It’s no secret that the Baltic nations are considered a hub for fintech activity. This is especially true in the wake of Brexit, given the compliance and regulatory uncertainty surrounding financial services between the U.K. and the European Union. Entrepreneurs need more clarity. Latvia, Estonia, and Lithuania are increasingly bridging that gap, thanks to a culture of nurturing tech innovation and embracing digitization that in many ways have made the Baltics the envy of the world.

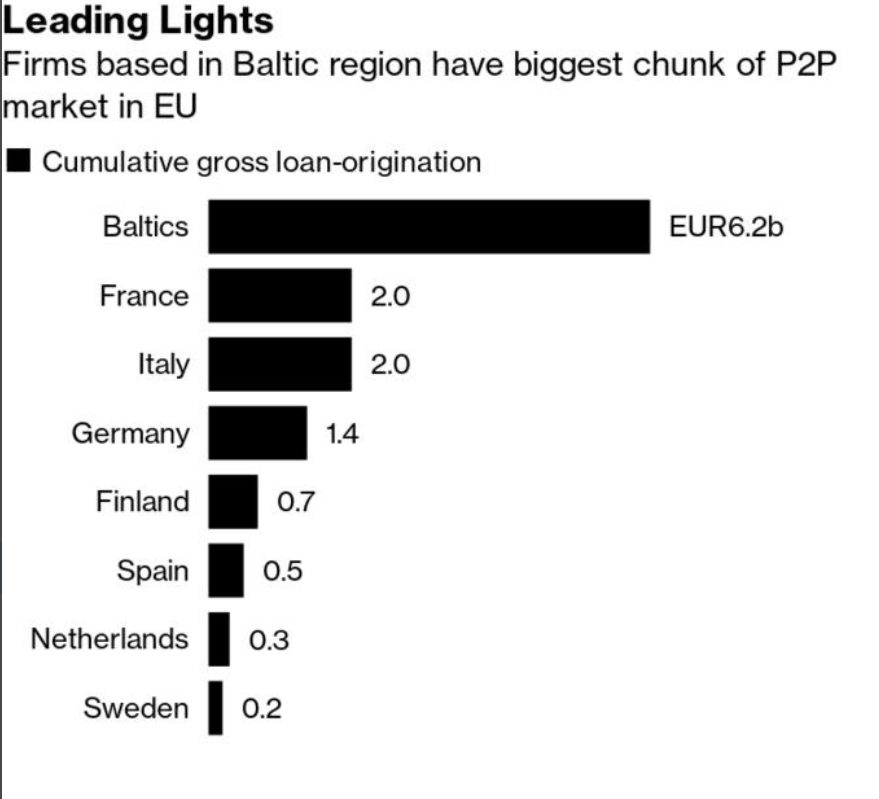

Fintech is the intersection of finance and technology. It is a sector that looks to tech to make financial services better and more intuitive for consumers and businesses alike. The sector has disrupted legacy financial systems by leaning into what consumers want and the way in which merchants and entrepreneurs can deliver. The Baltics take the lead in areas like peer-to-peer (P2P) investing, where the region has the largest slice of the market in the EU, with France in a distant second.

Source: Fintech Circle/Twitter

Because of the leadership role that Baltic nations have taken in fintech, the sector has been largely resilient throughout the health crisis. For example, funding raised by fintech startups in the region increased by 3.8x in 2020 to over $175 million. The number of deals also rose during the pandemic year from 41 to 45 in 2019 and 2020, respectively. That momentum started to pick up again later in 2021.

The Baltics have produced major fintech players on the world stage, like peer-to-peer (P2P) investing company VIAINVEST, money transfer company Wise, and payments company Paysera to name a few. These companies have altered the financial landscape in the region and serve as a model for other jurisdictions to emulate. Let’s take a look at some of the key themes for fintech in the Baltics.

