Even if you have a 9-5 job, you may be wondering how to think outside of the box to create multiple income streams. You’re not alone, as many people are wondering where to invest money to get monthly income. In fact, there’s even a name for it — passive income — and it could make the difference between pursuing your dreams and remaining stuck at your day job for the rest of your career.

The beauty of passive income is that it keeps working for you even when you are not working for it, like peer-to-peer investments. On the other hand, don’t let the “passive” in passive income fool you, either. There are some investments that will command more legwork than others, such as purchasing real estate as a rental property. After a while, you might be able to kick back but it probably won’t happen overnight.

To be successful, you just have to strike the right balance between ingenuity, patience, and picking the right investment. A little luck never hurt either. The good news is you are limited only by your imagination when it comes to investing money to get monthly income.

Information Products

Let’s start slow and then ramp up on risk and scale. We begin with information products. If there is a particular niche in which you boast more knowledge than the average person, this idea could be for you. Think hobbies, crafts, or skills such as craftsmanship or mechanics in which you have something to offer others. It can be anything, really. People are constantly hunting quality information on the internet, and you can capitalize on that demand with an online product such as an e-book or internet course.

To monetize, sell a digital product on Amazon.com or your own website with an e-commerce platform integrated. For videos, you might consider making a webinar that’s an hour or two in length to test the waters and selling on a platform such as Selz. Once it’s a hit, build an internet course on sites such as Udemy.com, Skillshare.com, or Coursera.com, as suggested by Bankrate.com. Make the frequency of the course monthly to keep the income rolling in.

Source: Twitter

In addition to investing money, this will also require an investment of your time. But if your brand happens to go viral like Kylie Jenner, it can pay off in spades. Speaking of Kylie, one type of affiliate marketing is to promote someone else’s brand on your own social media channels. You can do this by providing links on your page to sites like “Amazon, eBay, Awin and ShareASale.” To really drive it home, take a page out of Kylie’s book and incorporate images of the products from your own life that your followers can then purchase.

Another idea is vehicle advertising in which you turn your car into a moving advertisement for another brand. For research purposes, we applied for the vehicle advertising opportunity. In response, we were solicited to become an Uber driver. The moral of the story is it might not work for everyone.

Bonds Aren’t Boring

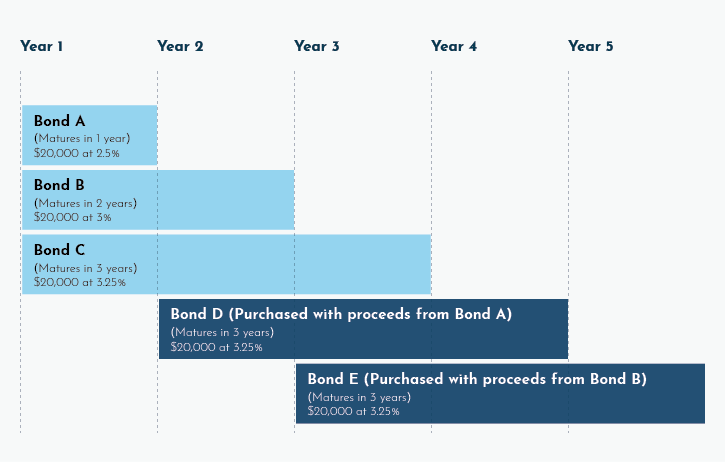

While on the surface bond investing might seem like a longer-term investment strategy, you can strategically stagger your allocations so that you are collecting income on a monthly basis. It’s known as a bond ladder, and it is comprised of multiple bond investments that mature at different times. You can craft it so that you are collecting monthly income. The way that a bond ladder is designed is to that you continue to reinvest the proceeds from maturing bond into another that will mature at a later date, hence the ladder. Fidelity has a tool to help you design your own bond ladder and other investment firms might offer something similar.

The greatest risk you are inheriting is that the issue defaults on the bond, in which case your principal investment would be wiped out. That is not likely to happen with bonds backed by a stable government, but if you have a higher risk/return profile and invest in corporate bonds, it’s a different story. The risk of default is commensurate with the size of the returns. Just ask the investors in the bonds of office space startup WeWork. After the company’s IPO got canceled and its valuation tanked, both equity and bond investors were left holding the bag.

Sample bond ladder

In the hypothetical example below, $60,000 is invested in three bonds with different maturities and yields in year 1. In year 2, the investor rolls the proceeds from Bond A into a fourth bond (Bond D). In year 3, the investor rolls the proceeds from Bond B into a fifth bond (Bond E).

