There have never been more opportunities to invest your hard-earned money than there are today. Mobile investment apps such as Robinhood have taken the internet by storm, making it possible to buy and sell assets with the click of a button.

But without learning how to save money first, it will be extremely difficult if not impossible to capitalize on any investment opportunity. Before you are in a position to allocate even 1% of your budget to investments, you’ll want to make sure that you’ve socked away enough money for a rainy day so that it won’t cramp your lifestyle.

Basically, it comes to a pair of themes — earning more and spending less — but there’s a whole lot of gray area in between. With the new year fast approaching, there’s never been a better time to begin your journey of how to save money so you can invest. To help you get started, we’ve created a list of ways to streamline your budget to make it easier to save money and direct it toward more rewarding endeavors.

Investment Overview

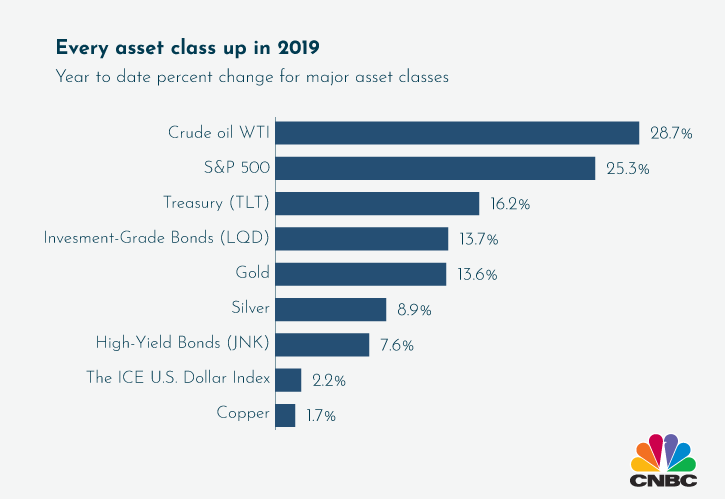

Why invest? You don’t want to miss out on returns like these:

The U.S. stock market alone has delivered returns of more than 25% year-to-date. Incidentally, European investors have different feelings toward owning U.S. stocks, with the Netherlands and Nordic countries more comfortable doing so vs. Southern European countries, according to a recent Goldman Sachs report.

Not included on the list are returns in categories such as P2P investing and cryptocurrencies. P2P loans can generate returns as high as 11%, depending on the risk/reward profile for a “diverse portfolio of consumer and business loans,” according to VIAINVEST. Cryptocurrencies are among the riskiest and most volatile asset classes, but bitcoin investors have achieved returns of nearly 100% year-to-date. Both are much more attractive than the 1.75% yield offered by a Chase six-month Certificate of Deposit (CD).

Saving money is the first step toward participating in these types of returns. But before you do, it’s important to cover the basics. Experts recommend that you sock away at least three-to-six months worth of living expenses in an emergency fund. Once you’ve done this, you can move toward your goal of saving money to invest. Let’s explore concepts and ideas surrounding saving money right away.

“Rich Dad, Poor Dad”

“Rich Dad Poor Dad is a book written by Robert T. Kiyosaki in which the author compares two fathers, one of whom was a friend’s dad who was rich and the other of whom was his own dad who was poor. In the book, Kiyosaki champions the importance of financial literacy and education. Chief among the lessons learned from his rich dad, Kiyosaki explains, “The rich don’t work for money, they have their money work for them.” He points to three ways that you can direct the money that comes into your hands, each of which has its own distinct results:

- Squander it and remain poor

- Direct it toward liabilities and join the middle class

- Invest and acquire assets to choose wealth

This accounting principle breaks down income into a trio of categories:

- Earned income (your paycheck from your job)

- Portfolio income – paper assets across stocks, bonds, mutual funds

- Passive income – e.g., real estate, P2P, etc.

These groups become more lucrative as you go down the list, and the goal is to convert earned income into passive and portfolio income sooner than later. Kiyosaki’s rich dad said: “If you want to be rich, work for passive income.” If successful, you can achieve greater financial freedom so that you don’t have to work a 9-5 job unless you choose to.

Governments tend to tax earned income higher than the latter two categories, which is one reason why you want to learn these skills as soon as possible. The rewards are sure to offset the risks if you do it right. Kiyosaki has developed a series of financial education board games that teach investment and trading skills so that you can make money regardless of the direction in the stock market: Cashflow 101, Cashflow for Kids, and Cashflow 202, and while this isn’t an endorsement of those products, there might be something you can glean from them.

