Diversification – this is a word used often in the investments world and it’s based on the idea that you shouldn’t put all your risk into one investment. ‘Don’t put all your eggs in one basket’, right?

But diversification is more than just spreading your money out over numerous investments. It also means you need to diversify your type of investment as well. All of this comes from Modern Portfolio Theory which is the basis for modern investment advice and has been for more than 50 years.

Asset Classes

Different types of investments are broken down into asset classes. The most common asset classes used for creating a solid investment portfolio are

- Stocks

- Bonds

- Real Estate

- Cash

- Precious Metals (like gold)

- Commodities (like corn or sugar)

- Foreign Currencies

Since the focus of this blog is p2p lending, you probably noticed that’s not one of the asset classes I listed. Part of that is because it’s new as an investment and part of it is that it is represented on this list by something else…….Bonds.

What is a Bond?

Bonds are a fixed income investment. The amount we earn is fixed every month. A bond is essentially a promise to pay. Do you have a home mortgage? That’s a type of bond where you promise to pay your $2000 of principal and interest each month over your mortgage term.

Sound familiar?

Our borrowers in a p2p loan have made a promise to pay us whether it’s for 6 months or 3 years. This means that P2P lending is like a bond investment for us as investors on a platform.

Then why consider using peer loans as an investment as a substitute for the bonds already available?

Bond Returns

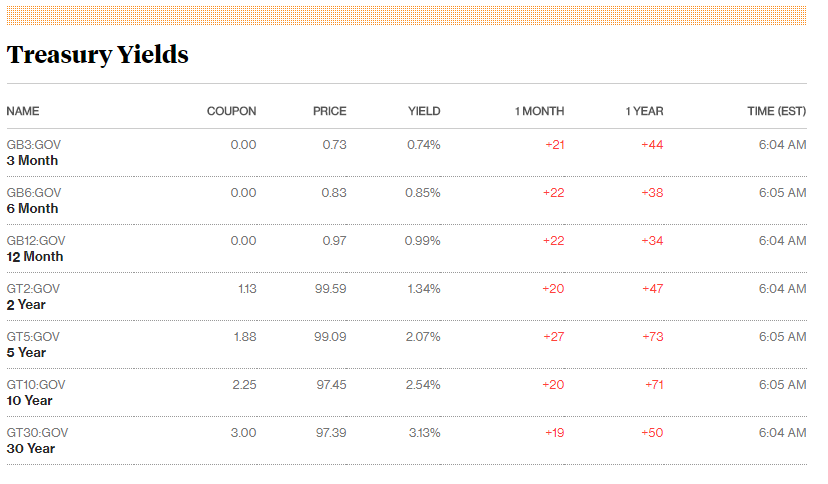

US bonds are generally considered the world’s safest investment as they are backed by the US Government. The returns from a US bond reflect it. Here’s a table from Bloomberg:

Returns are very low across the board from 0.74% yield for 3 months up to a still paltry 3.13% that requires you to hold your US government bond for 30 years.

The UK is not much better. This is a live chart from Investing.com on the 10 yr UK government bond:

Rates here are low as well currently at 1.196% yield for holding this 10-year bond.

Germany’s current 10-year bond is a very small 0.34%. In fact, 6 months ago, the Germans issued a ten-year bond with a negative interest rate. Negative interest rates mean you pay them for the right to hold their bonds as an investment. That doesn’t sound like a good way to make money to me.

These incredibly low rates are not even the worst part even they are pretty bad. Over recent years more and more people are asking themselves ‘Is this really a risk-free investment?’ and ‘Is this government as stable as we think it is?’ Without getting into too much of a political discussion, I think the answer for many of us in the West might be that we are not as sure of this answer that we may have been 5, 10 or 20 years ago. That uncertainty should be priced into the bonds so that the risk vs return ratio is appropriate.

Far too many people think that the real underlying risks are not reflected in these very, very low-interest rates meaning bonds should be avoided.

P2P Lending Returns

With peer to peer lending, we have a different situation. We have borrowers that pay higher rates and we have higher defaults from borrowers. Many platforms have low default rates overall, resulting in most investors believing we are being compensated for the risk we are taking.

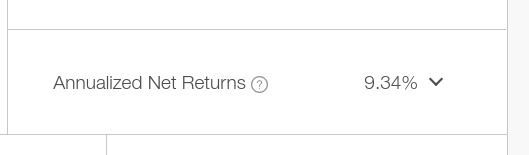

For example, my own Prosper rates are shown right here:

My goals for the first 3 years of investing was 12% per year and I hit that goal each year. My returns are down for 2016 and rates are lower for us investors overall. My current 9.34% return is still a pretty good yield.

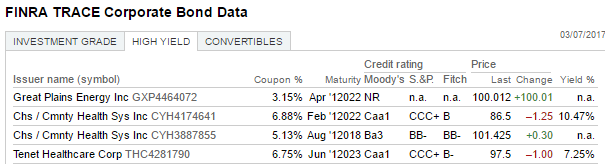

By comparison, a corporate bond to get a yield of 9.34% requires buying a CCC+ rated bond by S&P. CCC+ is a ‘junk bond’ just above defaulted status. That’s way too much risk for me. This bond is not a prime credit like my Prosper borrower is. My Prosper borrower is a much better credit and more likely to pay me.

This is from the NY Times:

Conclusion

As a new investor, you need to diversify among investments and asset classes. The bond asset class is mispriced at government levels throughout the West and US Corporate bonds as well. These bonds do not adequately compensate us for the risk we are taking with these bonds.

We can get paid for our risk more appropriately if we substitute our necessary bond investment allocation with an investment in multiple p2p loans preferably across multiple platforms and loan types.