Source: Fidelity

Dividends

Another way you can invest money to get monthly income is through dividend stocks. According to Forbes, dividend investments can deliver annual returns of as much as 15%, 20%, and 25% if you do it right. That’s higher than the broader stock market delivers in the average year.

I know what you’re thinking — dividend-paying companies make their distributions on a quarterly, sometimes semi-annual or annual basis. But hold on, if you’re willing to keep an open mind, you can still achieve monthly returns or something close to that time frame. Besides, there is a way to squeeze monthly payments out of this investment category thanks to creative investment products called exchange-traded funds, or ETFs.

If you don’t invest full time, ETFs make it easy and give you the opportunity to gain exposure to a group of dividend-paying stocks in a single fund. They do much of the research leg work for you, though you’ll still want to put in your own share of due diligence and compare features such as yield, price, and dividend-paying history including any pay increases or cuts. Dividend ETFs can offer you the best of both worlds, including regular payments — in some cases monthly — and an annual return as high as a double-digit percentage. DividendInvesting.com identifies monthly-paying dividend ETFs. Meanwhile, the Motley Fool shares a trio of UK-domiciled dividend ETFs:

- iShares UK Dividend UCITS ETF (LSE: IUKD)

- SPDR UK Dividend Aristocrats ETF (LSE: UKDV)

- BMO MSCI UK Income Leaders UCITS ETF (LSE: ZILK)

They warn not to get overly consumed with a high dividend yield, as it could increase the likelihood of an eventual dividend cut.

Next up is investing directly into dividend-paying stocks. We’re bending the rules here a pinch. But if you’re willing to expand your time horizon from monthly to quarterly, you will create more possibilities. The frequency in which dividend-paying stocks make their distribution depends on the company and sometimes the region, with U.S. companies preferring to pay quarterly and international companies opting to pay on an annual or semi-annual basis.

So, while you may have to wait three months to receive a check, the income is relatively dependable and could help offset those times when stock market returns aren’t spectacular.

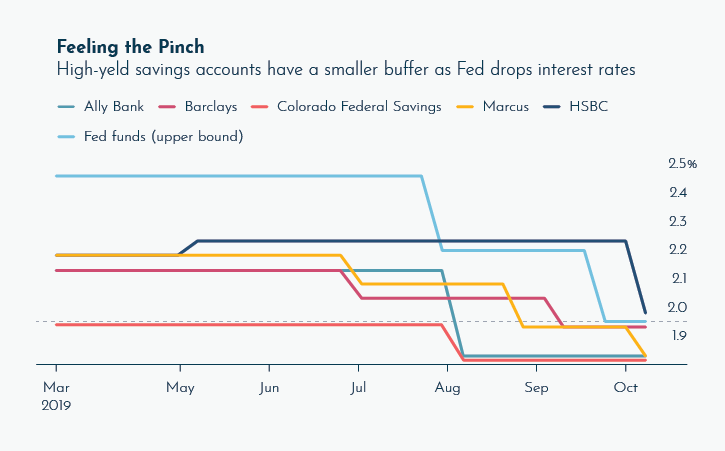

Morningstar recently compiled a list of nearly two-dozen of the leading dividend-paying stocks on the London Stock Exchange. While the way that these companies choose to direct their cash flow could change at any time, they are tried and true dividend payers, including Imperial Brands, whose quarterly payout yields an impressive 10%. It’s just one example, but compare it to the average savings account in which you’ll earn a depressing 1.9% in this low-interest-rate environment globally and dividend income never looked so good.

Source: Bloomberg/Bankrate.com

Besides, as entrepreneur Pierre Rochard describes, your bank is probably robbing you blind anyway. You might as well earn a higher return for it.

Source: Twitter

The below table is not investment advice. But it is a good place to start when researching companies that tend to pay dividends without interruption – even if they decide to lower it from time to time. You can generally bank on getting a disruption religiously since that’s part of the charm of these companies and they know it. Goldman Sachs research predicts that dividends per share in companies that comprise the S&P 500 index, the stock market barometer in the U.S., will increase 3.5% each year for nearly a decade.

