Looking at the best way to invest your money can be a time intensive and complex endeavor. We are not living in the Baby Boom era where options were simple and stability almost guaranteed. The recent global financial crisis, in particular, gave way to things like P2P lending and has opened alternative streams of attaining good returns.

In this post, we’ll look at the rate of returns offered by P2P lenders in comparison to that offered by traditional banks and stock exchanges.

Who Has Lion’s Share Now When It Comes to Lending?

According to a report from Ernest & Young, global lending from traditional banks reached USD $5 Trillion in 2017. This compared to some sources stating that P2P lending might reach USD $1 Trillion in 2020. The interesting thing to note is that the world economic crisis of 2008 was the enabler to the rise of P2P lending and it has found relevance in both emerging and developed markets.

The one thing that does stand out is the response from banks over the last year. They have been implementing their Artificial Intelligence (AI) systems to play catch up to the methods used by P2P lenders. They also automated many of their revolving credit facilities to bring more convenience to clients.

Yet, despite banks responding and P2P lending growing so fast, it begs to ask as to who offers the best return as an investor. It does seem that traditional banks are currently more favored to lend you money, but not considered a good option to invest capital with. We will unpack this to explain.

Who Offers What to an Investor?

- P2P lending

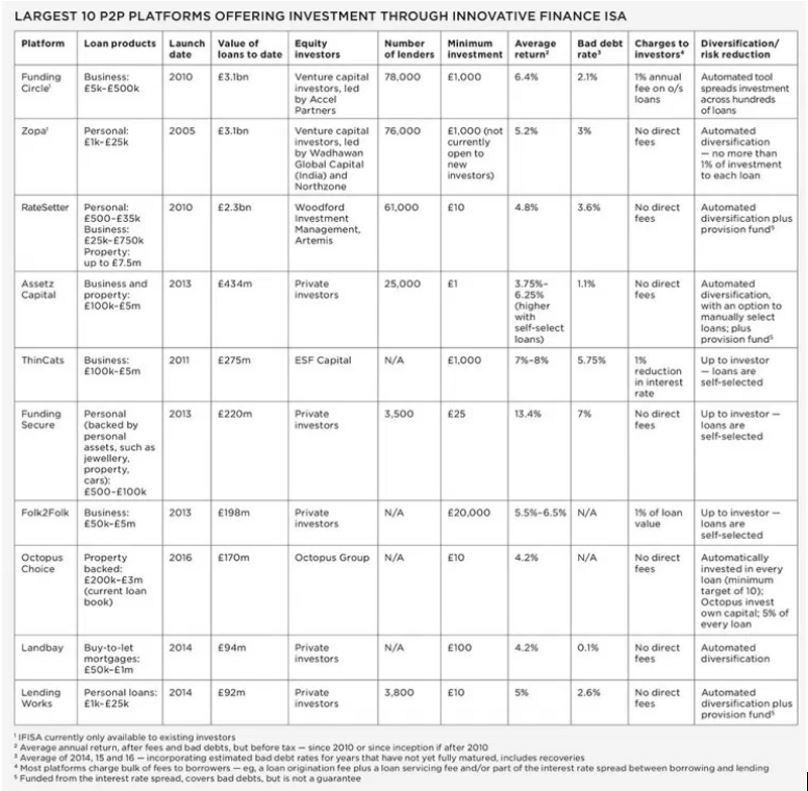

An interesting analysis was done by the online publication Young Fi Guy where it took the data that was compiled by CISI and it laid out the various returns that different P2P lenders in the United Kingdom managed to produce on average in the years 2014, 2015, and 2016.

The average return seems to be 5 percent with no direct fees charged to the investor. The only things the below table doesn’t mention are the bank charges or remittance fees you would pay and of course personal income tax on your profits.

The higher the return, it becomes evident that it is riskier because the default rate of bad debts tends to be higher as well. Funding Service, for instance, offers an impressive average 13 percent return, but their bad debt ratio is also much higher at 7 percent.

