-negotiable, such as mortgage, rent, groceries, transportation, etc. Charles Schwab recommends you include savings and investment goals in this category, so for example, P2P investing. Discretionary items more resemble your wants, such as entertainment, dining out, clothing, etc.

You don’t have to cramp your style when learning how to budget, either. Just make a place for your late-night Chipotle or Chick-fil-A visits, or whatever your guilty pleasure. The point is to make sure you’ve already assigned a place for these indulgences in your budget.

After subtracting expenses from total income, if the result is zero, congratulations! This means every EUR/GBP/USD etc. that comes in has a home in your budget. If the result isn’t zero, keep trying until it is.

You can find a sample zero-based budget spreadsheet here.

50/30/20 Budget

The 50/30/20 budget leaves little room for interpretation. If you would like to set it and forget it, this budget could be right for you. Basically, this budget allocates your income as follows: 50% toward essentials, such as groceries, utilities, etc.; 30% for personal expenses, such as entertainment, travel, etc.; 20% toward your savings goals.

It’s never a bad idea to keep an emergency fund for those unexpected expenses that can pop up.

If neither the zero-based or 50/30/20 budgets work for you, there’s always the tried and true “envelope budget.” As the name suggests, this approach involves earmarking cash for every expense in separate envelopes, such as for food, mortgage, rent, etc. If you stick to the cash in the envelopes, you won’t overspend. Of course, with the rise of digital payment apps, the use of cash is falling by the wayside so this approach might only appeal to a few.

Budgeting Myths

Even though you’re interested in how to budget, if you wanted to, you could come up with every excuse in the book not to budget. There’s not enough time, it’s too hard, or I’m already keeping track of everything I make and spend in my head. According to Ramsey, these are merely myths that prevent you from taking control of your finances. Fortunately, they can be busted. Let’s take a few of them one by one to prove that these are just excuses, all of which you can overcome.

- No time

If this is your excuse, Ramsey suggests your priorities may be out of whack. He recommends you identify activities that are eating your time that aren’t nearly as important as getting in control of your money. Also, keep in mind that while it may take a few hours to create a budget when you first get started, the amount of time will be drastically cut down once you get the hang of it. Give it a couple of months and before long you’ll just be plugging in numbers and letting the math do the work.

- Too hard

When it comes to the zero-based budget, only basic math is required. Remember, all you need to do is subtract your expenses from your income until you get to zero. So as long as you can do elementary school math, this excuse doesn’t hold water. Besides, there are a bunch of budgeting apps that make it even easier for you, which means you really have no excuse. We’ll discuss those in the next section.

- Budgeting in my head

While you may think that you’re already doing a budget in your head, think again. This is especially true if you are part of a couple, in which case you are only vaguely tracking what you spend. While the math required for a zero-sum budget is simple, it does require putting pencil to paper (or keyboard to spreadsheet.) Besides, writing things down is a cornerstone of learning how to budget.

Budget Apps

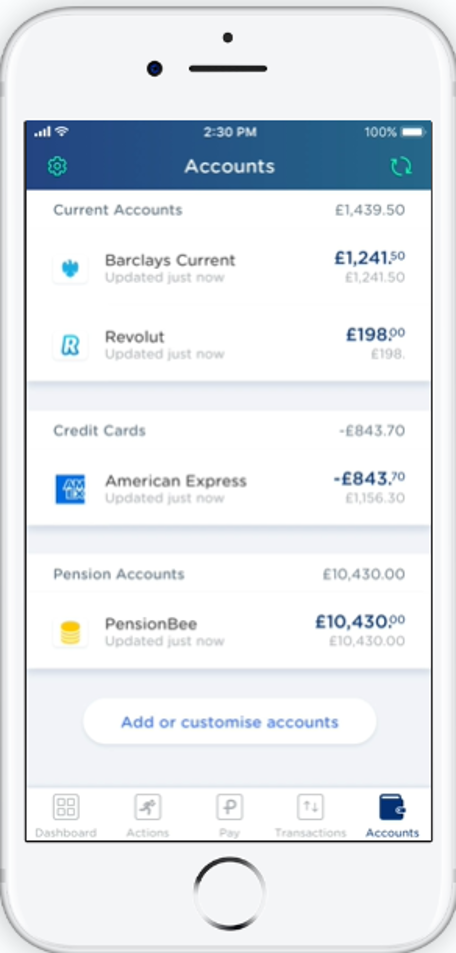

As promised, we’ve compiled a list of some of the popular budgeting apps to help you on your path to taking control of your money. These apps have become increasingly useful as thanks to the open banking regulation. With the new rule, you’re protected when UK banks share banking details with third-parties, such as budgeting apps, with your permission. Doing so gives a real-time element to your budgeting app as you’re dealing with actual transactions.