| Stock | Yield % | Forward Yield % | Economic Moat | Star Rating |

| Imperial Brands | 10.33 | 6.68 | Narrow | ***** |

| BT | 8.33 | 8.68 | Wide | ***** |

| SSE | 8.73 | 7.83 | Narrow | *** |

| British American Tobacco | 7.15 | 7.22 | Wide | ***** |

| HSBS | 6.69 | 5.48 | Narrow | **** |

| Royal Dutch Shell B | 6.41 | 6.6 | Narrow | **** |

| BP | 6.41 | 6.65 | Narrow | **** |

| WPP | 6.23 | 6.23 | Narrow | ***** |

| Croda | 6.23 | 6.23 | Narrow | ** |

| Carnival | 5.03 | 5.28 | Narrow | **** |

| Vodafone | 4.93 | 4.93 | Narrow | **** |

| GlaxoSmithKine | 4.67 | 4.44 | Wide | *** |

| BAE Systems | 4.01 | 3.4 | Wide | *** |

| AstraZeneca | 3.1 | 3.1 | Wide | ** |

| Johnson Matthey | 2.94 | 2.94 | Narrow | *** |

| Unilever | 2.93 | 3.08 | Wide | *** |

| Victrex | 2.87 | 2.87 | Narrow | *** |

| Smiths Group | 2.86 | 2.92 | Narrow | ***** |

| Reckitt Benckiseer | 2.8 | 2.36 | Wide | ***** |

| Pearson | 2.73 | 1.73 | Narrow | ***** |

Source: Morningstar

Rental Income

A coveted way to invest to invest money to get monthly income is real estate. That’s because while it might be a major investment of time and money, it can deliver those monthly payments you desire like clockwork. It is a long way, however, from spotting that rental gem to transforming it into a cash cow. The good news is that with the right mix of investment and planning, you can be well on your way to achieving this goal. Accredited Investment Fiduciary John H. Graves offers the following advice:

- Determine the ROI (return on investment) you are seeking on the venture.

- How much does the property cost plus expenses?

- Identify the risks with this particular dwelling and renting (neighborhood, number of renters on the street, renters who are late with payment, etc.)

Once you determine the amount of annual income you want the rental property to generate, and you factor in expenses such as the mortgage and taxes, you can come up with a monthly rental fee that you’ll need to charge to be profitable.

P2P Lending

If you haven’t heard, peer-to-peer lending is the latest investment craze, with the financial crisis of 2008 giving rise to the trend (though Prosper, the first P2P lender, launched in 2006.) In a nutshell, P2P lending is a way for investors with sidelined cash to lend to borrowers, either individuals or businesses, on a fintech platform and earn returns that outpace those of traditional investments. Either your capital is pooled with that of other investors or you might be able to select a borrower on a platform based on your own risk/return profile.

The minimum investments vary from platform to platform and can be as low as USD 25. So if you allocate across 100-200 different loans, it would require a startup investment of approximately USD 5,000.

In addition to VIAINVEST, some high-profile P2P lenders are the UK’s Funding Circle, U.S.-based Lending Club, Zopa, Australia’s RateSetter, and MarketInvoice.

Every firm has its own nuances, but basically, once a borrower snatches up your loan and begins making monthly payments, you proceed to collect monthly interest payments from the investment. The risk is tied to the possibility that the borrower defaults on the loan, in which case you could lose your investment if there’s no protection from the likes of the Financial Services Compensation Scheme.

By creating a successful P2P lending portfolio, you can earn a hefty monthly income. You might already know this from advertisements on the platform of the London tube in which fintech firms boast returns of 7.5%. Indeed, returns on P2P loans can range anywhere from 3% to 10%, the latter of which reflects a higher-risk loan such as “bridge finance or property development loan,” according to the Financial Times.

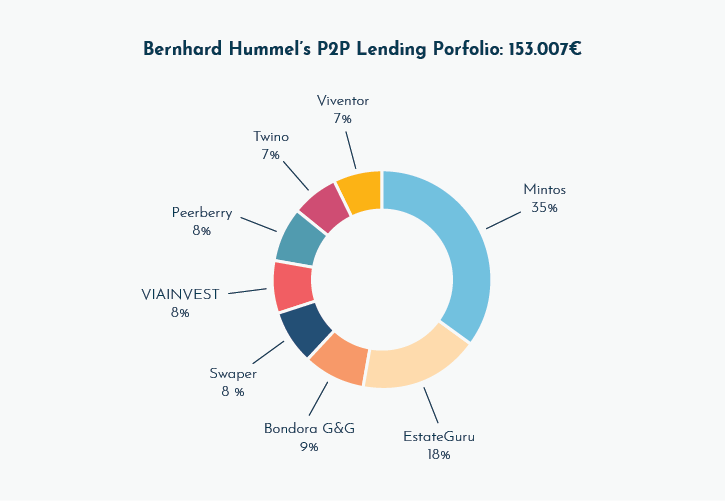

For example, after pouring €150.000 into loans across a myriad of P2P platforms, Austrian investor Bernhard Hummel generates 1,500 euros monthly passive income” from P2P lending. His monthly returns are at the high end at 12%. Hummel calls P2P lending “a great passive income source” and believes diversification is key. His investments are spread across eight fintech companies and P2P lending comprises 25% of his total investment portfolio. Here are the P2P platforms that have worked so well for him:

- Mintos

- EstateGuru

- Bondora G&G

- Swaper

- VIAINVEST

- Peerberry

- Twino

- Viventor

While this may be a feature of investing large sums of money into P2P lenders, there is something to glean from Hummel’s strategy. He makes it a point to visit the offices of the P2P lenders he is invests in, taking the opportunity to meet the CEOs of these firms and pepper them with questions. While physically visiting the office might not be reasonable for every investor, it is helpful to know that these companies have an open-door policy in which you can ask questions and get answers directly.

