After sweltering temperatures in Europe this summer and warm autumn, cooler temperatures are just around the corner. Meanwhile, as the Russian war in Ukraine drags on, a winter of another kind is quickly emerging in the European economy. While soaring inflation has become a common thread in the global economy, it has become especially burdensome for European countries, where an energy crisis of epic proportions has reared its head. With a recession a possibility before the year is over, Europeans are getting pushed to the brink.

While there is no clear indication of when the economic storm clouds will clear, and despite a risk-off environment in the financial markets, savvy investors are preparing for the economic winter by putting their money to work for them. While it might seem counterintuitive, one might want to consider the words of billionaire investor Warren Buffett. He famously said to be greedy when others are fearful and fearful when others are greedy.

In that case, now is the time to seek out the right investment strategies in this market cycle and then use those potential profits to build your emergency or long-term savings. Even conservative asset classes like bond mutual funds are delivering some returns for investors. Before we explore some options, let’s take a look at what is behind the headwinds that are slowing the economy.

European Crisis

Europe finds itself smack dab in the middle of a perfect storm comprising an energy shortage, a looming recession, and political upheavals from the U.K. to Italy with the collapse of the Draghi administration and the resignation of both Boris Johnson and Liz Truss. Meanwhile, policymakers are using their firepower to fight inflation, but after a season of loose monetary policy, the damage might already be done. Economists at Goldman Sachs predict it is a matter of when — not if — a recession hits in the Euro Zone even if the ECB has not issued any formal warning yet.

Much of the turmoil can be traced back to Russia’s war on Ukraine. It has wreaked havoc on the energy supply, considering that Europe relies on the former Soviet Union for a high percentage of its oil and natural gas. With the winter months not too far ahead, the timing couldn’t be worse for an energy crisis for Europeans, who are facing crippling costs in the meantime.

The son of a business owner in the historic city of Leicester in England’s East Midlands shared on social media how his mum is the owner of a small cafe. She saw her electricity bill skyrocket from GBP 10,000 per year to GBP 55,000 per year, making it impossible for her to operate her business as usual. Despite exploring her options, this shop owner is expected to be forced to close her business as a result of the unmanageable power expenses.

Source: Twitter

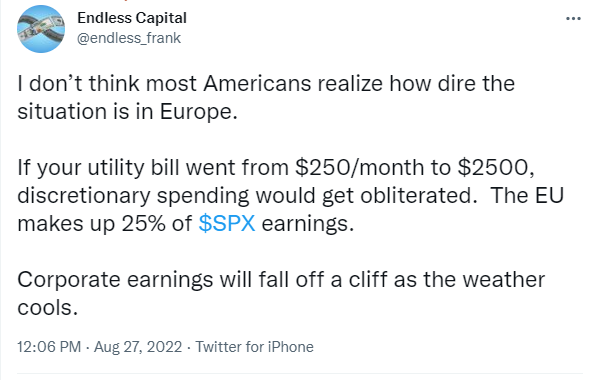

Twitter account Endless Capital similarly weighed in on what they described as a “dire…situation in Europe,” where households are seeing their energy bills soar from $250 per month to $2,500 per month. Money that would otherwise go toward discretionary spending in the economy is now being directed toward paying the light bill. This trend is taking aim at corporate profits, which Endless Capital expects “will fall off a cliff as the weather cools.”

Investors might think they are between a rock and a hard place, but if you look hard enough, there are opportunities for returns that could potentially be used to bolster savings.

European Savers

Despite the precarious economic backdrop, Europeans know how to save money, though some countries are more adept at it than others. During the pandemic, according to the World Economic Forum, European households socked away close to 19% of their income, which amounts to almost EUR 1 trillion that otherwise would have likely been spent.

Saving money is a learned behavior, according to FOM University of Applied Sciences for Economics Professor and Neuroscientist Dr. Mira Fauth-Bühler cited by Germany-based neobank N26. She says, “Our brains have not developed for the purpose of making clever financial decisions,” and instead people are “wired to seek rewards.” The key is patience, which is worthwhile when the incentive surpasses the discomfort associated with waiting.

Apparently, Spain has had some success in this realm, with a monthly rate of savings to income of 23% last year, according to an N26 customer survey. This breaks down to savings of approximately EUR 252 per month for Spanish citizens. Spain’s leading cities for savings were Barcelona (EUR 303.30) and Madrid (EUR 233.34), with users saving an average of more than one-fifth of their monthly income. By way of comparison, the same conversion ratios for Germany, Italy, and France were 18%, 16%, and 6%, respectively.

