The Baltic states of Estonia, Latvia, and Lithuania are becoming a hotbed for European fintech companies. Latvia’s latest entrant in the P2P lending market is VIAINVEST. VIAINVEST has some great features and an easy website to navigate. Let’s check out a couple of the benefits they offer on their platform for you as an investor.

Hold Some, Sell Some

As someone who lends on peer lending platforms, and as someone who does credit analysis for a living, I’m always looking at the credit side of a platform to see if they score a loan using sound credit principles. Most platforms have some transparency in this area without fully revealing how they evaluate and score loans. VIAINVEST has some safeguards for us investors, which you’ll see in just a moment.

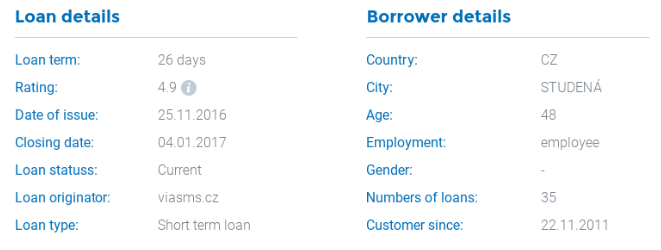

VIAINVEST has its own rating system and fixed interest rates set per country. The rating is a number from 1-10, and you can see here in this example that this loan is rated in the middle, a 4.9.

This is a 26-day loan for an employed person in the Czech Republic.

The company holds a portion (5%) and sells the remainder to investors. So if their credit system sucks, they will lose money too. That’s a good protection for us.

This makes VIAINVEST what we call a balance sheet lender, meaning they lend off their own balance sheet before presenting the loan to the marketplace. Balance sheet lending is common but different than a strict peer to peer marketplace where the platform only plays matchmaker between borrower and lender and does not suffer right away with loan losses.

VIAINVEST has the cash and the backing to fund these loans because…

VIAINVEST is Big AND It’s Small

Peer lending platforms are often small fintech companies having to raise money and prove their concept. Fans of P2P lending in Europe and around the world like this as their smallness makes them nimble and not tied into big bank legacy systems and compliance rules.

However, bigness has its advantages as well, especially when it comes to money and financial stability. The best of both worlds would be a peer lending platform to serve Europe that is nimble but backed by established money.

And that is VIAINVEST. It has all the look, technology and mentality of a fintech startup, yet it has the backing of a large financial non-bank lender, its parent company VIA SMS Group. The parent company has numerous companies that make many types of loans across Europe, not just consumer short term loans on the VIAINVEST platform.

Buyback Guarantee

VIAINVEST has a Buyback Guarantee on their loans so if a loan you invest in is more than 30 days late, then the company buys it back from you.

Why would they make a guarantee like this? VIAINVEST’s parent company has offices in 5 European markets and they use these companies to originate the loans. All the loans are originated online as parent company VIA SMS Group has developed complicated IT-based risk evaluation system with several evaluation phases that allow minimizing loan default risks.

Getting Started as an Investor

Minimum investments are 10 EUR per loan and loans are short term, up to 30 days. Anyone with a European Union bank account as an individual or a business can invest on VIAINVEST. While you can open your lending account in one of many currencies, loans are made only in EUR and you pay to convert your home currency to EUR based on Swedbank’s listed exchange rates.

You can check out a video of how VIAINVEST works in general right here. VIAINVEST charges no servicing fee to its investors.

Loans currently offered for investors are originated in Spain with an 11.2% annual interest rate and in the Czech Republic with a 12% annual rate. While these 2 countries are currently open to lenders, VIAINVEST makes loans in 5 countries so expect new countries to open up soon. Maximum loan amounts are 20,000 Czech Koruna (just under 750 EUR) in the Czech Republic and 600 EUR in Spain.

Thanks to the in-depth evaluation of borrowers, the Buyback Guarantee, and lending off their own balance sheet, VIAINVEST is hitting the ground running in Continental Europe.

Interested in lending your EUR on VIAINVEST? Check out one of more than 2000 loans currently available on the platform today by setting up an account at viainvest.com.