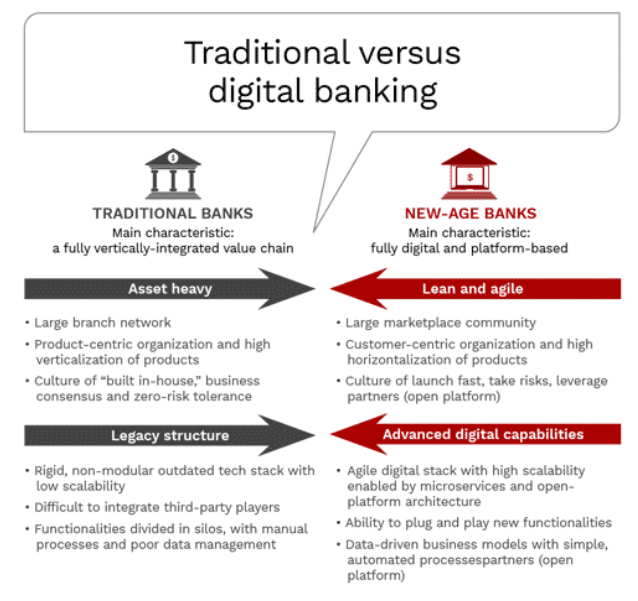

There isn’t a sector of the economy that the COVID-19 pandemic hasn’t touched, and banking is near the top of the list. Not only have bank branches been shuttered for months but the perilous nature of cash has thrust digital payments and banking into the spotlight. While digital banking is a trend that had begun before the pandemic took hold, its adoption has been hastened around the world as a result of the crisis. One of the key features of digital banking is that the consumer is the focus, not the products, as depicted by the below illustration. Once users get a feel for it, they are unlikely to ever look back and only the nimblest of banks will lead the way.

Source: Capgemini and The Financial Brand

Mobile apps, meanwhile, have already taken the investment space by storm, with fintechs like commission-free Robinhood thriving during the pandemic. Robinhood bolstered its user base from 1 million to 10 million in the past four years. Investors, especially millennials, have been flocking to investment apps to capitalize on what could be once-in-a-lifetime opportunity to buy stocks seemingly on sale, particularly in the technology sector. Even individual investors who were not in the market previously are piling on, and now the fintech phenomenon is also gripping banking.

Banks React to COVID-19

Traditional banks were left scrambling in the wake of the pandemic. Suddenly they became digital financial centers, with employees working remotely and branches handling inquiries online while juggling emergency loan requests and mortgage payment relief. Legacy banks are a far cry from neobanks, the latter of which is another way of saying online, digital or challenger banks whose relevance has ballooned during the crisis. Needless to say, both have been affected by the crisis but in very different ways. After UK digital banking platform Yobota found out one of its employees tested positive for COVID-19, the entire office emptied out and everybody started working from home, co-head of delivery Richard Oster explained in a recent LendIt Fintech webinar on digital banking. But because their technology is based on the cloud, the pandemic customers have not skipped a beat. Unlike a bank branch, nobody needs to be on the premises in order to make it work.

One thing that COVID did do was to cause the team to adjust their roadmap to add a payment holiday feature sooner than later, giving customers an opportunity to receive temporary relief on loan payments. Jason Maude, chief technology advocate at Starling Bank, explained how the team built the bank with the idea that it could be run from their laptops — even if those laptops weren’t always connected to the most secure networks. So they were not displaced by the lockdowns and social distancing requirements, but it was a challenge to get all 1,000 employees set up to work from home.

Revolut US CEO Ron Olveira explained how the global nature of the company meant that its various locations were affected in different ways, from Poland to Portugal to Mexico. The company only launched in the US in March 2020, so that presented a unique set of challenges as they were trying to build a team. The pandemic has forced the company to make decisions with a short-term perspective in view so that they can remain nimble and adjust when things change.

Evolution From Legacy Banks to Neobanks

Now that global economies are slowly coming back to life, traditional banks must keep some of the convenient features that customers have gotten used to. No longer will customers tolerate things like lengthy wait times, and they have grown accustomed to fully opening accounts online, without any human interaction.

By the same token, when it comes to financial advice, they want this service to be personalized, even if it’s an artificial intelligence algorithm driving the recommendations. They are also looking for a seamless mobile app to use that is easy to navigate and intuitive, one that also provides the opportunity for real-time data including transaction tracking.

