With 2021 about to be in the rear-view mirror, we thought it would be a good time to take stock of some of the key investment themes that have emerged over the past year and what’s ahead for 2022. Investors have had to navigate some choppy market waters with headwinds like inflation and the emergence of the omicron variant, which suggests that diversification could become more important than ever.

While there are still plenty of returns to be had, investors might also need to expand into new areas to capture them and move closer to their financial goals. Some of the areas we’ll explore include stocks, cryptocurrencies, non-fungible tokens (NFTs), peer-to-peer (P2P) investing, and sustainability as well as alternative asset classes including luxury items from fine art to fine wine.

In addition, we’ll take a look at some of the overhanging risks, not least including inflation and the omicron variant, as well as the effect they could have on investments. We’ll also tell you the latest exciting developments at VIAINVEST so you know what to look out for in the new year.

Risk On, Risk Off

Risk assets were hot as recently as early November as the global economy continued to recover from the pandemic-fueled slowdown. Before the month was over, however, the one-two punch of anticipated rising interest rates and the spread of the omicron variant has turned the tables. Categories from growth stocks to oil have felt the pressure, and the outlook is cloudy at best.

Meanwhile, the European Central Bank (ECB) is winding down its pandemic-fueled bond-buying program while the U.S. Federal Reserve has signaled its intentions to ease asset purchases, all of which could threaten to derail a bull market. The Fed also tipped its hand to plans to begin raising interest rates as consumer prices inch higher. In addition, the Bank of England has already begun to raise rates in an attempt to keep inflation at bay. The result of this uncertainty coupled with more hawkish economic policy has translated to greater volatility in the global financial markets with wild swings in both directions.

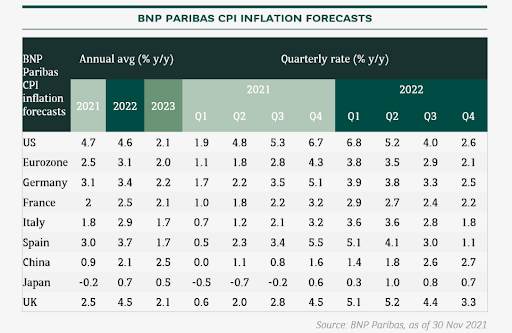

The outlook for 2022 is in many ways a wildcard. As countries go back on the defense to battle omicron, predictions are hard to come by. Nevertheless, there are some conclusions to be drawn. BNP Paribas is optimistic, predicting strong global equities thanks to robust corporate profits, a growing economy and low interest rates. The experts at BNP Paribas are particularly positive about the eurozone, Japan and the U.K. amid reasonable valuations and just the right exposure to value and cyclical stocks. They advise investors to steer clear of U.S. Treasuries, while real assets, precious metals, and green commodities are acting as solid inflation hedges. Below is the bank’s outlook on inflation in the eurozone and beyond, where elevated prices will remain a risk for the foreseeable future.

Source: BNP Paribas

Stock Market Outlook

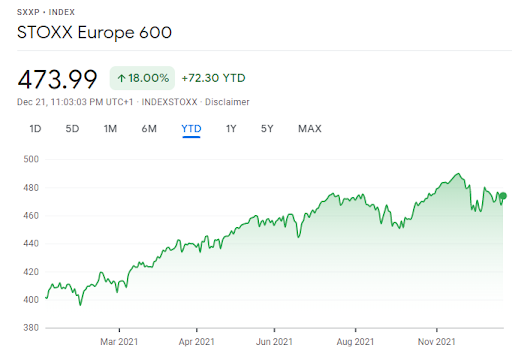

Stocks have had a good run in 2021. In the U.S., the major indices including the S&P 500 have set multiple fresh all-time highs, while the STOXX Europe 600 has similarly made its way into record territory. In both cases, strong corporate earnings thanks to a recovering global economy have fueled sentiment among investors.

European stocks have advanced approximately 17% year-to-date. The retail sector has been the exception, lagging their U.S. peers as European consumers have been more reluctant to spend their savings due to fears about potential layoffs, not to mention supply chain problems. European stocks could have more runway for gains in 2022, while some market experts are warning that U.S. stocks could take a pause.

Institutional investors are eyeing technology, healthcare and infrastructure, according to a Natixis survey. Within tech, one burgeoning segment is the metaverse, which is a virtual world that is expected to define Web 3.0. Ever since Mark Zuckerberg joined the metaverse bandwagon, changing the name of Facebook’s parent company to Meta, other companies are similarly looking to make their presence known in this virtual reality world.

Back to reality. As of early December 2021, fund managers, market strategists and brokers are optimistic about the prospects for European stocks in 2022, according to a Reuters poll. Survey participants forecast that the German Dax and France CAC indexes will see new all-time highs by the middle of 2022, fueled by corporate profits. Incidentally, France has a presidential election in 2022, which could influence investment returns.

The pan-European STOXX 600 is predicted to advance 7% next year to trade at a new record of 500 by mid-summer 2022 after setting an all-time high of 490 in November 2021. Meanwhile, European banking stocks are poised to benefit as central banks gear up to raise interest rates in the new year. These companies have already seen their shares advance nearly 30% in 2021. Luxury retail stocks are the ones to watch, experts say, as European consumers begin to feel better about the economy and look to purchase items like expensive watches, for example.