Baltics Savings

The war in Ukraine has also motivated many in the Baltics region to begin saving more money. According to a poll by Citadele Bank, 15% of Estonians have begun socking away money as a direct consequence of the war. In Latvia, 13% of survey participants say they are saving for the same reason, while the result is 12% in Lithuania. Citadele Bank’s Rainer Moppel says that Estonians have been hit especially hard by the cost of living increases, making it challenging for them to earn money for savings.

With inflation showing no signs of abating, and the energy crisis in full swing, consumers in the Baltics region are also stocking up their pantries with groceries for the cooler months. Estonia leads with 12% saying they are piling up groceries, followed by Lithuania at 8% and Latvia at 6%.

However, it’s not just the nearby war that has fueled more savings. Even before Russia invaded Ukraine, 44% of Lithuanians polled had already begun saving their money and continue to do so. The responses were 33% and 32% in Estonia and Latvia, respectively.

There are also those who say they cannot afford to save money because they are caught in the trap of living paycheck to paycheck. This group accounted for 23% of respondents in Latvia, 21% in Estonia, and 16% in Lithuania. Across the Baltic nations, citizens have also begun dipping into their savings to make ends meet.

The New York Times recently featured a beer factory in Estonia in which the business is preparing two separate price increases of 10% each in a year’s time for the first time in its 200-year history. Despite the double-digit percentage price increase, it still won’t be sufficient to cover the establishment’s costs. Management blames Estonia’s soaring inflation, which surpassed 25% in August, and the energy crisis, the latter of which will see its gas costs skyrocket 400% when the summer contracts come to an end. The electric bill is expected to double.

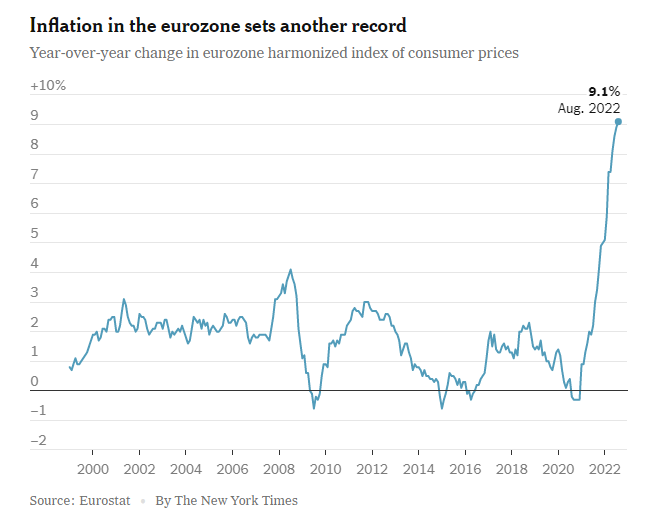

Consumer prices climbed 9.1% higher in the Euro Zone region, beating July’s record increase of just under 9%. Meanwhile, a year ago consumer prices hovered at just 3%, a level that would be welcomed with open arms in today’s economy. In addition to Estonia, Latvia and Lithuania are also battling inflation above 20%, fueled by energy prices which in turn are being influenced by the war in Ukraine.

Source: The New York Times

The desire among the locals in the Baltic nations is not surprising. According to another poll, by Luminor, a large swath of people living in the region agree that it is a good idea to begin saving for retirement early in life, between the ages of 18 and 24. The survey revealed that those that agreed with this premise were 43% of Estonians, 37% of Lithuanians, and close to one-third of Latvians. Fortunately, investment options could help them reach their savings goals even during an economic downturn.

Investing Psychology

Investing with a cloud of uncertainty could make some people anxious. Nobody knows for sure if a recession will hit, and how bad will it be if it does. However, psychologists say that people who worry or are overly anxious about the economy tend to make bad financial decisions. These behaviors might include borrowing money at excessively high interest rates or prematurely taking money out of a retirement account, which leads to fees. Instead, psychologists offer the following advice to help investors keep their cool regardless of the economic environment.

- Limit Your Focus: Instead of obsessing about the macroeconomic situation, keep your focus more on your own situation and options. Psychologists say it should cut out most of the related stress. While a recession may be lurking, it’s not something you can control so keep your focus on what you can control, like which investments you will choose.

- Hire a Financial Professional: If you have serious questions about the investment landscape, you might want to consider hiring a financial advisor. After all, understanding the markets is what they do for a living, and they could have some advice that will relieve any fears you have. Research shows that people who have a financial advisor lose less sleep over the state of the markets than those who don’t.

- Do Yoga: It doesn’t have to be yoga, but the point is remember to breathe. Find an exercise that will remind you to take deep breaths so that you have the tools to remain calm when anxiety tries to creep in.