Pay Off Debt

Let’s get the most practical of ideas out of the way. One of the surefire ways to free up money that you can then direct toward saving and ultimately investing is to pay off your debts. While it may sound like a painful process, it is really the only way that you can truly become financially free. In doing so, you can then generate enough revenue streams to reach major milestones in life, such as buying a home or whatever financial freedom means to you.

The more money you dole you servicing your debt, the less savings you have the power to accumulate for investing. Personal finance expert Dave Ramsey recommends the “snowball method,” in which you pay off your debts from smallest to largest no matter the interest rate. Pay as much as you can toward the smallest bill. If you need to, pick up a side gig (Uber/Lyft, garage sale, skip the pricey daily latte, etc.) All the while, continue to pay the minimum amount due on your other debts.

Once the smallest bill is paid off, fight the temptation to go on a shopping spree. Instead, apply that monthly sum toward your next targeted bill, hence increasing the amount you are throwing toward your debt and creating a snowball effect. This approach is as much psychological as it is practical, as the faster you see results, the more likely you are to continue the method, annihilating your debt the interim and giving you the ability to save more money for P2P investing, etc.

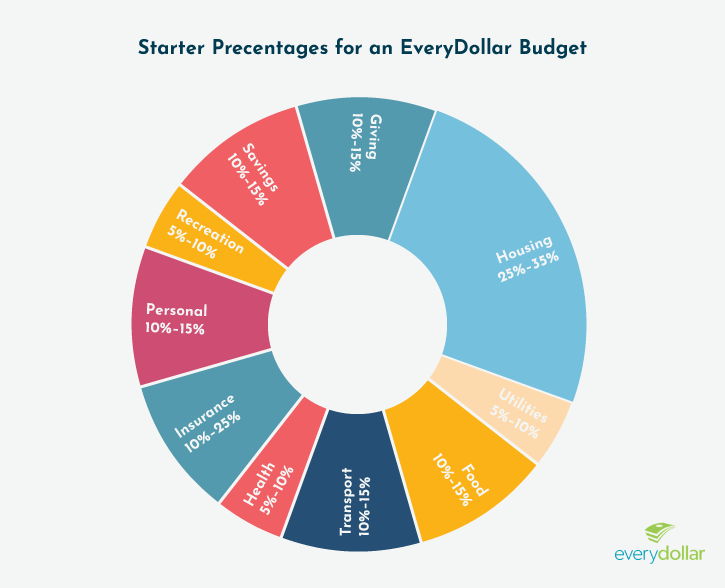

It’s also important to establish a budget so that you know where every euro/dollar/etc. is going before you get it. Ramsey calls this giving “every dollar a name” (groceries, medical entertainment, etc.)

Source: DaveRamsey.com

Dave Ramsey has some other tips as well:

- Set up automatic transfers from your checking to savings account to make it easier to pay yourself each month. Ramsey recommends allocating 10% of your paycheck, but do what you can afford.

- Buy generic over name brands for items that are basically the same thing, such as paper products, staple foods such as rice and beans, etc.

Content Streaming Services

Streaming content has proven to be cheaper than a traditional cable bill, and there are benefits of turning to internet providers. In the UK, households have already begun cutting ties with cable, with the number of pay-TV subscriptions falling by more than 400,000 households in 2018. But the last thing you want to do is pay for multiple subscriptions that end up canceling out any savings that you would otherwise achieve.

If you’ve heard of the streaming wars, then you know there is more viewing content available today than ever before. Netflix, Hulu, Disney+, Apple TV+ and more are all vying for your monthly subscription dollars/euros. It can be rather overwhelming, with not nearly enough hours in the day to load all of the classic and unique programming — from Star Wars to Game of Thrones to Friends — available.

As alluded to, in the UK, the popularity of streaming content is on the rise, especially among young adults. Brits between the ages of 18-34 spend an average of more than an hour on YouTube and 40 minutes on Netflix per day, according to an Ofcom report on viewing habits in the U.K. Meanwhile, Americans dole out more than USD 40 per month for streaming content across nearly four different service providers. More than half of Americans polled have grown increasingly “frustrated” by this trend.