Latvia’s Fintech Landscape

Latvia’s fintech sector has made its presence known in the EU, evolving since the 1990s when the Baltic nation became independent. With a population of under 2 million, Latvia has evolved from relying solely on legacy technology to being out front for digital integration from payment cards to online banking.

Legacy systems still exist, as consumers didn’t abandon ship entirely. But consumers also became more tech-savvy in their expectations, which plays into the offerings that fintech delivers. Ultimately, financial institutions and fintechs have learned to partner, and that has been key to the success of the sector in the nation. The end result is a fintech sector that is a force to be reckoned with in the EU.

With hundreds of startups combined domiciled in Latvia, roughly 20% of them operate in the fintech sector. That percentage is rising each year, according to Swedbank. Indeed, the number of fintech startups in Latvia has steadily increased from 66 in 2018 to 75 in 2019 and 91 in 2020, most of which are based in Riga.

The stars have clearly aligned, thanks to burgeoning talent, a strategic location, tech infrastructure and government policy including startup visas and sandboxes that nurture innovation in everything from tech hardware to payments. On the talent side, Latvia shines with a skilled workforce in finance and innovation, Swedbank explains, and these entrepreneurs have also begun to use their expertise in the area of fintech. Latvia’s workforce is young and often highly educated with strong university attendance and a growing number of students pursuing information technology and engineering specialties.

The workforce is also known for being bilingual, which helps to strengthen its appeal among international entrepreneurs and attract foreign investments. The same can be said for all Baltic nations. In addition, many Latvia-based fintechs have a presence abroad in places like Asia, Switzerland, Africa and beyond.

The international presence of Latvia’s fintech sector makes it possible for these startups to tackle some of the challenges on a global scale. For example, solutions developed by Latvian fintech startups are expected to raise the profile for remote financial services internationally, according to Toms Niparts of the Jeff App quoted by Swedbank.

Latvia scores well for fintech support with a Regulatory Sandbox and the Innovation Hub, via the Financial and Capital Market Commission (FCMC), where founders can kick the tires on their innovation and build in a way that their products and services will be compliant with regulation. Latvia is known for having a friendly regulatory framework toward the fintech sector, which became increasingly important in the wake of Brexit as founders looked to fill the gap left by the role the UK used to play. In fact, this is true of all three Baltic nations, which have been crafting regulation that is viewed in a positive light by the fintech industry.

Latvian regulators are focused on fintech and banking, and they are expected to create rules that support the needs of the fintech sector, according to a recent discussion hosted by the FCMC. They have shown a willingness to consult with local and international founders looking to set up shop in Latvia or revamp their business model in a regulatory compliant way.

Regulators are willing to help entrepreneurs get the relevant license they will need to operate. By the way, VIAINVEST recently obtained an Investment Brokerage Firm License for investment protection and product innovation, making it a fully regulated platform.

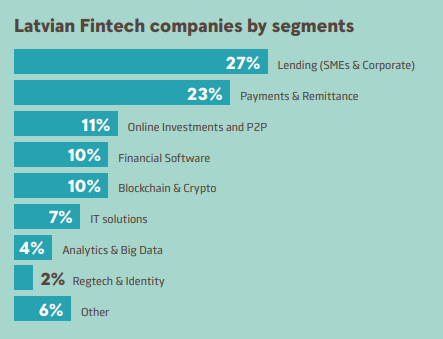

As far as the breakdown, lending startups dominate Latvia’s fintech sector, at 27%, and there is some spillover in this segment with P2P investing. Payments and remittances come in a close second, at 23%. Latvia’s profile in the cryptocurrency and blockchain space was thrust into the spotlight with the emergence of BitFury, a major industry player whose founders are Latvian.

Source: Swedbank

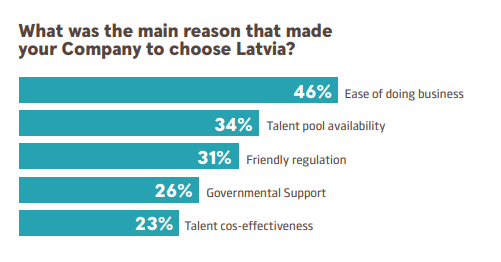

Swedbank polled fintech startups in Latvia to learn what drew them to the Baltic country. The most popular reason, at 46%, was how easy it is to do business there. The second most popular reason at 34% was the talent pool availability, followed by friendly regulation at 31%.