- Keep Your Perspective: Remember that investing is a marathon, not a sprint. If you get too fixated on what the EURO STOXX index is doing in a single session, you could lose sight of the bigger picture. If you are a long-term investor, keep your perspective over the past decade or so instead of how the market is doing at this point in time. In addition, remember to keep a diversified portfolio with exposure to various asset classes, so that if one category is underperforming, there’s a better chance of another asset offsetting that weakness with returns.

P2P and Lending Market Investing

Something to remember about P2P investing is that it really came into its own during the last financial crisis, in the 2008-2009 period. P2P came on the scene before that period in 2005, but its mettle was tested throughout the Great Financial Crisis. That’s when most every asset class was sent into a tailspin, with stocks down 55% in the United States. However, despite the market meltdown, P2P lending was producing positive returns for investors. Those results were a reminder to investors about the importance of a diversified portfolio.

Fast forward to 2022, and the economy is once again facing a contraction. This time around, investing in lending market has already proven itself, and investors have taken notice. A common theme that has been unfolding in the market is that P2P platforms have been increasing their rates alongside rising inflation and the ECB’s rate hikes, and transforming to a regulated investment platforms

In a video posted by the P2P Investing Europe YouTube channel, which boasts over 14,000 subscribers, host Angelo went over his latest returns. He described how P2P has been outperforming all of his other investments year-to-date. In July, his P2P portfolio generated returns of EUR 210.85. The No. 1 performer in his portfolio was VIAINVEST, with 12% returns. For 2022 so far, his broader P2P portfolio has generated an IRR of 8.51%.

VIAINVEST offers investing in asset-backed securities, or ABS, since early August. Investors can gain exposure to this asset class with a minimum allocation of EUR 50 for each asset. Each of the ABS comprises a basket of individual loans, which buoys the diversification that the investment has to offer.

Funds are held in segregated accounts apart from VIAINVEST. Investors have the security of knowing they are protected up to EUR 20,000 by the investor compensation scheme, a type of protection, though that does not include any potential underperforming loans.

In the current economic downturn, and given the uncertainty resulting from Russia’s invasion of Ukraine, investors have the opportunity to select investment platforms with an IBF license, like VIAINVEST. This should give them greater confidence that they will receive greater transparency and protection given the regulatory oversight.

Dividend Stocks

For investors who would also like exposure to the stock market, they might want to consider dividend-yielding stocks. As long as a company’s balance sheet is strong, they can continue returning profits to shareholders in the form of cash dividends. As a result, even if the stock price is languishing as a function of the risk-off environment in the stock market, investors will continue to receive dividend distributions, which can offset any short-term performance declines.

By nature, dividend paying companies tend to follow a more conserative model than other businesses because they have to be quite disciplined with their cash flow in order to return profits to investors. That’s why dividend investors can have a certain confidence that the company will manage to continue making distributions even in a shrinking economy.

Historically, U.S. dividend stocks outperform their European peers. However, Goldman Sachs strategists predict that there could be a paradigm shift in 2022 given the dynamics in the European markets where the chasm between stocks and bonds is widening. The strategist emphasized how high-yield dividend stocks are less vulnerable to any interest rate increases, noting that their steady distributions are a breath of fresh air in an economy where inflation and market volatility are rampant.

The Goldman Sachs strategist predicts the Stoxx Europe 600 Index will generate 10% dividend growth in 2022 compared to 7% for U.S. S&P 500 stocks. Morningstar analysts note that there are more European dividend stocks to choose from now than ever before, giving investors a chance to diversify away from stocks only in the financial and utilities sectors.

Savings

When it comes time for an investor to direct some of their profits to savings to have for a rainy day, there have never been more options. The rise of fintech platforms has paved the way for higher-yielding online products, creating more competition for funds. In this case, consumers are benefiting from the higher interest rate environment because online banks are offering higher yields too.

Goldman Sachs is behind digital bank Marcus, which had an APR of 1.7% as of mid-August, compared to 1.5% in the previous month. The latest yield is the highest rate that Marcus has offered since early in the pandemic in 2020. The yield on the Marcus account is headed toward its pre-pandemic highs. By comparison, other savings vehicles on the higher-yielding end of the spectrum include Ally Bank at 1.6%, and Barclays and Synchrony Banks, which are each yielding 1.65%.

Bottom Line

With the year’s final quarter quickly approaching, nobody is expecting the economy to surprise the upside. Economists are not painting a pretty picture for early 2023, as long as energy costs remain as high as they have been. The war in Ukraine is the wildcard, and Europeans are preparing for a worst-case scenario in which a recession arrives. Those investors with an additional revenue stream from which to draw will have the advantage and an opportunity to grow their savings simultaneously.