The world is increasingly going digital, including the monetary system. The economy has been flooded with digital assets and mobile apps that consumers are flocking to over traditional money and financial institutions. Cryptocurrencies like bitcoin are taking the lead on the digital transformation in a global economy where inflation has reared its head and seemingly intends to stick around for a while. The rise of bitcoin has challenged the legacy financial system and placed a fire under the feet of countries that have not already done so to go digital.

It is difficult for banknotes to compete with speedy electronic payments on the blockchain. And the more consumers hold into digital currencies, the less they will potentially make deposits into traditional banks, which threatens to disrupt the model of financial institutions.

Central banks digital currencies (CBDCs) are basically digital versions of cash denominated in the local fiat currency of a nation or area. Global central banks are increasingly pursuing them as they prepare to compete with the rise of digital currencies in the private sector. For its part, the European Central Bank (ECB) is exploring the integration of a digital euro.

In this article, we will explore how a CBDC actually works anyway as well as when a digital euro might actually materialize. We will also consider the pros and cons that policymakers are weighing as well as the role of the Baltic nations in the pivotal research process.

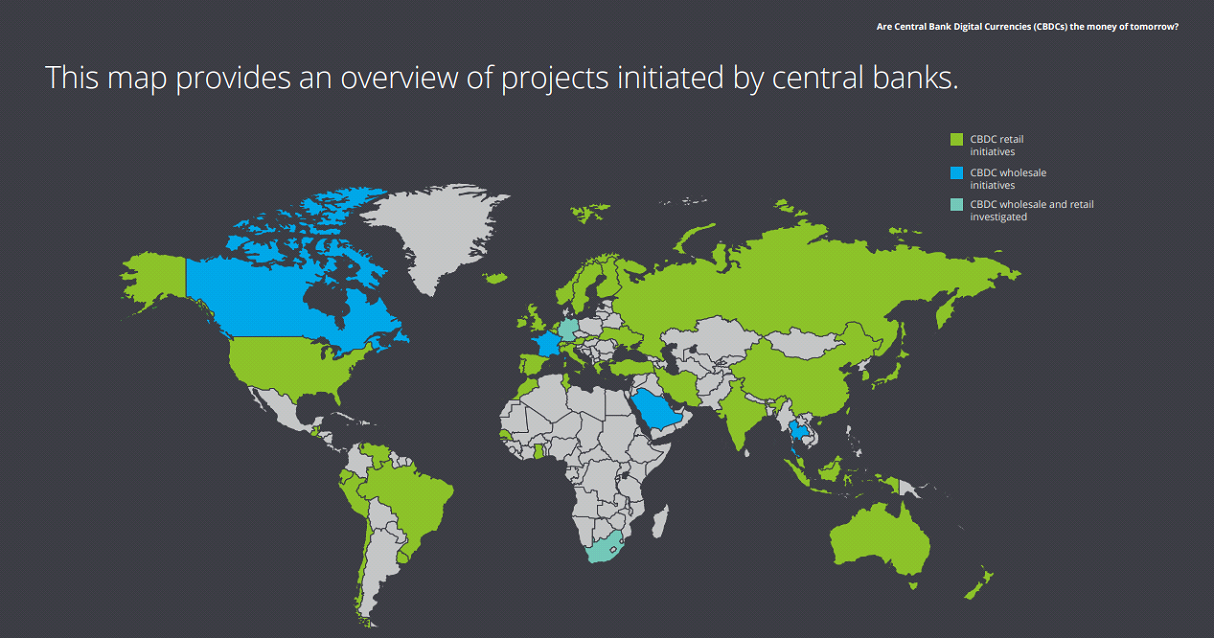

El Salvador has taken the dramatic step to make bitcoin legal tender for consumers and merchants in the Central American nation. The route that most countries are taking, however, is to pursue CBDCs. In fact, between 70-90% of global central banks are in the process of considering the implementation of a CBDC.

For officials, CBDCs can offer the best of both worlds – a currency issued by central banks that boasts the nimble characteristics of a digital asset. One country that is seemingly not going down this road is Australia. The Reserve Bank of Australia seems doubtful that a digital dollar is needed, though it plans to dig a bit deeper on the topic.

