When you have a burgeoning European alternative finance market originating over 400 million EUR per month, it’s no surprise that governments are paying close attention. So, what are some of the approaches that national authorities have been taking to encourage the sector, and what is the appeal? Continue reading How (and Why) Governments are Encouraging P2P Lending

Month: January 2017

How Fintech is Changing Financial Services

Posted onBanking is necessary, banks are not.

/Bill Gates, Founder of Microsoft/

Bill Gates said this way back in 1994. Banks have only gotten larger, less effective and more out of touch with the communities they are supposed to serve. Banks are such a vital part of the economy that most governments do whatever they can to avoid bank failures and the ripple effects it would cause. The Cyprus bail-in is just one example in Europe and the fall of Bear Stearns investment bank triggering the events that caused the Great Recession in the US is another.

Fintech is incredibly disruptive to the old line ways of doing things and conventional banking. We are going to look at 2 big ways financial services are transforming. Continue reading How Fintech is Changing Financial Services

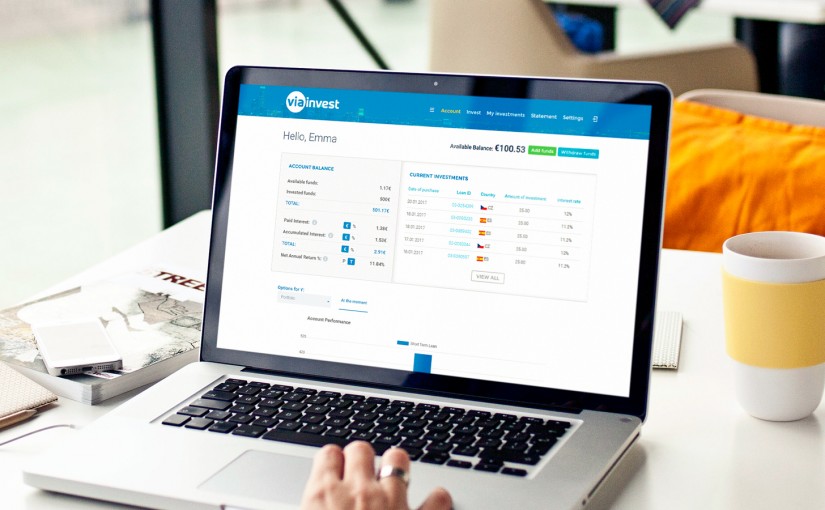

Updates in the Investor Account dashboard

Posted onTo help investors closely monitor transactions, current balance and future prospects in their Investor Account, we have recently modified existing indicators as well as added a new one. Continue reading Updates in the Investor Account dashboard

How to Set Up Your Own Investment Filters

Posted onYou may have noticed we have lots of loans available for investment on VIAINVEST. Currently, there are over 2500 to choose from so how do you make a decision?

You can set up your own filters for both manual investment (picking loans one by one) and our Auto Invest feature. Our minimum investment per loan is EUR 10 so you can spread your funds around into many loans. Continue reading How to Set Up Your Own Investment Filters

Invest It In: Viainvest opens p2p loans to investor lenders

Posted onVIA SMS Group has been operating since 2009 and operates in 5 countries (Latvia, Sweden, Czech Republic, Poland, Spain) and it has issued more than 1 million loans. Through their platform, you can now participate in their business.

InvestItIn.com appreciates the detail which VIAINVEST has answered our questions. We are sure that this in-depth interview will help you learn more about p2p investments and the specificities of VIAINVEST platform.

Read full article!

Trends in European P2P Lending

Posted onWhen it comes to P2P Lending in Europe, the dominant player is the UK, with by far the most platforms, most money invested and the clearest regulatory environment from their Financial Conduct Authority (FCA). While the UK is the biggest market and London the undisputed capital of P2P lending in Europe, the fastest growing region in Europe for alternative finance is in the Baltics. Continue reading Trends in European P2P Lending

Meet the VIAINVEST team: Eduards Lapkovskis, Member of the Board

Posted onNot that long ago an idea of advanced multiproduct alternative finance company was only a vision in Eduard’s mind. Now, more than 7 years later he leads fast-growing alternative financial services provider VIA SMS Group currently operating in 5 countries and has recently launched completely different product from ones offered before – peer-to-peer lending platform VIAINVEST.

Why did you choose to enter peer-to-peer lending market?

We are stepping into the new era of fintech where competition and increasing customer demands require potential to change quick and offer innovative, even revolutionary products and services. We have always tried to provide more convenient alternatives to the traditional banking services and VIAINVEST in comparison with bank investment products is offering great benefits not only to experienced investors but also to each individual that is looking for a safe and wise way how to manage personal finances. This is also one of our main aims – to provide a tool, real-time investment opportunities that are simple enough even for inexperienced investors, but also educates them on financial decision making. Continue reading Meet the VIAINVEST team: Eduards Lapkovskis, Member of the Board

Crowdfund Insider: Latvia’s VIA SMS Group Set to Launch New P2P Lending Platform Viainvest

Posted onLatvia-based VIA SMS Group announced this week it is launching VIAINVEST, a peer-to-peer marketplace for both private and legal entities offering to invest into consumer loans originating from non-banking lenders.

The full article can be found here!

Labs of Latvia: VIAINVEST – new platform to join the peer-to-peer lending community

Posted onMeet VIAINVEST: Blending Traditional Finance with P2P Lending

Posted onThe Baltic states of Estonia, Latvia, and Lithuania are becoming a hotbed for European fintech companies. Latvia’s latest entrant in the P2P lending market is VIAINVEST. VIAINVEST has some great features and an easy website to navigate. Let’s check out a couple of the benefits they offer on their platform for you as an investor. Continue reading Meet VIAINVEST: Blending Traditional Finance with P2P Lending