Source: Swedbank

Below is a map of Latvia’s fintech landscape:

Source: Twitter

Estonia’s Fintech Landscape

Estonia is a gem in the fintech world. Having gained a reputation as a digital society, the Baltic nation, which has a population of 1.3 million, has shown the rest of the world how digitization is done. For Estonians, digital life is a way of life, from education to healthcare, as the public sector has made it a priority to make people’s lives easier and of good quality. Similar to Latvia, Estonia’s digital integration has unfolded since the country became independent from the Soviet Union in the early 90s.

In Estonia, citizens complete their taxes in a few short minutes. Nearly all the country’s public services are accessible online around the clock. And they’ve been a first-mover for online voting and digital IDs. Tech innovation has been behind all these advancements. In response, Estonia was among two Baltic

nations to be named among the leading fintech countries of 2020, rounding out the top 10. It came behind Canada, Australia, Sweden, the Netherlands, Switzerland, Lithuania, Singapore, the U.K. and the U.S.

Through the first three quarters of 2021, Estonia was responsible for nine out of 10 of the biggest deals among the Baltic nations. The 10th deal occurred in Latvia involving Nordigen, a regulation tech (regtech) startup behind a freemium open banking API platform. In addition to regtech, Estonia’s transactions took place across wealth technology (wealthtech), marketplace lending, blockchain/cryptocurrencies, accounting and finance, payments and remittances. The biggest deal last year in this segment was Veriff, a global ID company that attracted USD 69 million to its coffers in a Series B round. Here’s a breakdown of the top 10 deals:

Source: FinTech Global

Meanwhile, local regulators have fintech on their radar, especially since Estonia rolled out the welcome mat for cryptocurrency startups early on, as described in a report published by TalTech School of Business and Governance and FinanceEstonia. A flood of crypto startups flocked to the country and over 1,300 activity licenses to operate in Estonia were granted. With officials taking a light-touch approach to regulation, companies leveraged their licensed status to present themselves as trustworthy.

Many of those licenses have since been voided as the Financial Intelligence Unit has sought to rein in the Wild West environment, now requiring companies with the license to be domiciled in Estonia, as one change. Now the Ministry of Finance has stepped in to craft a regulatory framework around crowdfunding, crypto assets, and unregulated instruments with a view toward investor protection. This appears to be a work in progress.

Estonia’s broader fintech sector is one that by all accounts is growing. Estonia’s fintech sector comprises five distinct players:

- Companies

- The state (different ministries, the Financial Supervision Authority, and Enterprise Estonia)

- FinanceEstonia as an umbrella organization for the public and private sectors.

- Incubators and accelerators

- R&D/universities

The tone of the relationship between fintech founders and other industry players is said to be casual and friendly, with market participants keeping an open-door policy for one another. This is made possible thanks largely to the fact that Estonia is a small nation coupled with the fact that the country has produced market leaders like Wise and Veriff, the TalTech report points out.

TalTech’s report provided the results of a 2021 survey in which participants expressed a desire for greater industry collaboration among fintechs in Estonia, something that could be facilitated by companies or regulators, for example. Otherwise, the country’s fintech sector runs the risk of shunning newcomers and stifling growth.

One issue that fintech founders say they have faced of late is wage inflation in which the cost of talent is on the rise. This dynamic is exacerbated by the small size of Estonia and the demand for skilled workers. One workaround could be hiring an international workforce, but the drawback is their potential lack of familiarity with what Estonia brings to the table.

As of 2020, Tal Tech identified 215 fintech companies in Estonia, up from 131 at year-end 2018. Estonia has the highest number of unicorns, or companies with a valuation of at least $1 billion, per capita globally, with seven, two of which are fintechs, Wise and Zego.