Meanwhile, the ECB has made CBDCs a priority, but the wheels of innovation turn slowly for most governments, with the exception of digitally savvy nations like Estonia. Nonetheless, the ECB is making progress. In addition, there are countries outside of the eurozone that are making their own digital currency plans, some of which are further ahead than others.

Globally, China was a first-mover to launch an online version of its fiat currency, the digital yuan. Meanwhile, the Federal Reserve has largely had its head stuck in the sand when it comes to tech innovation and digital currencies.

Not surprisingly, Europe has different takes when it comes to digital currencies. Euro banknotes have been a part of the EU economy for close to 20 years. The ECB is not ready to part with cash entirely, but policymakers are open to tech innovation. It is a good thing, considering electronic payments are surging, having climbed more than 100% higher in the 2010-2018 period in the eurozone.

Source: Twitter

And while Europe’s central bank has yet to make an official call on the potential role of a CBDC in Europe, a digital euro could see the light of day by 2025, officials have said. In this article, we’ll explore where the ECB stands on CBDCs and the path some countries outside of the euro area are taking.

CBDC Mechanics

In a nutshell, a CBDC is like an electronic version of cash only it is faster, sleeker and cheaper to send. A CBDC could be used to make money transfers, pay for goods and services at brick-and-mortar locations, or make purchases online in a similar way that a card would be used.

In the case of a digital euro, it would function like digital banknotes that are issued by central banks including the ECB and guaranteed by them. It would be made available to consumers and businesses in the eurozone. A digital euro or any CBDC for that matter would change the way that consumers pay for everyday purchases. Basically, it would offer the public a new option for payments, one that the ECB must make sure is secure and widely accepted first.

Most people have heard of digital assets, especially since bitcoin’s market cap has balloons to more than EUR 1 trillion. Not everyone, however, is familiar with what a CBDC is all about. No two CBDCs will be exactly alike, and while the blockchain is suited for them, some central banks could technically go in a different direction. CBDCs are the leading way that banks are expected to use the blockchain, however, which is the underlying technology of digital assets.

There is a two-pronged model for a CBDC. A retail version of a CBDC would be used by individuals and businesses. These represent the payments that consumers make to merchants, and what these transactions may be lacking in value they make up for in volume. Interbank CBDCs, meanwhile, are what banks would use for interbank payments.

Source: Deloitte

CBDC Pros

The International Monetary Fund has outlined the advantages and disadvantages to a CBDC system. They tout a more efficient payment system as the key advantage given the pricey nature of managing banknotes. In addition, the bankless and underbanked segments of the population would have a better chance of financial inclusion since participation in a CBDC would not require having a bank account.

The IMF also touts greater stability that would be associated with a CBDC, as well as fewer barriers to entry for startups looking to enter the payments fray. Officials pointed to Sweden and China, for example, where they say there is “an increasing concentration of payment systems in the hands of a few, very large companies.” China’s Alipay and WeChat Pay and Sweden’s Swish mobile payment system come to mind.

IMF officials also cited CBDCs as a way to “counter new digital currencies.” They say a central bank-backed digital currency would help to slow down the adoption of stablecoins, which are digital assets issued by the private sector but often pegged to fiat money, like the USD or EUR, for example. They suggest that stablecoins could be challenging to regulate and “could pose risks to financial stability and monetary policy transmission.”

Other pros for a CBDC include the speed in which payments can be settled. The electronic nature of a digital currency is such that the system continues to operate 24/7 instead of having to wait for the local time of a corresponding bank to catch up. CBDCs can operate around the clock, and payments can be settled straight away.

The blockchain, which is an immutable digital ledger, has also made sending payments cheaper and more efficient for local and cross-border payments. CBDCs are said to offer the best of both worlds — the safety of central bank money combined with the efficiency that digital assets bring to bear.

CBDC Cons

With any emerging asset class there are always risks, and the IMF has named a few. IMF officials lose sleep about the possibility of consumers shifting their savings from deposits held at financial institutions to CBDCs instead. This might pressure banks to increase deposit rates to compete and access riskier funding, all of which could place their balance sheets at risk with the potential for a systemic risk to the broader economy.