In the end, consider spreading your portfolio and not throwing all your eggs into one basket. If you look at the below table, this might just deliver an average 7 percent return if all goes well. It’s still better much better than a fixed deposit at your local bank in the United Kingdom or the United States for example.

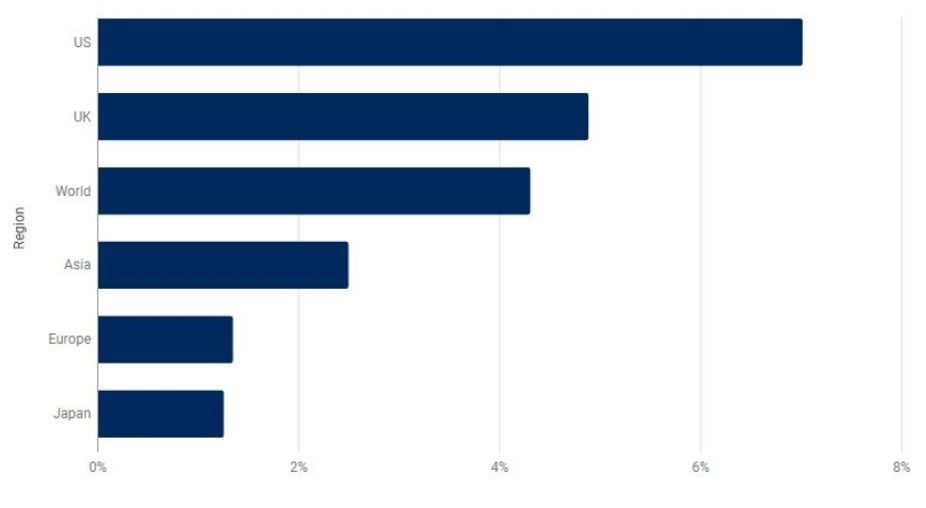

Source, Schroders viaYoung Fi Guy, Thomson Reuters Datastream as of 30 June 2017.

- Traditional Banks

There has been a turnaround in the way banks add value to customers. When looking at the average interest rates that are offered in the United States or the United Kingdom, it becomes clear that banks are not necessarily the best place to invest your money in.

CNBC did an analysis of “Where to earn the best interest on your money right now” and it was a shock to see that the average return was between 0.19 and 1.6 percent. Inflation and taxes alone would deduct any value you get from them. In fact, you could stand the chance of losing money in real terms when investing it in the bank because your return doesn’t keep up with inflation.

Across the Atlantic, we did a sample of what HSBC offered for their Fixed Rate Saver plans, and they too offered anything from 0.30 up to 0.70 percent. Compared to P2P lending, it doesn’t compare at all!

Yet when looking at some emerging markets like South Africa, Capitec Bank is a well-known retail bank and offers an average of 7 percent for fixed deposit investments.

- Stock Markets

To think that a mere decade ago, we saw one of the most dramatic financial market meltdowns in human history. Yet, the exchanges across the developed and emerging economies seems to have rebounded and offer decent returns.

Below is an analysis that was published by CityA.M. and it is encouraging to see that the U.S. managed to produce returns on an average of 7 percent and the UK 4.9 percent. This compared to fixed rate savings options offered by U.S. and UK banks, is a clear winner in the traditional financial stream.

Even with local income tax and trade commissions, it still offers a decent return and it stacks up favorably against P2P returns. Just keep in mind that share trading is considered a more long-term investment and the risks are also high.

Source, CISI from Young FiGuy

Who Offers the Best Return?

This short analysis brought a surprising bit of insight. Not only does P2P lending still offer a decent return, but we are also reminded that share trading is still a good alternative. Traditional fixed term savings investments don’t look or feel like the best option right now. In short, diversification is still considered best practice and it is still good to know that we can still rely on some traditional channels when investing, though emerging markets such as P2P lending appear to be taking the lead.