From lending to investing, digital disruption is now affecting every aspect of the finance industry, changing substantially what customers’ expectations are and the way how financial services are operated. In this post we will take a look at the asset and wealth management industry, that is now changing at an exponential rate.

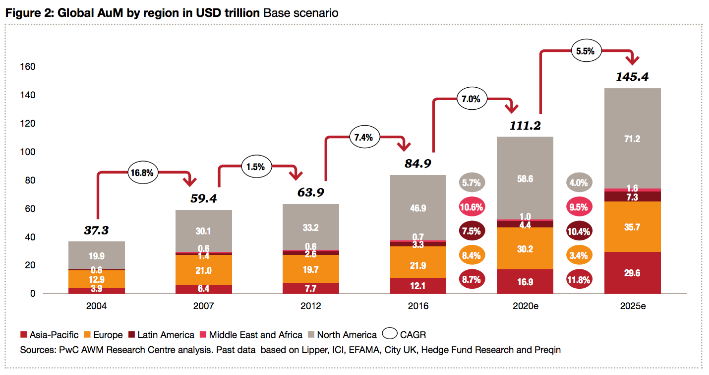

PwC estimates that assets under management (AuM) will nearly double by 2025, going from $ 84.9 trillion in 2016 to $ 145.4 trillion at that time, a growth that is likely to be slower in developed markets and faster in developing markets. The trend showed in the chart below, is also included in the latest report by PwC “Asset & Wealth Management Revolution: Embracing Exponential Change”, where they foresee, that in order to generate alpha, the number of asset managers involved in niche areas such as trade finance, P2P lending, and infrastructure will dramatically increase in the future.

Thinking about asset and wealth management we are considering a huge market, that is now changing drastically with Fintech and playing a significant role in this transformation is robo-advisory. Who are robo-advisors?

As defined by Investopedia robo-advisors are “digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. A typical robo-advisor collects information from clients about their financial situation and future goals through an online survey, and then uses the data to offer advice and automatically invest client assets.”

As easy to guess, given the level of automation and the lower labor costs, companies are in this case able to offer these services with notably lower fees, while maintaining a similar return on investment. Along with this robo-advisors come with an unbeatable level of accessibility, basically 24/7 from any device, with low to zero account minimums and often with useful features like automatic portfolio rebalancing and tax-loss harvesting. This makes them able to significantly broaden their target customers especially among the younger generations that are particularly conscious about fees and shown a preference towards ETFs and passive portfolio investing.

“Everyone talks about how robo-advisors can’t connect with clients. I actually believe in that kind of tools is like an ATM machine. We are all going to have it,” said Larry Fink of Blackrock. A supportable opinion, but lack of human empathy and personalization in the decision making are largely the two main disadvantages usually associated with this solution.

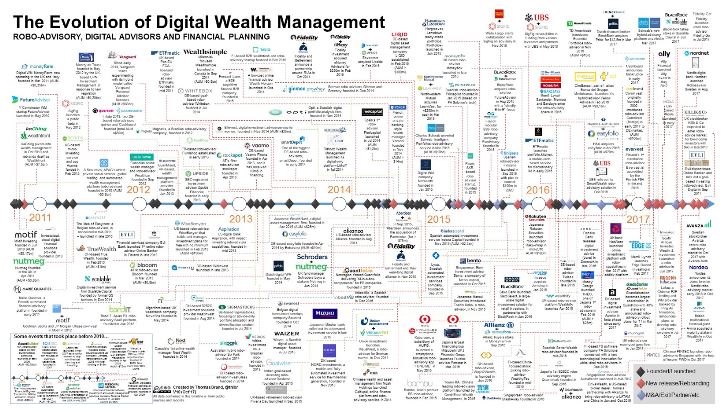

Thomas Brand, the Management Consultant at Accenture, did a great work by creating a timeline, representing an overview of the evolution of digital wealth management space, focusing mainly on robo-advisors and other forms of automated wealth management. We include it below as helpful to get an idea of how intense was the development of this sector since 2011.

Created by Thomas Brand, released under Creative Commons Attribution 4.0 International license. High res version here.

As reported by Capgemini the pace of growth of assets under management by robo-advisors is now impressive, with companies that have been pioneers in the field like Betterment and WealthFront, that manage already more than $ 2.5 billion of assets each.

“The robo-advice tool, which is also an asset-allocation tool, is kind of talking common sense and putting it into a very user-friendly model. If places like us don’t have that capability, we should have that capability, whether we built or buy, we should have it,” said James Gorman, Morgan Stanley CEO. He is not the only one to think that, with financial institutions that have made large investments in technology in recent times. Having said that it should be highlighted that if established wealth management firms are not willing to learn from the new kids in the block, represented in this case by Fintech startups, and adjust their business models accordingly, they could find a very complicated path ahead and a clear disadvantage in the market.