One solution that will cut down on the aggravation and help you to save money for other things like peer-to-peer investing is to streamline content. Rather than playing their game, beat them at their own game by choosing just one or two streaming services instead of three or four. If you’re not sure which one to choose, you’re in luck. Not only are streaming providers trying to outdo one another on price but they also typically offer a free trial of somewhere around seven days. Disney+ did this with its November 2019 launch. While we don’t recommend becoming a subscription hopper, there’s nothing wrong with taking Disney+ or any of the others upon a free seven-day trial before committing.

| Service | Monthly Cost | Launch Date | Shows | NETFLIX | $12.99 | Running | The Crown, Stranger Things |

| HULU | $5.99(with ads);$11.99 (ad-free) | Running | ER, The Handmade’s Tale | AMAZON PRIME VIDEO | $8.99 | Running | Marvelous Mrs. Maisel, Fleebag | CBS ALL ACCES | $5.99(with ads);$9.99(ad-free) | Running | NCIS, Picard |

| APPLE TV+ | $4.99 | Running | The Morning Show, For all Manind |

| DISNEY+ | $6.99 | Nov. 12 | The Simpsons, The Mandalorian |

| HBO MAX | $14.99 | May 2020 | Friends, The Flight Attendant |

| PEACOCK | TBD | Spring | Battlestar Galactica, Rutherford Falls |

Source: The Wall Street Journal

Of course, cutting out your streaming subscription altogether would save you the most amount of money that you can then invest. Eliminating your entertainment budget entirely, however, could prove to be a little like dieting – if you remove something you enjoy from your life completely, you might end up compensating for it by binging, or piling on the subscriptions, which would be worse than taking it in smaller doses. By the same token, make sure you don’t have any dormant subscriptions (streaming or otherwise – magazines, the gym, etc.) on auto-renew so that you’re not paying for a service that you’re not using.

Budget Items

Content streaming isn’t the only budget line item that you can slash to help you on your journey of how to save money. Here are a few other ideas along the same vein:

- Replace traditional light bulbs in your home to LED bulbs. A Forbes article documents how a personal finance author invested USD 200 to achieve this goal, in return for which he saw his electricity bill slashed by USD 75 per month as a result of the energy savings. Installing dimmer switches can also help you save on energy consumption.

- Wash clothes in cold water, not hot.

- Energy efficient major appliances can be pricey, so be sure and weigh the costs before you buy.

- Pay in cash. While the trend is toward mobile payments, some businesses will offer a discount (e.g., 10%) for paying in cold hard cash.

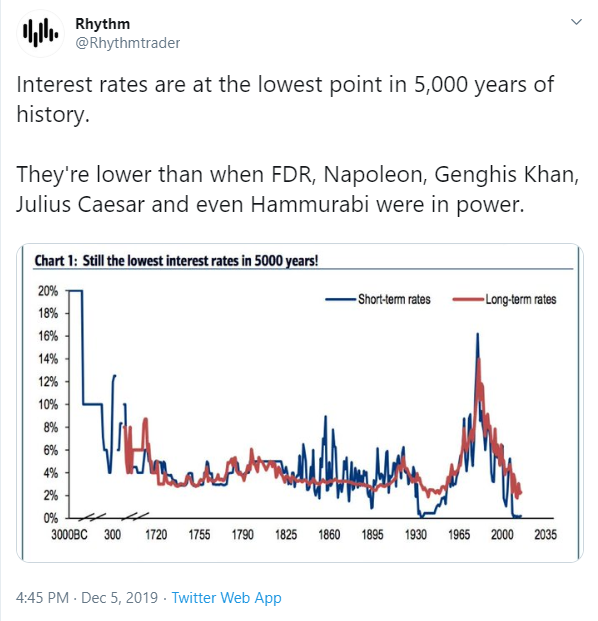

Consider Refinancing While Interest Rates Are Low

With the year 2020 right around the corner, the economy is poised to enter a new decade with interest rates at their lowest point in the last 5,000 years of history. As a result, there has never been a better time for homeowners to refinance their mortgage loans. In fact, refinance lending has increased nearly twofold in the last nine months. Overall refinancing activity is up more than 100% annually to its highest level since 2016.

Source: Twitter

Many of the folks refinancing took out their mortgages a year ago when interest rates were hovering a full percentage point higher vs. now. If done right, refinancing your mortgage can achieve the following benefits:

- Save money

- Build equity

- Repay your mortgage loan more quickly

A Bankrate analyst recommends refinancing your mortgage when you can slash “one-half to three-quarters of a percentage point off your mortgage rate.” On the flipside, there are costs associated with refinancing. So do the math and make sure your monthly mortgage payment savings will offset those expenses.

