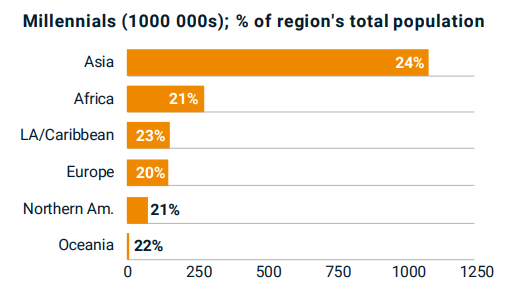

The millennial generation is growing in influence around the world. For example, in the United States, more than 50% of the population is either part of the millennial generation/Gen Y or younger. In the EU, there were roughly 102 million millennials living in member countries as of 2017, representing one-fifth of the population. As of 2020, more than 20% of the global population falls under the millennial category, representing about 1.8 billion people around the world. Asia is out front for the millennial generation, with this segment comprising 24% of the continent’s total population.

Source: MSCI.com

Incidentally, the rise of social media happened to coincide with the maturation of the millennial/Gen Y population, giving rise not only to their voice but also their influence in the world around them. These young generations have been among the first to speak out on issues ranging from climate change to a leveling of the playing field in the investment landscape. On the investment front, millennials between the ages of 21 and 30 are already out front in terms of their domination and influence when it comes to peer-to-peer investing.

Even throughout the pandemic, while physical gatherings were not possible, millennials, also known as the “digitally native” generation, did not skip a beat. This was because of their comfort level with the digital world, as they turned to their mobile devices and social media to continue to have their voices heard.

And many millennials have the education to support their opinions. More than 50% of millennials globally have gone on for some form of post-secondary education, outshining their older generation counterparts in this area. Millennials are also staying single longer than other generations did and are delaying the dream of settling down with a family, all of which has fueled their economic standing and therefore their influence in society.

A recent CB Insights report details industries across several verticals, including activities & hobbies, consumer goods, transportation, and finance, that are poised to flourish thanks to the participation of the millennial generation. Indeed, the stars are aligning for the massive generation as they hit their spending prime even as they are poised to inherit “USD 30 trillion in wealth from baby boomers and Gen X,” the report reveals. This transfer of wealth is sure to influence the direction not only of corporations but entire sectors as the young generation establishes trends in spending, investing and more. We have spotlighted some of the hottest areas of growth thanks to millennials.

Camping

While many millennials are delaying settling down and having a family, those who do take the plunge have demonstrated an affinity for adventure. As a result, the camping industry is booming thanks in large part to the trips that millennials have embarked upon. One area where this trend is evident is in campaign equipment, where sales climbed to more than USD 3 billion last year, vs. below USD 2 billion seven years prior.

In Europe, this trend has been playing out with the resurgence of Recreational Vehicles, or RVs. In the year before the pandemic hit, caravanning was one of the most popular ways in which people traveled. Caravan sales in Europe grew 4% that year, with more than 210,000 of these vehicles sold.

Now caravanning has only become more attractive in the wake of the pandemic as people seek to avoid large crowds. And with some borders remaining closed due to the delta variant, motorhomes are becoming the travel alternative. While this hobby used to be mostly enjoyed by the 55+ crowd, millennials have begun to appreciate the freedom of the open road. In particular, Brits under the age of 40 are increasingly jumping on the caravan bandwagon.

The average price for a camping vehicle is GBP 25,000, which makes this form of travel affordable in addition to convenient. The U.S. is still out front on the camping trend, as North America has 40% of the market share. Meanwhile, Western Europe represents 27% of the global camping market.

Travel

Millennials are fans of travel in general, not just camping. Their tech-savviness has them turning to online platforms in search of affordable and tailored situations. In doing so, they are increasingly taking a decentralized approach to travel in which the “middleman” is cut out of the equation, which saves them on expenses. The travel industry has had to adjust its models to appeal to this rising generation, whose approach to travel differs greatly from their parents and grandparents.

One thing that millennials and baby boomers have in common, however, is their desire to visit as many destinations as possible in their lifetime. In fact, according to an Airbnb poll, millennials would rather direct their savings toward their next trip than work on getting out of debt or even buying a home. Where they differ from older generations is that they prefer to use Airbnb or VRBO vs. traditional holiday stays at hotels, for instance.

