The European Commission has for some time now placed much focus around fintech capabilities and drivers it would like to see move forward so that European economies can harvest its potential. They started off by drafting various reiterations of a Digital Strategy as well as a FinTech Action Plan.

It aims to provide supporting legislation that will cultivate the necessary environment to give the European financial services industry a strong footing for sustainability and competitiveness. Some of these initiatives have seen more support given the impact of Covid-19 over the last year.

They argue that the fintech industry is the future of economic wealth creation and that a Digital Action Plan can be the catalyst for a more modern and legislatively-responsive economic trading block that is able to compete regionally and globally.

The Main Objectives of Each Plan in a Nutshell

The digital strategy

The European Digital Strategy aims to create a “democratic and sustainable society” where European audiences can use technology in an environment that they feel comfortable in. This trust is also aimed at focusing on the following actions:

- Work on ways to create more sustainable and carbon-neutral technologies that are not only environmentally friendly, but also greatly competitive

- Create new and revised rules to deepen the European marketplace for Digital Services

- Establish a media and audiovisual set of actions to support the European digital transformation so that it can become more competitive on a global scale

- Use this as a way to promote best practices that support local democratic elections

- Reinvent and modernize the eIDAS Regulation to ensure it improves its effectiveness from a compliance point of view

- Promote a database of electronic health records based on common European exchange formats to give European citizens secure access to and exchange of health data across the EU

The Fintech Action Plan for Europe

The Fintech Action Plan was developed to try and create a more orderly industry that protects both the consumer and provider. From a European Union point of view, fintech has been listed as a priority and needs to ensure that as a trading block, it uses this to sensibly create economic and other possibilities.

Here it will try to also create easy, yet comprehensive licensing models that give all fintech players a level playing field that is underpinned by a strong regulatory framework. Fortunately, public participation has been ongoing from various branches of the European Union to ensure it’s something that will work for everyone.

It also lists a Consumer Financial Services plan that deals with cross-border customer identification procedures and/or technologies. There are plenty of other things that it discusses and outlines in great detail, but the above are the most notable points with regard to the direction Europe is taking.

The impact of Covid-19 on fintech in Europe

According to Lexology.com, in response to Covid-19 and resulting measures taken by governments across Europe, many European consumers turned to digital financial instruments. This extremely fast uptick in adoption necessitated the implementation of policy frameworks and responses that will help this industry grow, but in a more secure manner.

“Such swift strides into the digital world need a coordinated policy response that will enable Europe to grasp all the potential of the digital age, including in financial services, and keep pace with its global peers.”

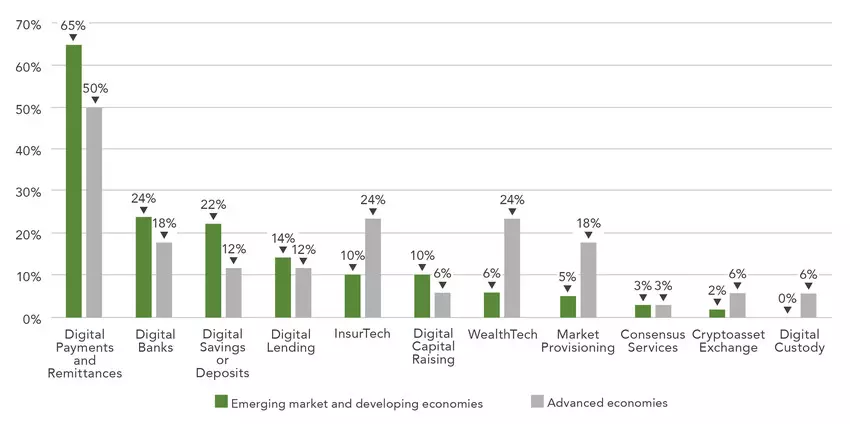

Below is a graph taken from the World Economic Forum, which illustrates that fintech adaption wasn’t just promoted as a result of Covid-19, but that there is a multitude of subsets that the market now serves. Looking at the growth rates, it has also spurred a faster implementation of regulations as well.

World Economic Forum – Global FinTech Regulatory Rapid Assessment Study (28 October 2020)

The Trends That Could Shape the Future of FinTech in Europe

FinTech to Become Even More Global

According to Finextra, the fintech industry isn’t as constrained as others. It refers to it having a “borderless” nature and that this puts any provider within easy reach of a consumer, no matter where they are.

They also argue that digital banks will therefore start becoming more established and will soon compete with longstanding banking giants in ways not ever seen before. Online payment providers are already competing on a global scale and consumers have unprecedented choice.

According to a UK publication by Robert Walter, one in three UK banking jobs advertised right now are “within tech.” As the UK is still Europe’s top financial hub, despite Brexit, it is clear that the banking industry has already recognized the necessity to move forward with fintech.

Cryptocurrencies Becoming More Recognized

You don’t have to be a fan of Elon Musk to know that cryptocurrencies have grabbed the attention of all people across the globe, and with Europe’s centrality when it comes to trade, it too will need to take notice of this trend.

A major development driven by the European Union is how regulation defines and manages what it calls Digital Finance. Here they explain that “the way in which we engage with our financial instruments are far more diverse” and this includes things like:

- Peer-to-peer lending (P2P)

- Current online banking channels

- Personal Investments

- Crypto assets

According to Analytics Insight, despite all the turbulence and unpredictability, most countries have started to adapt and legalize cryptocurrencies as a legal form of tender. This means that it has the ability to steer economic development in ways not known to be possible before.

With a decentralized power base, this also empowers the consumer to transact, invest, and trade in ways that would have been too hard to do if one had to rely on traditional means of banking instruments. This alone should let any investor or government sit up and take note.