Source: Google Finance

Not everyone is quite so bullish. Market strategist Stephane Ekolo at Tradition warns that the STOXX 600 index could fall to the 430 level by the end of next year, blaming an economic slowdown. Sectors that are most vulnerable to further potential lockdowns are at risk, including travel and leisure stocks. They’ve already taken the brunt of any selling in November 2021 when European shares in this sector fell to levels not seen since the height of the pandemic.

In yet another forecast, Morgan Stanley strategist Graham Secker says that European stocks are likely to sink by a double-digit percentage in 2022. The reason, according to him, is stocks have advanced for the past year-and-a-half with no serious pullback, and basically they’re due for one. On the bright side, he advises investors to buy the dip, as the bulls are likely to wrestle back control afterward.

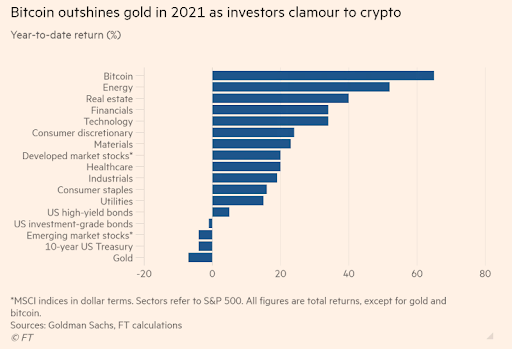

Gold’s Pain Is Bitcoin’s Gain

Bitcoin, the leading cryptocurrency, has been among the best-performing assets of 2021. As consumer prices have soared around the world, investors have flocked to the digital asset as a store-of-value asset, helping to send bitcoin to a fresh all-time high, though the price has since pulled back from that level.

Big investors have helped to fuel the bitcoin price, as institutional adoption has taken hold. There have been several catalysts, including the launch of the first bitcoin-based futures ETF in the United States. In addition, a trend emerged in which companies started buying up bitcoin for their treasuries, which has excited the cryptocurrency community.

Bitcoin set a fresh all-time high price of over $68,000 in 2021 and saw its market capitalization balloon to over USD 1 trillion. The market cap of the broader cryptocurrency market, which comprises thousands of digital currencies, even surpassed $3 trillion in 2021 at its peak. While bitcoin and other cryptocurrencies have since retreated from record levels, many have still been the top-performing assets of 2021.

Bitcoin’s rival store-of-value asset, gold, meanwhile, has suffered. The precious metal has fallen 5% year-to-date despite the rising inflation it is meant to protect against. According to Bank of America strategist Francisco Blanch cited by the Financial Times, fund inflows that might otherwise have gone to gold have instead been directed into bitcoin by investors.

Source: Financial Times

Crypto Outlook for 2022

With inflation rearing its head and not expected to abate until about the second half of 2022, all the stars are aligned for the bitcoin bull market to return. The catch, however, is that it depends if bitcoin behaves like the inflation hedge that market experts believe it can be. The cryptocurrency markets are unpredictable; some market prognosticators see the glass half full while others maintain it’s half empty.

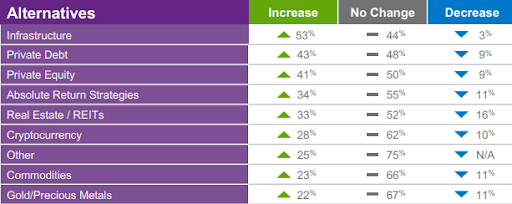

The Natixis poll warns that cryptocurrencies are due for a market correction in 2022. The survey also reveals that 28% of institutional investors plan to buy more crypto in 2022, while 62% of those polled will keep things the same and 10% will decrease their allocations.

Source: Natixis

Alternative Assets

Investors are left hunting yield in an environment where interest rates are low to negative and stocks are volatile. Alternative assets are increasingly fitting the bill. Luxury asset classes have been leaving traditional investments like stocks in the dust, but you have to know where to look. A MoneyWise report breaks down some of the best-performing alternative categories within the luxury asset class.

- Contemporary fine art: This category is increasingly looked to not only for home decor but also as an investment, outperforming the stock market. It encompasses pieces made after 1945. Over the past two and a half decades, contemporary fine art has generated annual returns of 14% while U.S. stocks have averaged annual returns of 9% in the same period. For the entire period of 25 years, contemporary fine art has beaten the S&P 500 index by more than 170%.

- Wine: Whether you prefer red or white, earthy or savory, France or California, this alternative asset goes down smooth. The Liv-ex Fine Wine 100 index reflects the value of the leading investable wines, and it has soared more than 270% in the past two decades. It even held its own during the financial crisis in 2008. Fine wine is in the midst of a bull market as the supply of vintage wine continues to dwindle among owners who keep depleting their own inventory.