Millennials would often rather walk in the shoes, so to speak, of the locals than to have a secluded vacation experience. Chances are you won’t find young travelers on a double-decker bus tour seeing the sights as they seek out authentic experiences instead. Millennials are also likely to rely on social media platforms such as Facebook to decide on their next excursion, using reviews as a way to vet locations, and they will shop around on multiple digital platforms until they find the best deal.

The hotel industry is having to remain nimble and adjust to the preferences of Generation Y. Scott Greenberg, who is at the helm of Smashotels, said, “If we attract young people, old people will show up. But if you build a hotel for old people, young people never show up.”

Before the pandemic hit, some of the top travel destinations or dream holidays among millennials were the following, in random order:

- Zanzibar, Tanzania

- Charlevoix, Quebec, Canada

- Wine Region of South Africa

- Salvador da Bahia, Brazil,

- Chiang Mai, Thailand

- Luberon, France

- Utah, U.S. (national parks)

- Cinque Terre, Italy

- Ubud, Bali, Indonesia

- Lisbon, Portugal

Physical Fitness

Millennials spend billions of dollars each year on staying fit. More specifically, they dole out USD 7 billion annually on fitness, which is twice as much as Gen X or baby boomers spend. Boutique gyms tend to have higher membership rates than traditional fitness centers. The younger population is willing to pay for the experience, where they get a sense of community.

Gen Y’ers are interested in getting gym memberships at small, boutique gyms and taking classes alongside their peers. Millennials are more likely than older generations to exercise once or more per week. Some of the exercise trends that have gripped Europe’s fitness industry include:

- High-Intensity Interval Training, or HIIT

- Spartan Races

- Bossaball

- Parkour

Dining

Millennials have played a role in disrupting the restaurant industry. In a world where they can order their next meal and have it delivered with one touch on their mobile device, this younger generation has come to prefer take-out or cooking their own meals. When Gen Y does go out to eat, which they do, they prefer fast-casual dining locations rather than traditional restaurants. They are looking for good prices, organic ingredients, fresh and healthy choices. While finding deals is important to the young generation, Gen Y’ers are willing to dole out more if they have to in order to get the experience and food they want.

Europe’s fast-casual dining market is on track to hit revenues of USD 17 billion by 2024, representing a CAGR of 6% in the seven years leading up to that year. Dining establishments are looking to make their restaurants more “millennial-friendly,” such as creating an atmosphere that supports interaction, conversation and fun.

Vegan and plant-based foods are some of the top dining trends, as is sushi, in the fast-casual setting. Restaurants that are looking to cater to Gen Y’ers need to be just as concerned about the technology they integrate as the health-conscious items they add to their menus, given the tech-savvy nature of this young generation. Chipotle has been successful at resonating in both areas, with its locally sourced food items, “made-to-order burritos and bowls” and digital restaurants. A couple of other features that are emerging, especially in the wake of the health crisis, are menu access via QR codes as well as app-fueled dining service. While this trend might be one that was born from the pandemic, it is one that is expected to stick.

Coffee Trends

Millennials are big coffee drinkers. While Gen X and Baby Boomers similarly like to have a cup of Joe, millennials started drinking it at the ripe age of 15. As a result, they can’t seem to go without it and are willing to pay a premium for their coffee. Millennials have been responsible for a renewed wave of attention on coffee and are helping to fuel sales.

There are certain trends that stand out in relation to millennials and coffee. For instance, They tend to flock to gourmet brands and have shown a desire for cold brew. Considering that this young generation places a great deal of importance on their well-being and health, they have demonstrated a desire for decaffeinated coffee to balance out their caffeine intake.

In addition, they have shown an interest in alternative creamers such as almond, coconut or oat milk as well as other nut and plant-based products. And in light of millennials’ desire to keep their carbon footprint at a minimum, this segment of consumers is also paying attention to products and packaging that are made in a sustainable and animal-friendly way.

Autos

Like baby boomers and Gen X’ers, millennials are interested in owning their own vehicles. But they are willing to drive inexpensive vehicles while maintaining a heightened focus on the car’s environmental impact. According to an EY survey that was done on the heels of the pandemic at the end of last year, demand for cars was on the rise.

