You may be looking for some road-map to help you understand what to expect from your investments during the health and financial crisis brought on by COVID-19, also known as coronavirus. While nobody knows for certain how things will play out, there are some common themes that are unfolding in the financial markets that we can explore, as well as the historical precedents from previous crises.

In short, one thing you can be sure to expect from your investment portfolio throughout the coronavirus is volatility. As countries place their citizens in lockdown mode, the global economy has all but come to a complete standstill, costing many people their jobs and taking investment portfolios on a wild ride.

But even if assets have been beaten down, that doesn’t mean that your investments — whether stocks, bonds, commodities or something else — will stay there. In fact, as some countries that have begun to see early signs of a recovery, the financial markets are already responding with gains on certain days, suggesting that investors are hopeful there is a light at the end of the coronavirus tunnel.

In fact, throughout the crisis, peer to peer (P2P) investors are seeing little to no disruptions to their investments as individuals and small businesses alike flock to the lending sector. We will get into this asset class more below.

Historically, financial markets have proven to recover in the wake of global crises, from the Great Depression of 1929 to the Great Recession of 2008/2009. Even if it doesn’t happen overnight, there’s no reason to think that this time will be any different.

The thing to remember about the recession brought about by COVID-19 is that it was triggered by a specific event that once resolved is expected to return to normalcy in subsequent quarters.

Investment Portfolio Example

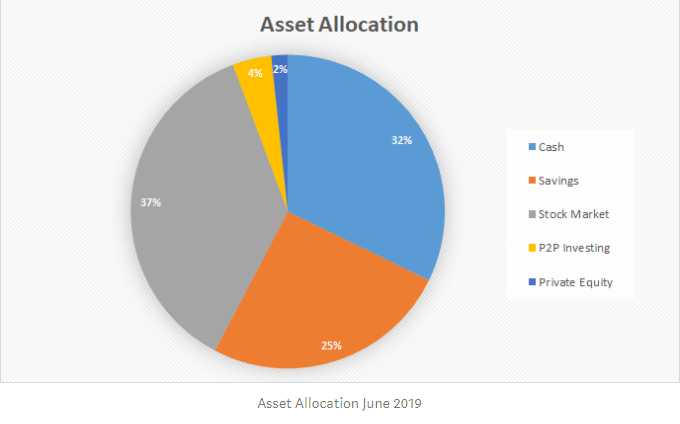

Most investment portfolios have at least some stocks in them. Financial blogger Fernando Lopes illustrated his investment portfolio asset allocation as of June 2019. And while it was pre-coronavirus, it demonstrates one way to approach the markets during better economic times. Lopes allocates 37% of his investment capital into equities, 32% into cash, 25% in savings, 4% in P2P investing, and 2% in private equity. Let’s explore how those asset classes are faring in the coronavirus crisis.

Source: Medium

Stock Market Reaction

Fast forward to today, and the FTSE 100 index has shed one quarter of its value year-to-date. The S&P 500 index in the U.S. lost one-fifth of its value in Q1. The German DAX similarly shaved off one-quarter of its value in the first quarter of 2020.

The point is, if you are invested in equities, you’ve seen this portion of your investment portfolio shrink in recent weeks. From technology to retail to travel, there has been no escaping the carnage. And while stocks will likely continue to take investors on a wild roller coaster ride for the foreseeable future, once the economy finds its footing again, the markets have a better chance of recovering too as corporate profits return.

In the U.S., major investment firms like JPMorgan are expecting that while the pain in the economy will persist for the first couple of quarters of this year, there is an end in sight. Economists are predicting a U.S. economic recovery in the second half of this year, which could be reflected in stock prices as well.

Source: Twitter

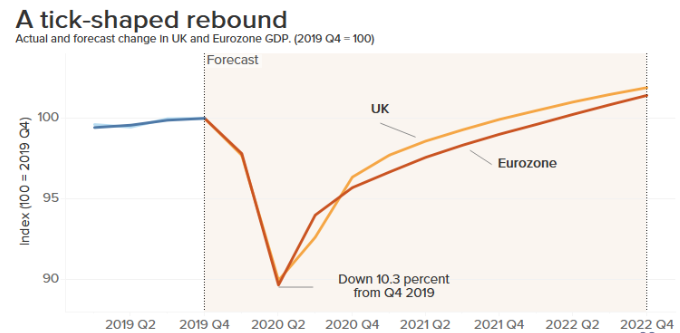

In the UK, accounting firm KPMG is anticipating that economic growth will be flat in the second half of 2020, which considering the magnitude of the recession could be worse. The good news is that the spreading of the coronavirus is showing signs of slowing in Italy and Spain, two of the hardest-hit European countries, which bodes well for the rest of Europe. If the situation improves, the UK economy is expected to be on its way to recovery in the second half of 2021, KPMG forecasts.

