It’s said that starting to invest at a young age is one of the key preconditions of building wealth. We all know that it’s good to start saving and investing early, but how much of a difference does it make in practice?

Compounding Returns

Compounding returns involve reinvesting the interest/income from your investments to give you higher returns in the long term. If you have a € 1,000 that returns 1% interest per month, then over a year it would return € 126.83 if you automatically reinvested the interest or € 120 non-compounding. It is widely quoted that Albert Einstein called compounding interest “the greatest mathematical discovery of all time” due to its impact over long time periods.

There’s a rule of thumb used to approximate compounding returns in your head, called the ‘Rule of 72’. To use the rule, you take the annual rate of return that you hope to make and divide 72 by this number. This roughly gives you the number of years it takes for your investment to double.

So for example, let’s say you consistently make 12% returns on a peer to peer lending platform like VIAINVEST. Using the Rule of 72 it would take approximately 6 years (72 divided by 12) for your initial investment to double, assuming continually you reinvest the returns. Note that while not exact, it’s a useful way to start to think about investing. In this case, the real answer is closer to 6.12 years.

Using this approach, even small investments at a young age have time to grow into considerable amounts. On my blog, I have been developing a free tool to allow you to experiment with different investment scenarios. Here we can use this to experiment with two different scenarios:

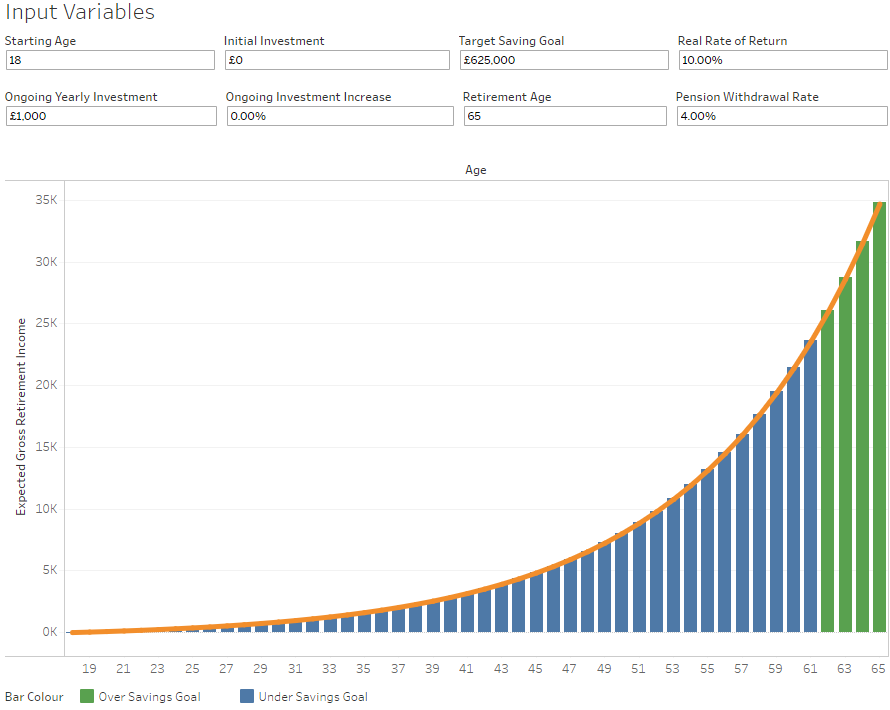

- Investor A: Starts investing at age 18 and saves £ 1,000 per year with an annual real return of 10%

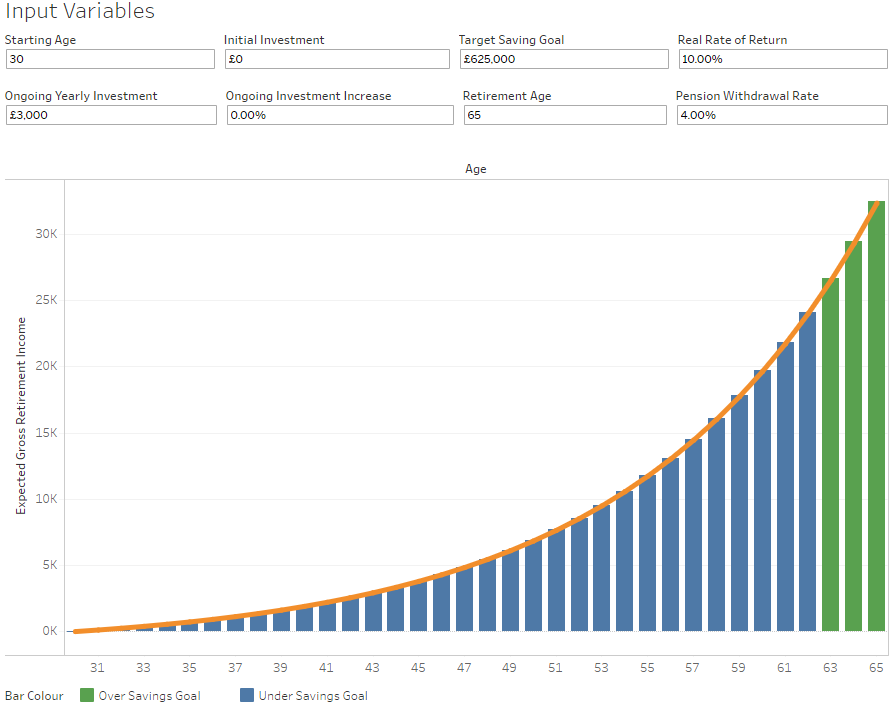

- Investor B: Starts investing at age 30 and saves £ 3,000 per year with the same annual real rate of return of 10%

Here is what happens to investor A:

By the age of 65, they now have wealth worth £ 871,975. The vertical axis in the chart above is the expected retirement income they’d have using an approximate historical pension withdrawal rate.

Here’s investor B:

By the age of 65, investor B now has a wealth of £ 813,073. So, even though they saved three times as much every year, by the age of 65 they still had less than their younger counterpart. You can view the underlying data used for these calculations here.

Time to Learn

Many investors make mistakes when they first start and it can take years of practice and refinement to develop a long-term strategy that works well for them. Even if you have no money to invest, it’s good to start reading and practicing for the future to help you avoid first time mistakes.

In my case, investing a small percentage of my income from my first job encouraged me to keep up to date on the economy and investments. Peer to Peer lending is emerging as a new asset class which could revolutionize the way we invest, but the industry is still quite young. It’s good to have more time to understand and experiment with your first investments.

Higher Risk Opportunities

As they start to near retirement many people change their investment portfolio to lower risk, lower return investments like highly rated government bonds or cash. Unlike young investors, they do not have decades of paid work ahead of them to recover from poor investment performance. The younger investor not only has more years of compounding returns but may also be able to hold a higher risk/return portfolio in the early years.

Summary

In practice starting to invest a few years earlier can make a huge change to your long-term financial health, often more than you would imagine. It’s difficult to visualize the impact of compounding returns until you view it on a financial calculator, or mock it up for yourself in a tool like Microsoft Excel.

Other factors like the opportunity to learn and experiment with your investments and the option to take on a higher risk/return portfolio than someone nearing retirement further enhance the returns of the early starter.