Hello to our valued community!

As we usher in a new month, it’s time for a quick reflection on the key statistics from September.

Continue reading VIAINVEST performance in September

Hello to our valued community!

As we usher in a new month, it’s time for a quick reflection on the key statistics from September.

Continue reading VIAINVEST performance in September

Hey there, VIAINVEST community and investors!

We hope your journey with us has been profitable thus far. The passion and trust of our community contributed to our success, and we are excited to bring you more updates as we continue evolving our platform. So, without further delay, let’s begin with the most recent updates.

Continue reading Operational updates: September 2023 edition

We wish to inform you that VIA SMS Group and Twino are renewing their collaboration. Leveraging the achievements of the previous partnership in Vietnam, both teams are prepared to integrate their expertise to enhance the development of the VAMO Philippines’ lending market. Continue reading A New Chapter of VAMO Philippines Development

Here’s a recap of VIAINVEST’s key metrics from the past month:

Publication and Funding Dynamics

Loans Published: EUR 7,856,345

Loans Funded: EUR 7,391,852

With the active participation of loan originators, we rolled out EUR 7,856,345 in securities underpinned by loans from our network. In response, our dedicated investors contributed EUR 7,391,852 in August. Continue reading VIAINVEST’s August Performance 📊

Hello investors and VIAINVEST community!

We hope you’ve been experiencing positive progress with your investments here at VIAINVEST. As we sail through 2023, our team has been working diligently behind the scenes to provide you with the enhanced tools, features, and opportunities that you’ve been asking for. Let’s get straight into the heart of our latest operational updates! Continue reading Operational updates

Let’s take a look at VIAINVEST’s data from the previous month.

Publication and Funding Dynamics

Loans Published: EUR 6,744,286

Loans Funded: EUR 6,747,667

The amount of Asset-backed securities published increased in tandem with the activity of loan originators. In total, we published EUR 6,744,286 in securities backed by loans originated by our network. Our investors, on the other hand, invested EUR 6,747,667 in July. Continue reading The Performance of VIAINVEST in July

August 2 marks an essential milestone for the VIAINVEST. It’s been one year since the launch of asset-backed securities. Let’s take a moment to reflect on the statistics and the journey of growth.

67.6 Million Asset-Backed Securities Funded Since the Launch

Within just one year, 67.6 million asset-backed securities have been funded. We are more than grateful for the credibility and trust that investors have placed in VIAINVEST. By providing an accessible and streamlined process for asset-backed investments, we’ve been growing together with both loyal investors and newcomers alike. Continue reading Celebrating One Year of Asset-Backed Securities

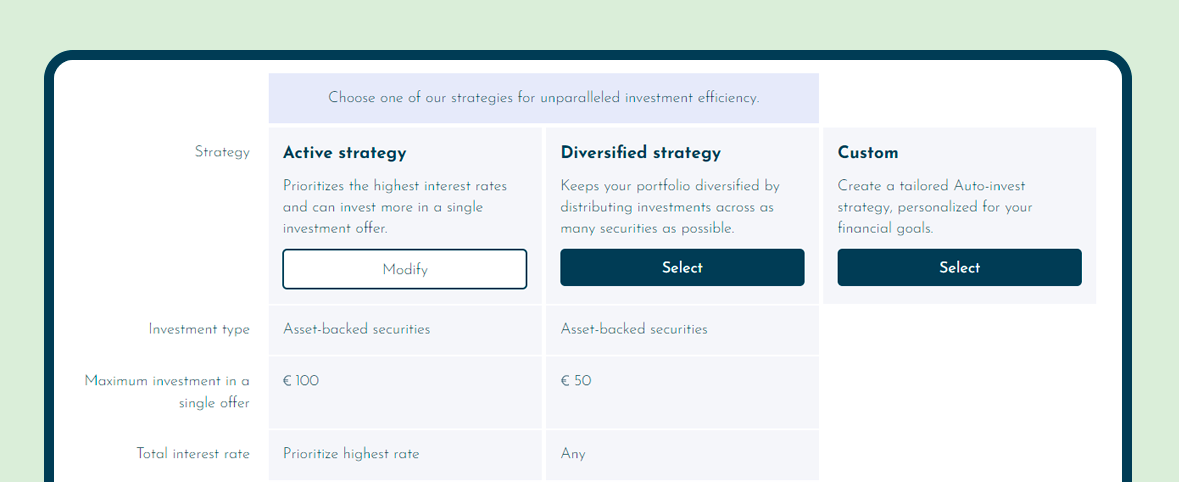

Our most effective investment tool has just gotten better. VIAINVEST’S Auto-invest solution has received a major overhaul and now includes pre-defined investment strategies to manage your investment portfolio.

Pre-defined automated strategies

We are now offering Active and Diversified automated strategies to all clients who have completed a product suitability assessment and have automated investments available. VIAINVEST strategies are designed to invest in accordance with their objectives and automatically adjust to available offers; there is no need to actively manage them or worry about their settings. This simplifies the investment process and maximizes return by keeping funds invested at all times.

Continue reading The new Auto-invest is here

The parent company of the VIAINVEST investment platform, VIA SMS Group, has released two sets of financial statements: Audited Consolidated and Separate Financial Statements for 2021 and Unaudited Consolidated and Separate Financial Statements for the year 2022.

By publishing these financial statements, VIA SMS Group maintains its commitment to transparency and accountability by informing investors and stakeholders about the company’s financial performance. The financial statements provide an overview of the financial position and performance of the entire group.

Read complete reports here: https://viasmsgroup.com/investor-relations

Did you know?

To ensure that investors have access to the latest and most relevant info, financial reports for all loan originators can be found in the respective Base Prospectus approved by Latvijas Banka, the central bank of Latvia: Disclosures | VIAINVEST

It means that investors can access information about each loan originator even if Audited Consolidated and Separate Financial Statements are not published on the Group’s website yet.

Furthermore

VIAINVEST investors have used to await and look into the parent company’s VIA SMS Group statements. However, as a regulated platform, VIAINVEST now has its own obligations. One of the essential obligations imposed is the requirement to publish financial statements on a regular basis. As a result, the VIAINVEST team will issue the platform’s audited annual financial statements this year and in the future. Investors will have access to the platform’s financial statements for 2022 in April 2023.

Let’s take a look at some recent developments.

Asset-backed security portfolio surpasses cessions

VIAINVEST is steadily converting its loan portfolio from cessions to asset-backed securities, and we have recently passed an important milestone. Our clients’ asset-backed securities portfolio has exceeded that of cessions, suggesting that cession investments are being steadily repaid.

We anticipate that this process will continue at a rapid pace, with loan portfolios originated in the Czech Republic, Romania and Poland being the first to be fully converted to asset-backed securities.

Continue reading VIANVEST platform updates: Asset-backed security portfolio exceeds cessions.