The IMF counters this risk with the idea that CBDCs would not generate interest and therefore their risk to bank deposits could be less severe than feared. Incidentally, there are ways to generate interest in the cryptocurrency sector through a market called decentralized finance, or DeFi, where the value of the market currently exceeds USD 264 billion.

Additionally, a recently published report by the BIS and other central banks states officials are concerned about the possibility of bank runs in times of economic crisis. They say that the lower cost nature of digital currency transactions could lead to bank runs during another financial crisis.

Academics are worried about a CBDC disrupting the traditional financial system and warn that it could thwart tech innovation in the private sector. The propensity for cybercrimes including hacks increases as the world goes digital. In addition, a CBDC would be less private than banknotes as there would likely be a digital identity tied to each transaction. ECB officials have maintained that a digital euro would strike a balance between privacy and security.

The ECB and a Digital Euro

CBDCs have officially been on the radar of the ECB this year. Over the summer, policymakers launched a formal investigation into the concept on the heels of the positive results from an earlier research project that involved Estonia and other countries.

In addition to studying the potential risks and benefits, policymakers are exploring features like how a digital euro would look and be distributed to businesses and the public alike. The ECB must assess how a digital euro would affect the payments landscape as well as any new policies that might need to be crafted. It is this very probe that will determine whether the central bank decides to move forward with a digital euro.

Morgan Stanley estimates that a digital euro would inhale 8%, or EUR 873 billion, of consumer bank deposits. This could throw the “average loan-to-deposit ratio” off kilter for some of the smaller nations in the eurozone, including the Baltics. In this example, Morgan Stanley analysts assume that euro residents 16 years old and up would each transfer EUR 3,000 to a digital wallet overseen by the ECB to start, which is a conservative scenario.

ECB executive board member Fabio Panetta recently noted that the ECB is still exploring whether to launch a CBDC on the blockchain for a retail use case. He acknowledges that cash’s role in society is on the decline, and if the trend persists down a digital path, banknotes could go the way of the postage stamp. Nonetheless, even if the economy is going digital, the ECB overall does not expect that CBDCs will serve as a replacement for cash but rather will supplement banknotes. But by offering a digital currency, eurozone countries stand a better chance of competing with the private sector’s innovation that has led to the creation of bitcoin.

The central bank also tapped a banking executive to lead its digital euro program. Evelien Witlox, who previously spearheaded global payments at ING, will become program manager for the ECB’s digital euro program in early 2022.

For his part, Panetta, who was formerly at the helm of Italy’s central bank, emphasized that a digital euro would not be designed to go head-to-head with cryptocurrencies like bitcoin but instead to provide another option. He also reportedly said that most likely, CBDCs will ultimately attain legal tender status in their respective countries but this is not a given.

In his latest progress update, Panetta explained how with a market cap of more than USD 2 trillion, the value of cryptocurrency assets has surpassed that of securitized assets pre-Global Financial Crisis. He mentioned regulatory loopholes that must still be addressed in the crypto markets, noting that in a decade, if consumers don’t get their digital assets from the public sector, they will do so elsewhere. Panetta also emphasized that the objective is to deliver digital assets without compromising financial stability vis-à-vis criminal activity.

Source: Twitter

A criticism of the ECB’s digital euro advisory group has been that while ECB board members say “many high-quality experts from the private sector are willing to contribute to the digital euro project,” they appear to be missing a key ingredient. There are seemingly no blockchain developers or decentralized finance (DeFi) projects on the list of advisors, which begs the question of how officials will be able to navigate the emerging blockchain waters on their own.