- Luxury Watches: Fine jewelry never goes out of style, and luxury watches are no exception. Luxury brand Rolex makes fewer than a million new watches annually, which is not enough to meet demand. As a result, the secondary market for luxury items is quite popular, a trend that is expected to persist for the foreseeable future, as per McKinsey & Co. Marketplaces exist on which you can buy and sell luxury watches, with Rolex Daytona going for as much as $50,000. It is a pricey hobby but if you can afford to get your hands on some of these items, you might be able to turn around and sell them in the secondary market for a profit.

Non-fungible tokens (NFTs): While NFTs are not on the MoneyWise list, they have been one of the hottest investment categories of 2021. NFTs are digital tokens on the blockchain comprising some component like art, music, video, etc. The most in-demand NFTs have been selling anywhere from hundreds of thousands of dollars to millions, including on traditional auction platforms such as Sotheby’s and Christie’s. The trend is likely to persist into 2022 based on the pace of adoption among pro sports leagues including European football, famous athletes, celebrities, and major companies. The below NFT sold for USD 69 million in a Christie’s auction, the artist for which is known as Beeple.

Source: Twitter

Peer-to-Peer Investing

P2P investing is yet another alternative asset class that investors are turning to for returns in the current environment. Investor Jean Galea says on his website that European P2P platforms offer the best returns out there compared to the U.S. and Asia.

At VIAINVEST, the highlight of 2021 was being granted an Investment Brokerage Firm License and becoming a regulated investment platform. It did not happen overnight, as management started a close cooperation with the Financial and Capital Market Commission (FKTK) back in 2020. By September 2021, we finally obtained the license, marking a huge milestone for the team as well as the P2P community.

VIAINVEST has begun the transition period to a regulated entity, which will unfold through the early months of 2022. During this period, VIAINVEST will gradually shift from selling claim rights to listing asset-backed securities. Users may already notice slight changes to the registration form that will require them to update their details and pass the appropriateness test. Don’t overlook this, as it’s the only way to determine which investment products fit each investor’s risk/reward profile and ensure that they won’t face any restrictions when looking to access investment opportunities, such as the auto-invest feature.

Before we look ahead to 2022, let’s reflect on the past year, which has been a roller coaster. In early 2021, the pandemic was still affecting several European countries in a major way. With no crystal ball to reveal what the COVID impact would be, in 2021 VIA SMS Group decided to maintain a rather conservative approach towards lending which started in 2020. We introduced stricter credit scoring methods with an aim to maintain high-quality credit portfolios and avoid the risks associated with major defaults.

This explains why the published loan volume decreased since the pandemic started. But in the second half of 2021, we were able to increase the loan supply by 35%. We are planning to continue moving further in the same direction in 2022 because to our investors, it is the safest and most reasonable approach.

Investors on the VIAINVEST lending platform can look forward to the following updates in the new year:

- We will completely switch to offering securities

- The IT system will be updated, which will result in an improved user interface.

- We will initiate the passporting of our operations across the EU/EEA and will continue to offer our services in Latvia, regardless of an investor’s country of origin.

- We expect to expand our investment portfolio by adding new loan originators.

As we embrace the IBF license, look for new products to make their way to the pipeline in 2022!

Sustainability

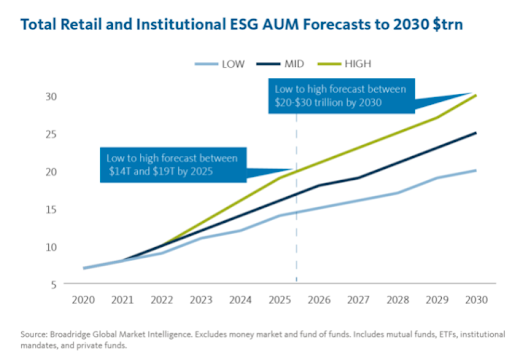

Environmental, social and governance (ESG) investing has been a major theme of 2021. As investors increasingly demand that the companies they invest in take steps to become more sustainable, and as the rules around ESG standards become clearer so greenwashing is eradicated, ESG is likely only going to gain more traction, especially among Millennials and Gen-Z’ers. According to a Broadridge Financial Solutions report cited by Barron’s, global sustainable investing currently hovers at USD 8 trillion and might potentially increase to USD 30 trillion by 2030.

Source: Broadridge

ESG is no longer just about a company, project, or government’s carbon footprint. While C02 is still in focus, the targets there have already been set so the themes have been expanded. For example, the way that an employer treats their staff has become relevant, as areas like diversity, inclusion, and worker rights gain importance.

Conclusion

While there’s no crystal ball into 2022, there are some key themes that are likely to stick around for the foreseeable future that should help investors to navigate the uncertain markets. As investors hunt returns to offset the economic uncertainty, alternative assets including P2P are likely to remain in the spotlight. NFTs and the blockchains on which they’re built have plenty of catalysts and will be ones to watch as well. Bitcoin also has the wind at its back in the inflationary economy, volatility in the BTC price notwithstanding.

Experts advise investors to maintain a long-term time horizon of the next five-10 years, as the risks that are present now are likely to dissipate by then. In the short term, while there are plenty of headwinds, they could potentially ease by the second half of 2022. Overall, whether investors are facing a glass half full or glass half empty situation depends on how diversified their portfolio is and how long it takes for some of these uncertainties to play out.