While Ramsey has a budgeting app dubbed EveryDollar, it’s geared toward American users. Below is a list of apps that are recommended in the UK and European Union.

- YNAB

YNAB is offered as an alternative to the American EveryDollar app, according to a Reddit thread. One Reddit member states, “I second YNAB and I prefer it to EveryDollar. I’ve used YNAB in [the] UK and NZ, but I don’t bother using the option to sync with my bank accounts and don’t ever plan to.”

One personal finance review gave YNAB a rating of 8.7 out of a possible 10. The beauty of YNAB is that it syncs with your bank account automatically, so there’s no need to manually add transactions if you don’t want to. In addition to budgeting, YNAB also offers an Investment Monitoring feature, whether you’ve got an account with Fidelity or Vanguard for instance. A drawback appears to be that the app doesn’t automatically sync with loans and investment accounts, based on user reviews, which could be a drag if you’re trying to keep track of your P2P investments. On the bright side, it appears you can manually add these balances through a feature called Tracking Accounts, which is tied to a net worth report.

- Yolt

Yolt is a free budgeting app with solid reviews on TrustPilot. They are known for streamlining your accounts across savings, credit cards, pensions, and investments in a single place.

Source: Yolt.com

Users cheer the easy navigation of the app and overall appear to agree that it’s useful. It does what it’s designed to do, which is to let you see where your money is going. You should be able to sync some but not all bank accounts. For instance, Tesco Bank syncing was not working as of January 2020.

One complaint from a user is that the app doesn’t support Barclaycard, which the company said it’s in the process of trying to fix. It’s also not designed to support weekly pay, so that could be a bit of an inconvenience for some. Users would also like to see more categories within the budget, such as fitness for gym payments, etc.

- Squirrel

Squirrel is a paid budgeting app that is designed to help you save, budget and manage your bills. It’s managed by Barclays and it automatically divides your salary across bills, savings and a weekly allowance. Your income is released on a weekly basis so that you don’t overspend.

Customers can’t speak highly enough of them on Quora, but the company is apparently developing a new version of the app so you may have to wait to sign up.

The Squirrel app is one way you can participate in P2P investing, as retail investors can back personal loans. They also have plans to expand the app to allow individual investors to back home loans, starting in March. The home loans are said to offer lower risk than personal loans. Interest rates range from 4% for residential home loans, 5% for business real estate loans, and 6%-7% on personal loans.

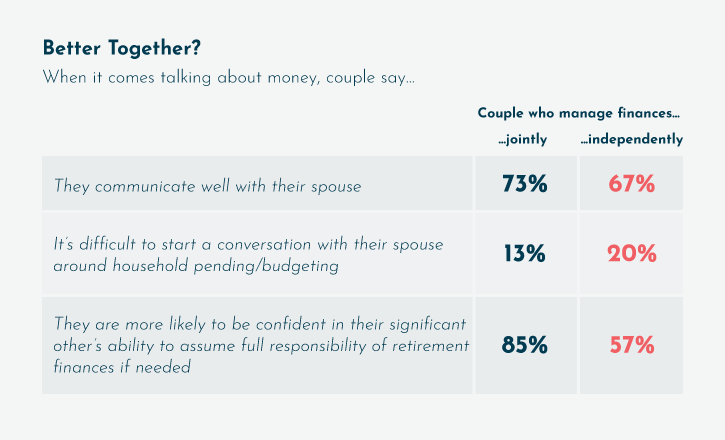

Couples budgeting

When you are part of a couple, you may decide to continue navigating your finances alone or combine them. Combining finances can be a slippery slope but nothing that a good amount of communication and budgeting can’t solve. The hardest part is reportedly getting the conversation started, but you can make it as informal as you’d like – perhaps bringing in date-night favorites such as beer or wine – or treat it more formally if you prefer.

When you decide to go all in, experts recommend that you start by tracking your spending and savings, including credit cards and other bills so each spouse is aware of the other’s cash flow situation. It will avoid surprises down the line and open the door for communication when it comes to savings and goals.

A couple highlighted in The Wall Street Journal was in for a rude awakening when they realized they had different ideas for saving and spending. One spouse’s lifestyle was more social and involved dining out more frequently while the other would prefer to direct that money toward savings. By creating a budget, and with some compromise, they were able to create room in the budget for the one spouse to continue occasional social outings. This couple earmarks 15 minutes each week to discuss finances to decide if they need to make any tweaks to remain on track for long-term goals.

Another couple featured in Forbes are millennials who are living together. They keep their bank accounts separate and split bills down the line. They each continue to save separately for retirement but the girlfriend worries that their social life is eating into funds that could be otherwise directed toward retirement savings. Forbes recommends budgeting apps that are geared toward couples, such as Simple and HoneyFI. In the UK you might try Goodbudget.