- Wise

- Pipedrive

- PlayTech

- Bolt

- Skype

- Zego

- ID.me

More potential unicorns are also in the pipeline, as illustrated below.

Source: Kaido Saar/Finance Estonia Chairman/E-Estonia/YouTube

Estonia’s fintech sector is experiencing growth of more than 30% each year. One trend among Estonian startups is that they tend to be international businesses right from day one rather than starting locally and expanding their footprints abroad. This has something to do with Estonia’s small population.

More than two-thirds of Estonian fintechs operate across four categories. These include:

- Digital asset exchanges

- Digital lending

- Digital payments

- Enterprise tech provisioning

Estonia’s fintech sector is filled with young startups. Over half of Estonia’s fintechs are three to five years old, while 15% were only founded in the last two years or so. As of year-end 2019, Estonian fintechs had total assets of EUR 1.03 billion across EUR 235 million in revenue, reflecting industry growth of 1.5x in the last two years. Most of the volume belongs to fintechs in digital banking and lending. Estonia employs over 2,000 people in the fintech sector.

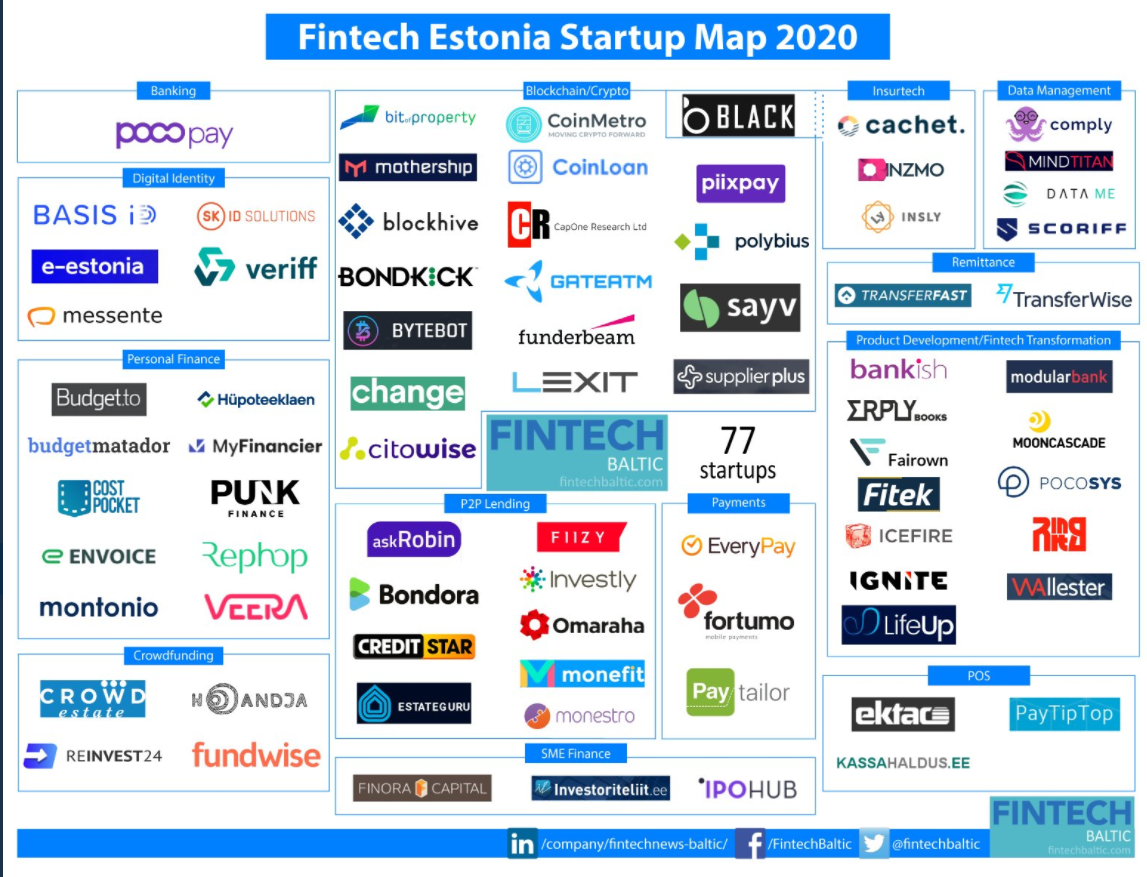

Source: Fintech Baltic/Twitter

Estonia Fintech Report.pdf

Lithuania’s Fintech Landscape

Lithuania has a population of 2.7 million, 82% of whom are internet users. Thanks to a speedy internet connection and a robust digital presence including e-signatures, fintech entrepreneurs can launch a startup in as little as a day.

Over 43% of fintechs located in the Baltics region are based in Lithuania, giving it the leadership position on this front. More broadly speaking, fintechs in the Baltics comprise approximately 7% of fintechs operating in the EMEA region, a notable percentage in light of the combined population of the three Baltic countries of less than 6 million.

Most Lithuanian fintechs operate in the payments niche, at 69 companies. Coming in a close second at 64 companies is the category named “other” comprising blockchain, crypto, cybersecurity, and investments. Next is financial software, at 46 companies, followed by lending at 30 and digital banking at 21.

Lithuanian fintechs include names like SME Finance and TransferGo, to name a couple. While Lithuania has yet to crown a fintech unicorn, Paysera’s recent Spain expansion is expected to bolster its valuation and make it a contender. The majority of fintech startups tend to be in the payments and lending categories, though financial software including APIs is also on the rise due to demand thanks to the convenience the tech provides. Automated credit services are another up-and-coming area. Close to two-thirds of fintech companies that operate in Lithuania have their headquarters in the country.