Rebates and Rewards

If you haven’t noticed, loyalty programs, rebates and rewards are kind of a big deal, especially among credit card companies. If you aren’t already doing so, why not take them up on these rewards? Chase is popular for giving away bonuses for using its cards for everyday purchases such as groceries or fuel. To qualify with the Chase Freedom card, you must spend in a designated category and then you can earn up to 5% back. Other card issuers with similar programs include Discover, Bank of America, Citi, and Capital One.

Credit card companies aren’t the only ones who will reward you for your loyalty, however. Cryptocurrencies may be an emerging asset class but blockchain startups have caught loyalty fever as they continue to seek mainstream adoption. One company dubbed Lolli works with your shopping habits and rewards you with crypto for simply making purchases. Lolli lets you earn free bitcoin (BTC), the original cryptocurrency, when you shop online at any of their top-brand partners, of which there are hundreds. According to the company, they “give an average of 7% back in free bitcoin when you shop at 750+ top merchants.”

Source: Lolli.com

If you’re willing to explore another internet browser, you can continue to earn cryptocurrencies. Brave is a new privacy-centric browser that rewards its users in its own cryptocurrency, Basic Attention Token (BAT) for agreeing to view and engage with ads. They call them “frequent flier tokens,” and once you’ve accumulated enough BAT in your wallet, you can withdraw the funds through a platform dubbed Uphold and send it to your bank account.

Side Hustle

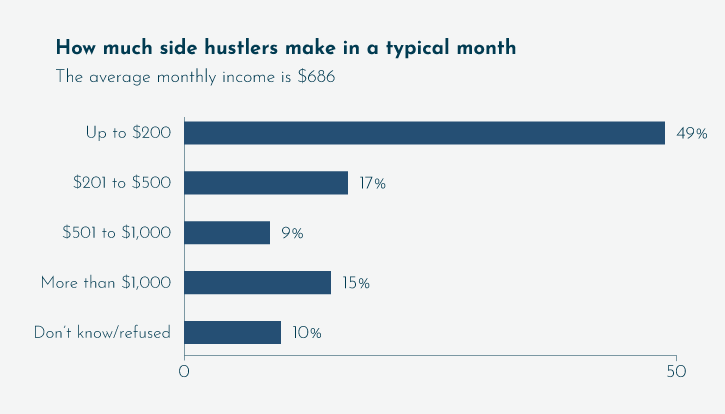

According to Bankrate, more than one-third of Americans have a side-job, otherwise known as a side-hustle. The beauty of a side-hustle is that if you plan it right, you decide when you work whether it’s after your 9-5 job or on the weekends. Millennials are the most likely generation to pursue a side-hustle, fueled by their desire to pay off debt. A global report by Deloitte found that Gen Z’ers are also open to the idea of participating in the gig economy to bolster their income.

While it might be part-time, side hustles are no joke. In the U.S., for instance, the side hustle generates an average of nearly $700 per month. That’s more than USD 8,000 in one year’s time, which could go a long way when trying to save money to invest. Bankrate identifies the top four side hustles:

- Home repair/landscaping at 12%

- Online sales at 7%

- Crafts at 7%

- Child care at 6%

Source: Bankrate.com

A similar trend is unfolding in the UK, where 25% of adults work a side-job after their regular 9-5 work day. The average annual income from a side hustle in the region is more than GBP 6,600 after taxes, though some make as much as GBP 12,000 per year, according to a Vistaprint poll. If a side-hustle happens to be tied to your passion, it may start out as a part-time gig and flourish to take on a life of its own.

P2P Investing

On your journey of how to save money, you can make some short-term investments to accelerate the process. While it may take years to earn the returns you desire in the stock market, you have other options that can help your cash hoard grow faster than it would sitting in a low-interest savings account earning peanuts.

Let’s say you’re going to need to access your money in two years to finance a major milestone in your life. Why not explore P2P investing, where you and other investors on a platform such as VIAINVEST partner to play the part of a bank by issuing loans and collecting interest payments from a consumer who fits your risk/return profile. You can choose to participate in short-term loans that expire as soon as 30 days or longer-term loans that last for two years. While P2P investing is not immune from the risk of default, you can tailor your risk tolerance so that you decrease the chances of getting left holding the bag.

Psychology of Saving Money

One more tip for saving money – avoid impulse buys. Financial planner Dr. Brad Klontz explains that it is not human instinct to save, especially if you have more than your neighbor. While it may feel selfish at times to set money aside for your future while others are less fortunate, it’s important to fight the emotional urge to share your good fortune at the expense of building long-term wealth.