Speaking of millennial couples, that is the perfect time in your life to get rid of debt. CNBC features a young couple in their 20s who currently earn a combined USD 124,000. For 14 months, the couple lived with their parents to pay down debt and save money. They were able to pay off most of their debts, including nearly USD 90,000 in college debt, in 2.5 years. They paid a low rent during this time and aggressively directed their income toward debt. Even after they were in a better financial situation, their frugal habits remained with them and have become a way of life, which has helped them to save for a house. They are also on track saving for a USD 25,000 emergency fund. In addition to their day jobs, Marissa, the wife, also maintains a side-gig in which she earns more than USD 27,000 a year from a YouTube channel focused on budgeting.

Source: The Wall Street Journal/: 2018 Fidelity Investments Couples & Money Study

DIY Budgeting & Investing

Once you tackle the skills of do-it-yourself budgeting, it will be that much more natural when you are ready to transition to do-it-yourself investing. Andy Bell, author of “The DIY Investor”, explains that what typically prevents people from confronting their financial situation is fear. Data indicates that the number of DIY investors is projected to grow to 7 million. If you would like to become part of that group, then the “effort and engagement” that you apply to budgeting can certainly be replicated in your investments.

He explains how people may be more inclined to obsess over saving a few EUR/GBP/USD with a coupon for a local restaurant than they are to research major decisions as they relate to their financial independence. To start, the basics include knowing what’s in your retirement fund, how much money you need to retire, and identifying what your investment goals are. It’s about setting goals and creating a strategy.

| Company | Country | New loans [M EUR] | vs. previus month | vs. last years month | Ablrate | Great Britain | 0,4 | -3% | -50% |

| ArchOver | Great Britain | 0,1 | -97% | -97% | Assetz Capital | Great Britain | 21,4 | -40% | 125% | Bondora | Estonia | 15,0 | -6% | 67% |

| Bondster | Czech Republic | 3,6 | -11% | n/a |

| Colectual | Spain | 0,1 | -68% | -10% |

| Credit.fr | France | 2,1 | -6% | -7% |

| CrowdProperty | Great Britain | 2,5 | -17% | 49% |

| Dofinance | Latvia | 1,6 | -7% | -22% |

| Estateguru | Estonia | 8,8 | 32% | 175% |

| Fellow Finance | Finland | 15,5 | 5% | -16% |

| Finansowo | Poland | 1,1 | 10% | -8% |

| Finbee | Lithuania | 1,0 | 1% | -5% |

| Folk2Folk | Great Britain | 7,2 | 254% | 135% |

| Geldvoorelkaar | Netherlands | 2,6 | -52% | -18% |

| Growly | Spain | 0,5 | 72% | -25% |

| Grupeer | Ireland | 5,7 | -23% | 187% |

| Investly | Estonia | n/a | n/a | n/a |

| Iuvo Group | Estonia | 6,0 | -5% | 46% |

| Kameo | Denmark | 4,3 | 42% | n/a |

| Klear | Bulgaria | 0,2 | 31% | 2% |

| Landlordinvest | Great Britain | 0,0 | -100% | -100% |

| Linked Finance | Ireland | 3,7 | 36% | 26% |

| Look&Fin | Germany | 1,2 | 15% | -45% |

| Mintos | Latvia | 317,4 | 16% | 111% |

| MytripleA | Spain | 2,5 | -57% | 43% |

| Neafinance | Lithuania | 1,8 | 23% | 29% |

| October | France | 7,4 | -58% | 88% |

| PeerBerry | Latvia | 20,5 | 18% | 166% |

| Proplend | Great Britain | 3,2 | 293% | -72% |

| Ratesetter | Great Britain | 68,4 | -4% | -23% |

| Rebuilding Soc. | Great Britain | 0,1 | -47% | n/a |

| Savy | Lithuania | 0,9 | 39% | 60% |

| Smartika | Italy | 0,0 | 100% | -20% |

| Soisyt | Italy | 0,8 | 15% | 105% |

| Sourced | Great Britain | n/a | n/a | n/a |

| Swaper | Estonia | 4,9 | 19% | -33% |

| TFGcrowd | Estonia | 0,4 | 13% | n/a |

| ThinCats | Great Britain | n/a | n/a | n/a |

| Twino | Latvia | 15,4 | -8% | -22% |

| Viainvest | Latvia | 6,7 | -4% | 12% |

| Viventor | Latvia | 5,5 | 27% | 49% |

| Zopa | Great Britain | 120,5 | 101% | -4% |

One category that is designed for DIY-types is P2P investing, the recent activity for which is outlined in the above table.