However, nobody is expecting the shift from traditional banking to neobanks to happen in one fell swoop. Instead, what the pandemic has essentially done is to accelerate the move to digital banking.

It’s a natural evolution considering consumers have come to expect speed and efficiency from non-banking apps such as Netflix, Amazon, Zoom, Uber Eats/Grubhub and other platforms. Especially during the pandemic, users began to realize the benefits of having stored information on these platforms to make for a more streamlined experience the next time, and now it’s banking’s turn.

Consultants at McKinsey & Co polled bank customers across Europe, including the UK, France, Spain, Italy, Germany and Portugal and found that digital banking is on the rise across those jurisdictions. According to the survey, more than 20% of those polled in Spain and the UK dived into online banking for the first time ever during the pandemic, something that probably would never have occurred without the push from the lockdowns due to pandemic.

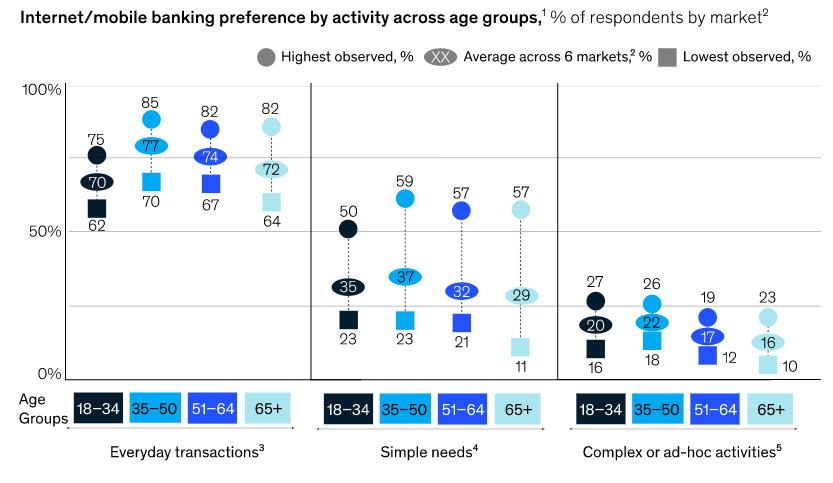

A separate survey, this one by BCG, asked UK residents about their banking habits in the spring of 2020, more than 60% of whom revealed that they had relied less on cold hard cash since the pandemic came on the scene, and more than 40% of survey participants transferred money via social media messaging apps. And while millennials are out front, they are not the only generation fueling the trend. According to McKinsey & Company, age is not a factor when it comes to digital banking preferences.

Source: McKinsey & Company

Starling’s Maude in the LendIt webinar addressed whether technology leaves the elderly population — who generally rely on physical branches — out in the cold. He said that it’s a misnomer to characterize technology as a younger-generation phenomenon.

Even at the launch of Starling Bank they were initially expecting millennials to sign up, but to their surprise they have a “range of people from across the spectrum” who are keen to use online banking services. Maude noted that considering the internet has been around since the nineties, “people of all stripes” have had plenty of time to get comfortable with using the technology. The challenge is to make online banking intuitive and flexible so that everyone can access it.

Neobanks vs. Brick and Mortar Locations

The digital trend is expected to take hold, with more than 20% of those surveyed indicating they have no plans to visit a physical bank branch once the pandemic is over. Additionally, wealthy customers are also turning to relationship managers for financial advice via video conferencing, the BCG poll reveals.

Banks had already started closing physical branches before the pandemic, and they are expected to continue doing so to adapt to this changing environment. Those that do will benefit from a lower-cost model, both for acquiring customers and delivering products and services, kind of like the neobanks.

The UK was a first-mover on neobanks, which are basically another way of saying digital banks, and has been integrating them for the past decade. European countries boast a 45% market share, with nearly five-dozen neobanks, followed by the Americas with a 30% share across nearly 40 companies, according to Medici Research. Neobanks are becoming the next wave of unicorn startups, with valuations of at least $1 billion.

- Revolut has a valuation of more than $5 billion,

- NuBank has a valuation of $10 billion,

- Germany-based mobile bank N26 has a valuation of more than $3 billion,

- UK challenger bank Starling recently attracted GBP 40 million to its coffers. The company’s deposits have grown twofold in the past six months, bringing the total to more than GBP 2.4 billion in deposits

You may have heard about Norwegian software company Opera, which is known for its web browsers, acquiring Lithuania-based digital bank AB Fjord Bank in an attempt to bolster its fintech footprint in Europe. Opera will run a specialized bank, presenting another challenge to legacy banks and giving consumers more options to manage their personal finances, with plans for a deposit and loan service to make its debut this summer. Opera is not new to fintech and earlier this year scooped up Estonia-based digital wallet and payments platform PocoSys, with a new card and app in development for a European debut.

