We’ve been publishing deep dives into our loan originators, and now it is time to talk about Romania. We asked the VIACONTO.ro country manager, Maksims Babašs, to tell us more about the operations of this loan originator.

Background and Evolution

VIACONTO.ro’s journey in Romania has been a blend of challenges and triumphs. We navigated through a few obstacles, including IT issues, partner integration, and rigorous compliance audits by regulators. These experiences have strengthened our resilience and enriched our understanding of the Romanian market. Our success lies in our commitment to building a trustworthy brand and securing a stable position in the market. We focus on serving private individuals – Romanian citizens, with tailored financial solutions. VIACONTO.ro was established in 2017 in Bucharest, Romania, and we’re currently a team of 8.

Role and Operations

At VIACONTO.ro, we see ourselves as a vital cog in the VIAINVEST ecosystem, providing robust support through our specialised credit analysis process. Our comprehensive approach involves various verification stages like scoring, mobile phone checks, credit card verification, facial recognition, document validation, and credit bureau data analysis. This thorough process ensures we maintain high creditworthiness and risk assessment standards for each application.

Market and Competition

What differentiates VIACONTO.ro in the competitive landscape of the Romanian market is our swift operational capacity and strong customer focus. We prioritise understanding and meeting our customer’s needs, which helps us stand out as a reliable and responsive loan originator in Romania.

Challenges and Learnings

As a loan originator, VIACONTO.ro has faced various challenges, particularly in adapting to the market’s dynamic requirements and our partners like VIAINVEST. We’ve embraced these challenges as learning opportunities, continually refining our strategies and operations. While there are no specific challenges towards VIAINVEST, our collaboration has been smooth and fruitful, contributing significantly to our growth.

Risk Management and Transparency

Regarding transparency and risk management, although I am not directly involved in communicating with VIAINVEST and its investors, our team ensures regular and detailed updates about loan performance. We adhere to strict transparency and risk assessment standards to provide investors with accurate and up-to-date information.

Future Outlook

The strategic decisions of our Board guide the future trajectory for VIACONTO.ro. We aim to continuously enhance our loan origination processes, adapt to market changes, and explore new avenues for growth, aligning with VIAINVEST’s overall objectives and vision.

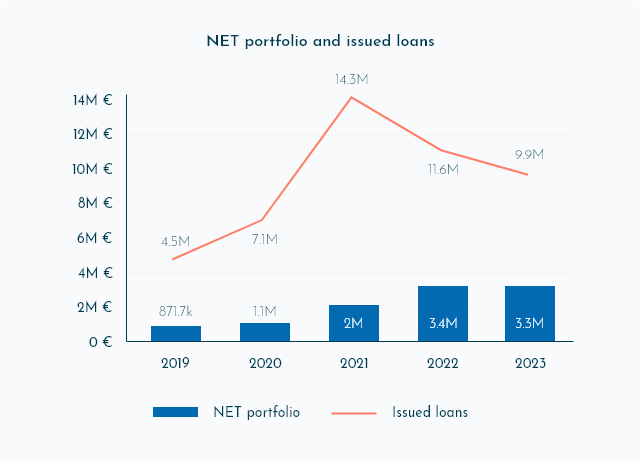

Growth over years

VIACONTO.ro saw approximately a 28.22% increase in clients at the end of 2023 compared to 2022. Their total number of clients is increasing, new loans are being granted, work is progressing, and the portfolio is stable due to a systematic issuance strategy.

That’s it for this month’s blog on loan originators. We hope you enjoyed it and learned something new.

Make sure to read the previous editions:

Happy investing!

Team VIAINVEST