Meanwhile, economists do tend to agree that the economy will experience a recovery after the coronavirus – it just won’t be overnight. Economists at Hamburg-based Berenberg suggest it will be two years for UK and eurozone economic expansion to return to pre-corona levels.

Source: CNBC/Berenberg Economics

Famous investor Warren Buffett once tipped his hand to his firm’s investment strategy, saying, “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” An article in The Motley Fool urges investors not to panic, reminding them that this isn’t the first time that the bottom has fallen out in the stock market.

One stock market crash in relatively recent history occurred in 1987. In the month of October during that year, the FTSE 100 shed nearly 25% of its value over a two-day span. After falling nearly 40% in total, stocks were back to their pre-crash levels within two years before moving even higher. Long-term investors who stuck it through were rewarded not only from capital gains but also from companies that paid dividends throughout the recovery.

This time around, there are some pockets of strength in the stock market. For instance, if you are holding technology stocks that are focused on cloud computing, for instance, you could see some impressive gains. This is a result of more people working from home, which has resulted in higher demand for cloud-based services. Video conferences and instant messaging have never been so popular.

On the flip side, any exposure to travel-related investments, such as airlines, is experiencing the brunt of the stock market sell-off. That’s because of travel restrictions handed down by many countries in an attempt to stop the spread of coronavirus.

For example, airBaltic has temporarily suspended its flights as a result of the coronavirus and slashed its workforce by 700 employees. The airline has enough cash flow to continue paying the other 1,000 employees until mid-May but uncertainty still abounds as the airline doesn’t know when it will resume flights.

And while we will not advise which stocks to buy, the Motley Fool author suggests that FTSE 100 stocks could represent a bargain today that will become profitable later, suggesting that investors stick to “established, blue-chip FTSE 100 stocks.”

Bond Market Reaction

If investors are fleeing stocks, they are flocking to the fixed income markets instead, where governments and corporations borrow money from investors. Bonds were not yielding much before the coronavirus pandemic, so the outbreak has only amplified the situation. According to The Guardian, a three-year loan is yielding a mere 0.204% for bond investors. Nonetheless, the UK is experiencing the strongest investor demand for government bonds that it’s seen in 15 years.

If you’re a millennial investor, chances are you have some but not a big percentage of bonds in your investment portfolio. That’s because the risk/reward scenario for bonds is less compelling for someone who is looking to grow their savings as much as possible, not just preserve it.

During times of crisis like we are in now, however, all bets can be off, and the bond market could also display volatility. Any tidbit of good news in the economy could cause investors to take a chance on stocks again and flee bonds, but these trends are quite fluid and changing nearly by the day.

But what you can expect from bonds during the coronavirus crisis is to see the bond price rise while the yield, or interest rate, falls, as these two features have an inverse relationship. In other words, it might not be the best time to add bonds to your portfolio considering that prices are mostly on the rise. This is especially true if you’re selling beaten-down stocks low and getting into bonds at higher than usual levels.