It’s no wonder that neobanks are having their day in the sun. Bloomberg reports that physical banks across Italy, France and Germany are currently servicing fewer than 3,500 customers, which could result in permanent branch closures. And according to McKinsey, between 10-25% banking customers in Western Europe plan to make fewer visits to brick-and-mortar banking locations even once the crisis is over. Between 30-50% of customers will still make the trip for complicated banking issues.

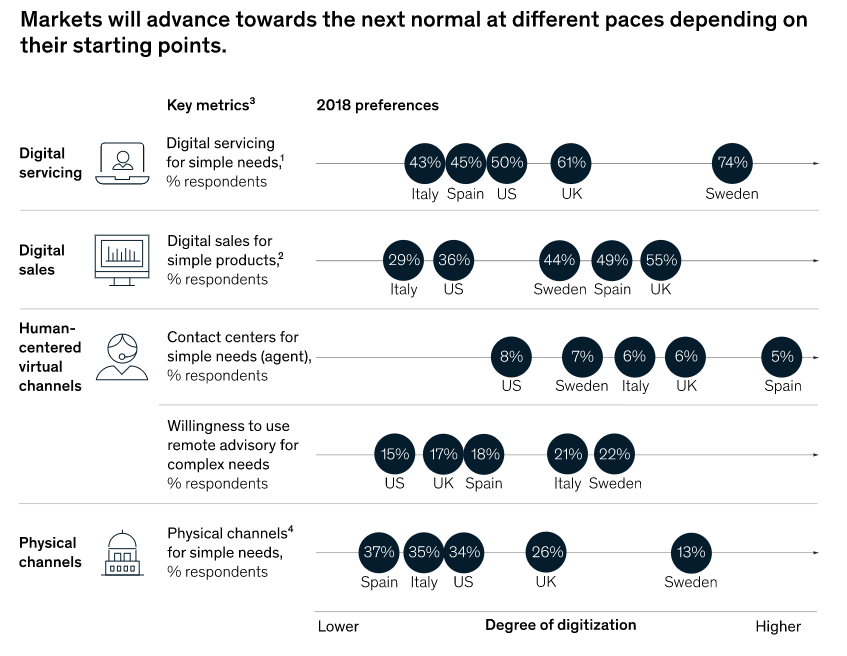

And while for the most part users can expect more self-service features including smart ATMs and kiosks, there is no one size fits all model. Countries that are further behind with digital banking adoption, including the US, Spain and Italy, will have further to go than countries like Sweden, which is well on its way to a cashless society.

McKinsey research suggests that countries will move toward digital banking at their own pace. For instance, as of 2018, nearly three-quarters of Swedes use digital banking for simple needs (balance inquiry, transactions, opening an account, etc.) compared to 61% in the UK, 50% in the US, 45% in Spain and 43% in Italy. On the flip side, only 13% of Swedes use physical locations for simple banking needs.

Source: McKinsey & Company

That’s not to say that physical bank locations are going to disappear altogether. According to Revolut US CEO Ron Olveira, the move to digital banking will be more of an evolution and will result in a “blend” of fintech and traditional offerings. While branches once served as the only point of contact for customers, they have now morphed into problem and complaint centers, when the issue goes beyond a customer’s comfort level for digital, such as having a locked account or special check of some sort, for instance. And some baby boomers are still not sold on the security of mobile banking and therefore will still visit physical branches.

The Wirecard scandal certainly didn’t help the cause for the fintech space, given that it’s a payments platform. The experts on the LendIt panel, however, maintain that the $2 billion scandal was an accounting failure, not a tech one. As a result, they’re not anticipating any knee-jerk reaction by regulators to rein in the space. On the other hand, it may be the catalyst regulators need to learn how financial technology works and how 24/7 digital banking happens. The more they know about it, the more that they can trust the technology.