In the wake of Brexit, it has not been uncommon to see UK-domiciled fintechs relocate to Lithuania. According to the Bank of Lithuania, nearly two-dozen of UK fintechs possessing e-money licenses moved their headquarters to the Baltic country, like Revolut and Yapily.

Aalto Capital identified a couple of fintech startups to watch in Lithuania:

- Numai, a rent-to-buy service provider

- Heavy Finance, a P2P lending platform for the agriculture industry that specializes in heavy machinery-backed loans

According to reports, Lithuania has become so popular for fintech startups that regulators have had to take a step back and keep a closer watch on things. The Bank of Lithuania is cracking down on the sector in response to the Wirecard accounting scandal. While Wirecard is a German company, Vilnius-based UAB Finolita Unio was allegedly used in the illegal transfer of funds.

Speaking of Vilnius, the capital city is hard for entrepreneurs to ignore, with so many alluring features. The cost of living is seen as being attractive while the quality of life is hard to beat, with an average commuting time of 30 minutes and a trend toward adopting a four-day workweek. A one-room apartment rental can be found for as little as EUR 500 per month, and a fintech founder can buy lunch for under EUR 10. The “city in a forest,” as it’s known, is also a perfect place to relax with no shortage of parks and trails.

Local fintechs will also count big tech companies among their neighbors, including the likes of Google, Uber, and Revolut, all of which have a presence in Vilnius. Tech startups located in the city are known for securing foreign investments, even surpassing the levels of their entrepreneurial peers in London and Tel Aviv in the 2016-2018 period. In addition, Invest Lithuania forecasts that Lithuania will be adding hundreds of fintech jobs sooner than later.

Conclusion

While the fintech sector has not been immune to the effects of the pandemic, it has been resilient thanks to the robust demand for e-commerce and digital services. It appears that this momentum is poised to continue for the foreseeable future, especially considering the way that the Baltic countries have embraced tech innovation. Funding for tech companies in Eastern Europe more broadly is also expected to rise in 2022, all of which bodes well for the startup environment. Payments and lending including P2P investing are the top areas to watch.