Commodity Reaction

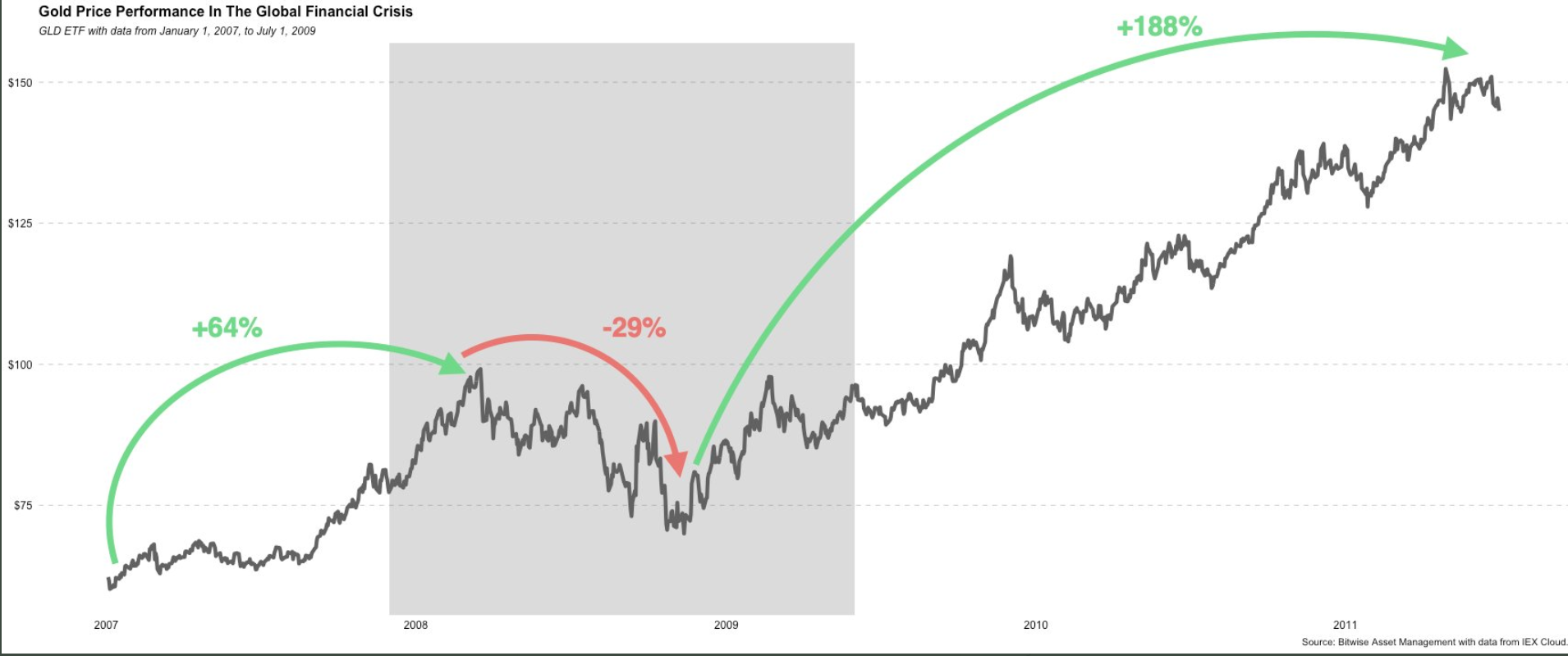

Our model portfolio from Fernando Lopes doesn’t hold commodities, but we’re going to explore this asset class anyway. Here is where you can expect your investments to shine during the coronavirus crisis — especially if we focus on precious metals like gold — while there is otherwise market panic.

Gold is a safe-haven asset, one that’s designed to perform well during times of economic turmoil. While other asset classes like stocks and bonds are vulnerable to central banks around the world printing trillions in more money and setting interest rates at close to zero, gold is different. It’s considered a store of value and therefore is less vulnerable to the whims of monetary policymakers.

Source: Bitwise

At last check, the gold price was hovering at USD 1,647/oz and analysts at Goldman Sachs have placed a USD 1,800/oz 12-month price target on the precious metal.

Bitcoin is the biggest cryptocurrency and has also earned the nickname as “digital gold.” That’s because it has similar characteristics to physical gold, only in digital form. Similar to the precious metal, there is a finite amount of bitcoin that will ever be created, which is unlike fiat money and therefore should not lose its “purchasing power.” While central banks have turned on their printing presses, the gold supply only increases 1-2% each year, while the bitcoin supply is capped at 21 million.

Bitcoin is a lot younger than gold and therefore is still proving itself as a store-of-value asset. But most recently, a bitcoin investment during the coronavirus crisis would have momentum on its side.

P2P Investing Reaction

Another bright spot in your investment portfolio during the coronavirus crisis might be P2P investments. In fact, P2P investing has grown leaps and bounds since the financial crisis of the 2008 era. So there might not be a whole lot of historical precedent to go by. But industry participants are largely optimistic.

For instance, the P2P lending landscape might look different when the COVID-19 crisis is over, but it should emerge stronger and more mature than it was before, according to Marina Smirnykh, CEO of financial platform Nibble. There have been some casualties among P2P lenders that might make investors nervous, including Estonia-based Kuetzal and Grupeer in Latvia. But Smirnykh believes that their demise will force other P2P lenders to rise to the occasion to regain the trust of investors in the sector.

A report citing a poll by Croatia-based Robo.cash suggests that P2P investors are not displaying a knee-jerk reaction to the fallout from the coronavirus crisis. The survey found that more than three-quarters of European P2P investors are sticking with their strategies from pre-corona and haven’t touched a thing.

Roughly 20% of investors saw their P2P allocations fall either as a result of making withdrawals or lifting their allocations to other asset classes. About 3% of investors ramped up their P2P investments since the crisis.

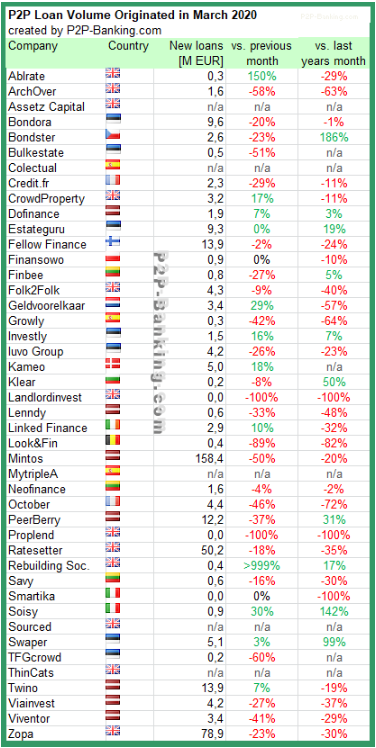

Source: wiseclerk/P2P-Banking

The need for cash right now is greater than ever, which has placed great demand for loans among individuals and businesses. As a result, investors may fear that the risk of loan defaults is greater given the uncertainty in the global economy. Nonetheless, lending volumes appear to be intact.

