Nearly everyone throughout the world needs to interact with money in some way or another for them to survive. We work to earn and then pay to maintain our way of life. How we manage that way of life is often what we have most control over.

To that end, the smart or responsible way of managing your personal finances in your daily life is based on how well informed you are about the subject matter. This is known as being financially literate and being able to apply your knowledge thereof often determines or measures just how well versed or financially literate you really are.

How Financial Literacy Is Linked to Behavior

Being financially literate is more than just being well versed on the topic. It is counter productive having all the knowledge about sound financial practices, yet not using any of it in your day-to-day life.

A person’s ability to demonstrate their financial literacy is linked to their behavior and the consequences of their financial decisions. According to Wim Mijs in the Financial Literacy Playbook for Europe, financial literacy from a European point of view is inextricably linked to a person’s well-being.

General things that are looked at when financial literacy behavior is evaluated may include things like:

• The use of Internet banking / mobile banking facilities

• Having a savings plan (especially for retirement)

• Being active on investment platforms (bonds, stocks, etc.)

• Levels of debt and how much of your disposable income is spent on servicing debt

• Having a drawn-up budget to help track and manage your expenses

• General attitude toward money and long-term planning

• Being able to maintain a health credit score (i.e., paying bills on time)

Factors That Drive the Average European’s Level of Financial Literacy

Europe as a whole is a very diverse continent and there are great variations of financial literacy between Europe’s East and West, and those belonging to the European Union and not. Many have national strategies for financial literacy that are directly incorporated into education programs.

At the AMF Scientific Advisory Board Conference in 2016, Gianni Nicolini explained that a survey was done across a few European countries focusing on general financial literacy questions and some questions to measure behavior.

The results were less than desired, with most country respondents scoring less than 50 percent on general investment questions. The United Kingdom was one of the worst performers and Spain performed incredibly well. In addition to this, they also asked these same respondents to divulge their participation in a variety of financial related activities. This was to try and see if there was a correlation between having financial knowledge and how it is actively applied to the management of their personal finances.

Nicolini’s conclusion was that while there were pockets of excellence, European financial literacy is a “work in progress” overall. His findings listed these five conclusion points:

- Financial literacy is low on average

- It changes a lot when different areas of knowledge are taken into account

- Investors are on average more knowledgeable than others

- There are differences between investors (bond, stock, mutual fund investors)

- Financial literacy seems to be related with financial behaviors

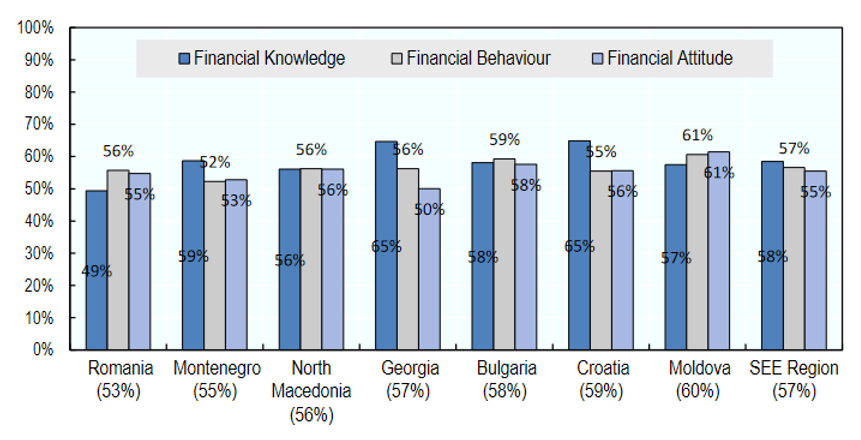

Another study done by the OECD on Financial Literacy of Adults in South East Europe, where a similar exercise was done, demonstrated a perceived higher level of financial literacy when compared to Western European respondents. Although this is hardly conclusive, it does provoke questions about these differences.

OECD (2020) Figure3.1. Components of overall financial literacy; Page13

European Financial Literacy Compared to the Rest of the World

It is interesting to note that according to Balancing Everything, Europe does seem to be in line with average global trends, but lags when compared to other developed economies in the Western Hemisphere. Studies highlight that:

• The average rate of financial literacy in Europe is 52 percent.

• Fifty percent of adults worldwide understand inflation and interest rates.

• The average score on the U.S. national financial literacy test was 68 percent.

• Montana residents know the most about handling personal wealth.

• Minnesota has the highest literacy rate on money issues (82.08 percent).

• Americans over fifty-one years old represent the most financially literate age group.

• Only 12 percent of millennials have asked for professional help with personal finances.

How to Boost Financial Literacy in Europe within a Digital Age

According to a publication by Insurance Europe, financial literacy in a European digital age needs to be cultivated from an early age so that responsible financial behavior can be fostered when it comes to taking full control of a person’s finances.

Michaela Koller, Director General of Insurance Europe explained that “Technology-based tools can contribute to raising financial literacy levels and help overcome some of the barriers to financial education by making it faster and more convenient to access information and by reaching a wider potential audience.”

This means that the key is driving people to the right kinds of tools and information sources that will constructively shape the way people think about their personal wealth creation potential.