Banking Cafes

Another trend that is popping up is variations on the banking format, from mini-centers to cafe-style locations, which even though they are physical locations are designed to attract “digitally savvy” millennials and Gen Z’ers. Capital One introduced the concept last year, offering Peet’s Coffee and tea via a full-service coffee bar and giving holders of its credit card a 50% discount. It’s kind of like a cross between a coffee shop and a co-working space, with a combination of banking services, Wi-Fi and of course, coffee.

Investment Mobile Apps and the Pandemic

Investment mobile apps were already all the rage before people were stuck inside during the pandemic, but now they are catching on like wildfire. From Robinhood to LU HK, a new wealth management app launched in Hong Kong, people are flocking to financial apps like never before.

For its part, LU HK uses artificial intelligence to create a tailored “contactless” investment experience for users, which plays into a socially distanced society that has become the new normal and targets “working from home” investors. After opening an account in a few short minutes, users gain access to mutual funds across markets and asset classes.

Over at Robinhood, in March average customer trading volume was up threefold vs. year-ago levels, and the trend has persisted in the following months. In the US, investors were directing the stimulus checks sent by the government to stimulate the economy into investments on the Robinhood app. Demand has been so robust that it knocked the app offline for a couple of days, but the company has since strengthened its IT infrastructure. But Robinhood has delayed its European expansion as a result of the mishap.

Amsterdam-based Bux recently launched commission-free trading app Bux Zero in France. In an attempt to lure millennials, the app also added a new social feature, which delivers news on the markets, individual stocks, products and more in the same way users are used to getting content online. Bux, which also links to financial education blogs, is looking to simplify investing and make it fun for users, pointing to a wave of new investors who have entered the stock market during the pandemic.

Investors have flocked to the stock market in an attempt to profit from the volatility. Besides, there’s not much yield available in the bond market, where even a risky US corporate junk bond is paying a paltry 2.875%. Fortunately, other options exist, like peer-to-peer investing, where investors have been known to generate double-digit percentage returns.

P2P Investing Turns a Corner

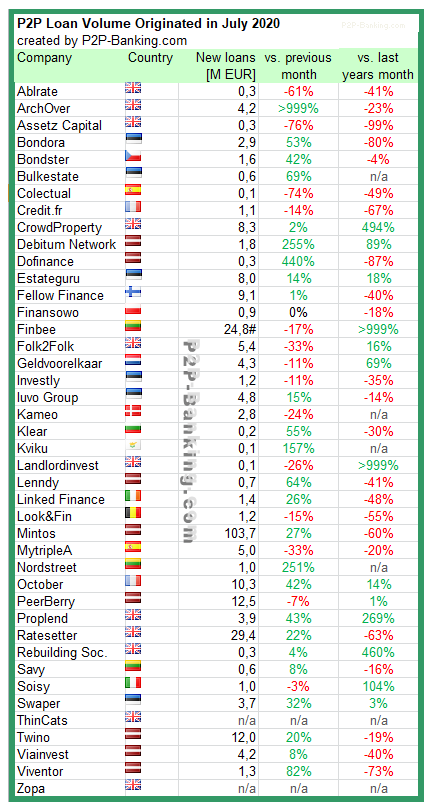

Peer-to-peer investing has also been in flux during the pandemic. Considering that P2P investing came into its own after the financial crisis of 2008/2009, the COVID-19 pandemic is basically the industry’s first crisis and it has tested the mettle of P2P investors globally. By way of comparison, one of the trends among major investment banks during coronavirus has been earmarking huge sums of loan loss provisions to cover potential consumer and corporate defaults. P2P investors have similarly been a bit skittish about the risk of defaults, particularly during the early months of the pandemic. But the recent data indicate that loan originations are beginning to inch higher once again versus recent months, which is an indication that recovery is afoot. New loans vs. year ago levels show mixed results.

Source: P2P Banking

Meanwhile, analysts expect that P2P lending is on the road to recovery this summer. The momentum started in May, when European P2P total funding grew by more than 33% vs. April. Also in May, more than 43% of lending platforms saw higher loan volumes. And according to Google Trends, interest in P2P investing strengthened in mid-May after a slow start to the year.

Digital Banking and the Future

The consensus within the digital banking community is that digital banking is the future, and COVID has accelerated this push to financial technology. Yobota’s research reveals that 66% of UK residents are entirely dependent on the digital space for their financial transactions, and among 18-34 year olds the percentage is even higher. What the pandemic appears to have done is to make people comfortable with digital banking and investing sooner than they may have otherwise been. The digital banking community is fully expecting this shift to stick around.