According to another poll cited by P2P-Banking, the trend is mixed for P2P investments during the coronavirus investors. Of more than 100 German investors polled, more than 10% have increased their allocations to P2P lending investments that are being offered at a discount in the secondary market. About one-third of those surveyed are keeping things on cruise control and not changing a thing as it relates to P2P investments. Another 26% are making withdrawals to buy stocks, and 20% are doing so because they are spooked by the risks.

Cash

Of course, cash is king, and that hasn’t changed throughout the coronavirus crisis. Our model portfolio also keeps a percentage of assets in cold hard cash in the event of job loss or unexpected events. Liquidity can be hard to come by during emergencies, and earmarking a percentage of your portfolio to cash can go a long way. In fact, experts are recommending during the coronavirus crisis to double whatever percentage of your investment portfolio you have allocated to cash.

Experts are advising savers not to deplete their accounts as a result of coronavirus. It may be tempting in the current low-rate environment where savings are not yielding very much. But the low interest rates aren’t expected to last forever.

Instead, what you may want to do is find the financial institutions that are offering the highest rates and redirect your savings to these accounts. While some 40 million Brits have savings accounts that can be easily accessed, only 10% of them practice this strategy to improve returns.

Private Equity

One of the investment categories that the model portfolio uses is private equity. Now PE is not something that you can readily gain exposure to simply by using an online broker, as they don’t trade in the stock market. Private equity is an alternative investment that’s generally reserved for ultra-high-net-worth investors. You may be invested in PE through a pension fund, however.

In any event, we can still extrapolate something from the way that PE firms are behaving throughout the coronavirus crisis. While there is a slowdown in activity among PE firms, things have not come to a complete stop. Throughout the downturn, they are strategically funding companies that have fundamentally strong businesses and have been “disproportionately” impacted by the virus, according to a report in Business Insider.

Historic Precedent

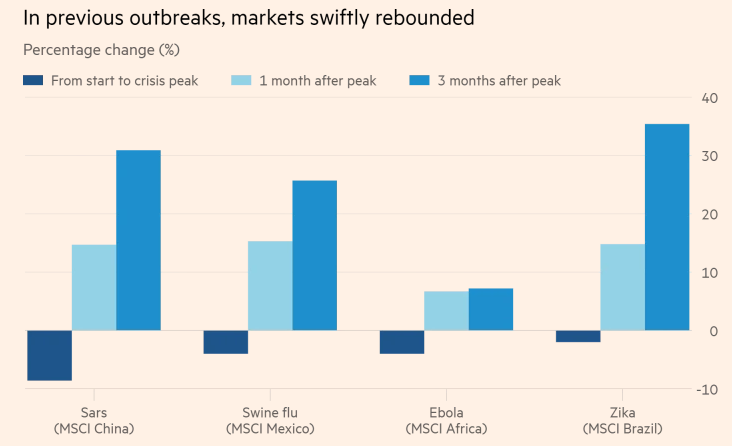

COVID-19 is not the first outbreak to hit the global economy. In the not too distant past, the Severe Acute Respiratory Syndrome (SARS) outbreak of 2002/2003 similarly gripped the financial markets. The SARS pandemic persisted for six months while the disease made its way from North America to South America to Europe and Asia before it was eradicated.

With SARS, in addition to other disease outbreaks historically, stock markets initially priced in the bad news quickly and fell but generally recovered as quickly as they declined. For instance, during SARS, the MSCI China index shed nearly 9% but then rallied more than 30% later in 2003. A similar story unfolded with the MSCI Mexico index. At the time, a JPMorgan strategist wrote, “These episodes did not lead to a prolonged period of selling and were a buying opportunity within weeks.”

Source: JPMorgan/Financial Times

Roller-Coaster Ride

While you watch the volatility unfold in your investment portfolio during the coronavirus crisis, it could be tempting to sell everything. But if you are in it for the long haul, then bear markets and volatility are something you’ll quite frankly need to get used to, as they tend to happen from time to time.

Financial experts are advising investors to diversify their portfolios across asset classes and regions, which could offset some of the market swings.

Of course, if there are investments that you believe won’t be able to rise after the coronavirus crisis is over, you may want to reevaluate your portfolio. If you need to liquidate some assets to survive as a result of the economic recession, you’re not alone. But aside from that, the financial markets have history on their side, so the experts are saying don’t panic and don’t make investment decisions based on your emotions.