More than 30% of people polled who did not own a vehicle at the time planned to buy one in the coming six months, close to 50% of whom were millennials. A mere 6% of those polled were interested in buying an electric vehicle, which is surprising considering the focus of young consumers is on the environment. But they are not looking for gas guzzlers and are happy with a small sedan.

Millennials are keen to buy vehicles to use for travel, which is a trend that emerged due to the health crisis. EY polled more than 3,300 consumers in close to a dozen countries. More than 300 of the survey participants were from the U.K.

Micromobility

While millennials have demonstrated a greater interest in owning a vehicle, they are also big proponents of the micromobility economy. This segment comprises ride-share and bike-share programs as well as e-scooters. The micromobility sector was growing hand over fist but the pandemic threw things for a loop. People stopped traveling, and the providers of micromobility services felt it. Nonetheless, this sector is poised for a strong comeback as it is a preferred method over public transportation.

Cities are responding to this trend in a post-pandemic world with more bike lanes, for example, as people begin to use scooters, mopeds and bicycles more frequently and for longer trips. Bicycle paths are popping up more often in places like Brussels, Montreal and San Francisco, and millennials are fueling much of the demand for these services. They want to be travel in a fun, safe way, and micromobility fits the bill.

Millennials & Money

When it comes to money, millennials are more comfortable with using a mobile app than they are using a traditional financial institution. They are the generation of financial technology (fintech), neobanks and challenger banks, cryptocurrencies and investment apps. Gen Y’ers are a tech-savvy bunch that are quite comfortable using online tools to manage their finances and for banking.

Additionally, millennials prefer getting their financial advice from their mobile app ecosystem instead of sitting down in person with a financial advisor, the latter of which is the more traditional approach. Challenger banks have come in to meet this demand and they continue to grab market share away from the financial institutions.

Millennials also invest in the way that they live, on their own terms. Rather than limiting themselves to traditional asset classes, such as stocks and bonds, Gen Y’ers have moved toward alternative investments, such as peer-to-peer investing. While P2P investing is not limited to any one generation, it is not uncommon to find people between the ages of 25 and 40 on either the lending or borrowing side of the P2P equation.

Even though they’re young, Gen Y’ers have money to invest. Whereas baby boomers were in the habit of socking away about 11% of their money for investing, millennials earmark up to 18% for it, as per a BlackRock poll.

Considering that their mobile device is never too far away, as millennials are in the habit of checking their phones more than 100 times each day, they have all of the apps, social media, education and technology at their fingertips to invest. Putting their cash in a savings account just doesn’t cut it, especially with interest rates as low as they are. Young investors know where the returns are, and they aren’t content not having access to liquidity on a reasonable basis.

P2P investing is one of the areas that ticks all the boxes for them, considering investors can generate returns in the double-digit percentage range in some cases. Plus the upfront capital requirements are not too steep, as they can direct EUR 500 and gain exposure to a number of different borrowers that fit their risk/reward profile. P2P investing provides millennial investors with the diversification that they are looking for.

And when they want to invest in the stock market, digital brokers are just the touch of a button away. More than three-quarters of the assets on the U.S.-based mobile broker Robinhood originate from millennial investors, according to the CB Insights report. It is difficult for banks to compete with the technology that digital brokers have to offer, including features such as face recognition for speedy access as well as cross-platform capabilities so that users can access more products in one place.

Millennials are poised to inherit trillions of euros in the coming decades, which will only increase their earning power, spending power and influence even more. It will also come in handy to help pay off any college debt that might have stuck around.

Economic Bounceback

As the global economy continues to recover from the pandemic year, millennials are expected to play a key role in that bounceback. After adhering to the lockdown and social distancing measures in 2020, they are ready to return to their lives including traveling, face-to-face gatherings and office work.

All of this bodes well for the global economy, especially considering that millennials are so young in their professional careers and adult lives. They are not only disrupting key sectors of the economy, but they are helping to drive the economy itself in a more mobile and decentralized direction. As long as they continue to do so, their spending, consumption and investment styles will set the tone for many sectors.