Crypto Staking and Lending

If you want to take a walk on the wild side and it matches your risk/return profile, you might want to venture into cryptocurrencies. While it’s a volatile and nascent market, there are opportunities for you to invest to get monthly income. Blockchain projects are looking more and more like the crypto version of banks every day and staking and lending — two separate activities — are evidence of this.

Let’s start with staking, which is basically crypto jargon for earning interest. The projects behind proof-of-stake cryptocurrencies reward you for holding the coins you own in a designated digital wallet. In doing so, you are supporting the completion of transactions on the blockchain network but can’t access your coins for a certain period of time. There are multiple cryptocurrencies and exchanges that support staking, so you can take your pick.

With staking, you have the option to participate in the process directly, though it can be tricky to navigate – especially for novice investors. The other option is to capitalize on the staking features that cryptocurrency exchanges offer. They make it relatively straightforward.

For instance, cryptocurrency exchange Coinbase lets you earn rewards for staking cryptocurrency Tezos. Your estimated annual return is approximately 5%, which you can start withdrawing after a holding period of between 35 and 40 days. After that, the rewards stack up every few days. In addition to Tezos, Coinbase also supports the following coins for staking:

Cryptocurrency exchange Binance supports staking for the following cryptocurrencies: Stellar (XLM), Algorand (ALGO), NEO (GAS), Ontology (ONG), VeChain (VTHO), Tron (BTT), Komodo (KMD), Stratis (STRAT), and Qtum (QTUM).

Next up, crypto lending, a process that’s very similar to P2P lending and that is part of the decentralized finance (Defi) phenomenon. While fintech companies have been around for about a decade, crypto lenders have less of an operating history. Many market leaders recommend diversifying your investment portfolio so you can offset some of that risk.

While the details vary based on the lending platform, basically you are combining your crypto with that of other lenders on the platform to issue to loans to borrowers. In exchange, you earn interest, which can be as high as 14% on some platforms.

While there are multiple lenders to choose from, not all of them distribute interest on a monthly basis. BlockFi does – it pays monthly compounded interest. If you own ether, the cryptocurrency of Ethereum, which is the second biggest crypto network, you can earn a return of more than 6% monthly.

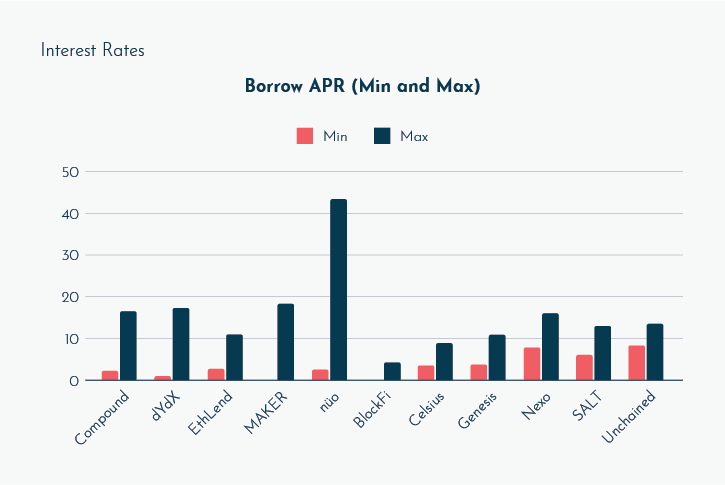

The most popular cryptocurrencies that are accepted by lending platforms are bitcoin (BTC), Ethereum (ETH), and various stablecoins, which as the name suggests are more stable cryptocurrencies tied to fiat currencies. After you transfer the coins over to the lender, you begin earning returns. Similar to staking, you generally won’t be able to access the crypto you are lending for a period of time. Below is a list of a few of the popular lending platforms.

Source: Graychain.net

Investing in crypto can be a real gamble, in which case you might prefer sports betting though some say to be successful it takes just as much effort as a 9-5 job. In either case, just make sure it’s legal in your jurisdiction.