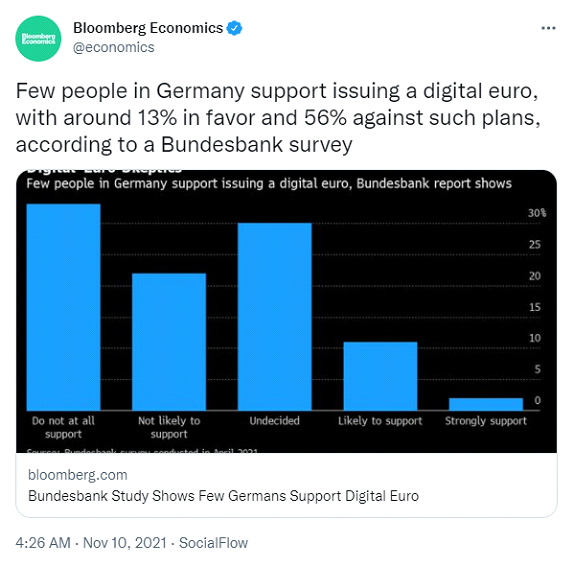

Outside of crypto, the digital euro has other critics as well. According to a Bundesbank poll cited by Bloomberg Economics, in Germany, most locals are not in favor of issuing a digital euro, with more than half of survey participants against the initiative. Approximately 13% of poll participants support a digital euro.

Source: Twitter

Baltic Nations Step Up

When it comes to digital payments, Estonia is light years ahead of much of the rest of the world. The Baltic country has already created a “digital society” of sorts that is touted as a model for other governments to emulate. As a result, its view of a digital euro holds a great deal of weight.

Estonia’s Eesti Pank, the ECB and several other central banks including those from Spain, Germany, Italy, Greece, Ireland, Latvia, and the Netherlands recently came together to study the implications of a digital euro. This research was separate from the ECB’s two-year investigation into a digital euro that is currently underway. The results of the research were promising for a digital euro.

In the digital euro experiment, officials created payment transactions with digital money using participants from countries across Estonia, Latvia, Lithuania and Spain. According to their findings, a blockchain-based digital euro system hits on all cylinders: it can support nearly an “unlimited number of payments” simultaneously amid a “very large money supply” and is more environmentally friendly vs. the traditional card payment infrastructure.

They also found the blockchain-based system to be scalable so that it could be expanded to handle even more digital euro payments. For their study’s purposes, the digital euro supported 300,000 payment transactions per second, and transactions were completed in less than a couple of seconds. The carbon footprint was less than traditional card payments.

Estonian officials also discussed an electronic ID, or eID, that would be tied to a digital euro, which some might argue would be a violation of privacy. The purpose of the eID, however, would be to ensure both security and privacy so that details are limited to the parties involved in a transaction, but anti-money-laundering protocols are still upheld. Estonia already touts a digital ID system for its population of 1.3 million. Eesti Pank policymakers also found that the blockchain-based payments system struck a balance between privacy and security, such as anti-money-laundering controls.

Latvia has also weighed in on the prospect of a digital euro. The Bank of Latvia reportedly determined that if Europe fails to act on a digital euro, it will become vulnerable to both “geopolitical and strategic risks.”

Conclusion

The ECB’s digital euro investigation is still in the early innings, but the wheels are in motion, which is more than the United States can say. As central banks drag their feet on implementing a digital euro or other CBDC, entire countries are moving forward by integrating the private sector’s digital currencies. El Salvador is a key example, having made bitcoin legal tender in the Central American nation and preparing the launch of a Bitcoin City.

For Europe, cryptocurrency adoption is already at hand. The central, northern, and western European region leads the world for its cryptocurrency economy, which has a value of USD 1 trillion attached in the 12-month period leading up to mid-2021, according to crypto market data firm Chainalysis. In fact, this region accounted for one-quarter of the world’s crypto activity between the summers of 2020 and 2021 fueled in part by the rise of the DeFi market. The UK leads the way for crypto transactions across all of Europe.

A digital euro would require a monumental undertaking in terms of infrastructure, expenses, adoption, and more. Nonetheless, officials are in a bit of a catch 22. While they continue to perform their research, private sector innovation is only growing stronger, as is cryptocurrency adoption. The ECB’s Panetta has vowed to introduce a digital euro prototype by the year 2023. At least by that time, the central bank will have tipped its hand to the design of its potential CBDC. And while the ECB does not want to rush into a digital euro, Panetta has made it clear that by the same token, regulators want to “go fast.”